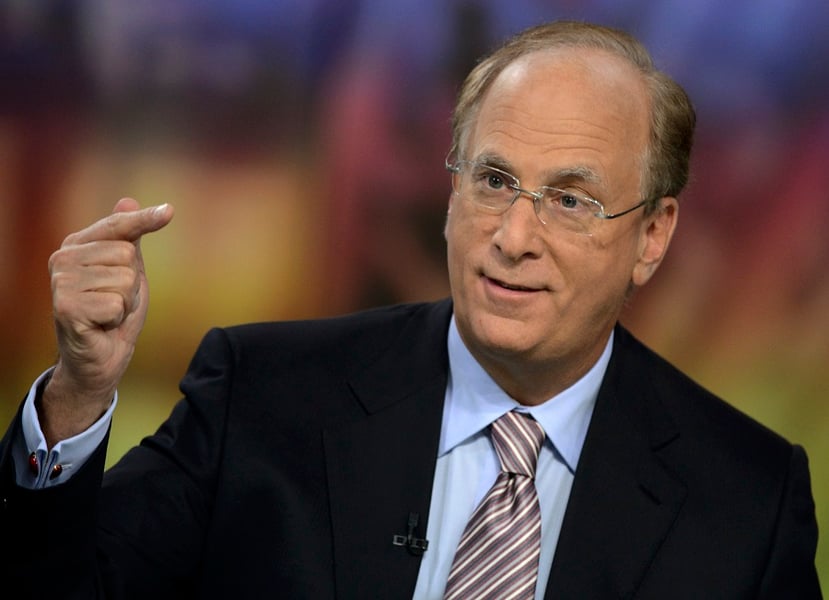

BlackRock Inc. CEO Larry Fink had a stark message for a private audience: As bad as things have been for corporate America in recent weeks, they’re likely to get worse.

Mass bankruptcies, empty planes, cautious consumers and an increase in the corporate tax rate to as high as 29% were part of a vision Fink sketched out on a call this week. The message from the leader of the world’s biggest asset manager contrasts with the ebullient tones of a stock market that has snapped back from recent lows.

Even among Wall Street luminaries, Fink speaks with particular clout. He has been advising President Donald Trump on how to navigate the effects of the coronavirus pandemic. And BlackRock is playing a key role in the Federal Reserve’s efforts to stabilize markets, helping the central bank buy billions of dollars in assets.

Fink said on the call with clients of a wealth advisory firm that bankers have told him they expect a cascade of bankruptcies to hit the American economy, and he wondered if the Fed needed to do more to provide support, according to a person with knowledge of the remarks.

A BlackRock spokesman declined to comment.

Even as the U.S. is plunged into deepening economic gloom, it will have to raise taxes to pay for emergency efforts to rescue sectors grappling with a difficult recovery, Fink warned on the call.

Among his predictions: lifting the 21% corporate rate signed into law as part of 2017’s tax overhaul to about 28% or 29% next year, according to the person. Fink also said he sees tax rates for individuals going up.

Raising taxes would water down the biggest legislative achievement of Trump’s time in office, in which he and a Republican-controlled Congress drove through the most significant changes to the tax code in decades.

Lower corporate rates juiced profits and showered cash on shareholders through increased dividends and stock buybacks. Now, at a time when many taxpayers are less able to bear the burden of higher taxes, the government may be forced to extract a larger share of companies’ and individuals’ income.

The spread of the coronavirus and the measures taken to mitigate it slammed the brakes on the economy. While Trump pushes to reopen commerce and his officials predict a rapid rebound, public health experts and some economists are skeptical the crisis will soon be over.

Politicians, business leaders and economists are beginning to confront the risks of a limited federal response that might speed the demise of smaller companies and wreck state and municipal finances that pay for schools, law enforcement and infrastructure.

That won’t be the only strain on companies. Many may have to operate with only about half their staff in the office for more than a year, Fink said. Across white-collar industries, millions are working remotely from home. It would be hard to see a complete return without mass availability of rapid testing, he said.

There’s a risk that the U.S. outbreak will be severe enough to leave a long-lasting impact on the American psyche, undermining Americans’ willingness to take public transport or fly, Fink said, adding that he's not aware of any of his CEO peers planning international travel this year.

Underscoring the point, this week home-sharing leader Airbnb Inc. and ride-hailing firm Uber Technologies Inc. announced plans for mass layoffs as they wrestle with falling demand and dimmed prospects for the rest of the year.

Many of the U.S.’s 30 million small businesses have struggled to get the relief they need. If the crisis continues, about 25% of those companies could close permanently before year-end, according to an April report released by Main Street America, a network comprising approximately 300,000 small businesses.

Restaurants that typically operate with thin margins will struggle to survive as they plot out ways to lure back customers with social-distancing measures in place, Fink said.

Fink also said he was concerned the worsening economic duress could further fan the flames of nationalism. The devastating impact from the coronavirus could make it a bigger threat to the global order, he said.

Eliseo Prisno, a former Merrill advisor, allegedly collected unapproved fees from Filipino clients by secretly accessing their accounts at two separate brokerages.

The Harford, Connecticut-based RIA is expanding into a new market in the mid-Atlantic region while crossing another billion-dollar milestone.

The Wall Street giant's global wealth head says affluent clients are shifting away from America amid growing fallout from President Donald Trump's hardline politics.

Chief economists, advisors, and chief investment officers share their reactions to the June US employment report.

"This shouldn’t be hard to ban, but neither party will do it. So offensive to the people they serve," RIA titan Peter Mallouk said in a post that referenced Nancy Pelosi's reported stock gains.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.