Welcome to the big time, bond ETFs.

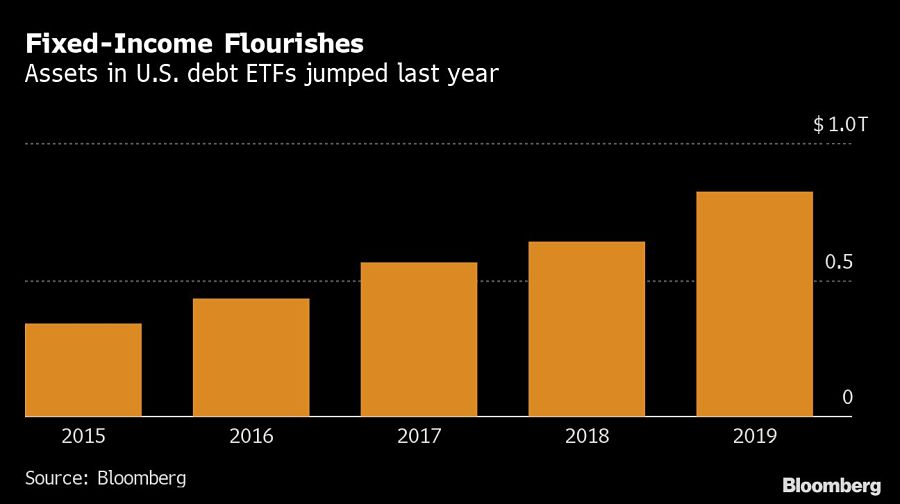

Long overlooked as the younger sibling of equity exchange-traded funds, strategies focused on corporate or government debt took in more than $150 billion in the U.S. last year, the most on record and just shy of the sum netted by their stock counterparts. It was the biggest annual leap for bond ETFs since 2014, boosting assets to more than $800 billion, data compiled by Bloomberg Intelligence show.

While the fixed-income world is inherently conservative, the ease and low cost of ETFs are rapidly wooing converts. Worries that stocks have reached their peak, continued uncertainty over the direction of U.S. interest rates and rampant geopolitical risks have bolstered demand -- especially as traders find more and more innovative ways to strategically use these products.

“Investors are seeing the efficiencies that can be found using the ETF vehicle,” said Kevin Flanagan, head of fixed-income strategy at WisdomTree Investments Inc. In finance, “typically you see equity folks take the lead and bond guys follow, and that’s continued,” Mr. Flanagan added.

Liquidity concerns that have plagued the sector since its inception seem to be fading. While anxiety about a potential mismatch between the liquidity of a fund and its underlying securities hasn’t disappeared, bond ETFs seem to be inspiring more confidence as time goes on and they endure market fluctuations.

Fixed-income funds currently make up about 20% of the $4.4 trillion U.S. ETF market, but a BlackRock Inc. report from June suggests assets could explode to more than $2 trillion globally over the next few years.

In Europe, bond ETFs attracted more money than stock funds for the first time in three years in 2019, data compiled by Bloomberg Intelligence show. Flows into debt ETFs almost doubled in Australia, and Taiwan’s ETF market surged thanks to interest from life insurers.

“There’s a huge wave of wealth retiring, and bonds are traditionally the safe-haven asset that preserves wealth,” said Will McGough, chief investment officer of retirement strategies at Stadion Money Management.

Overbought stocks

By contrast, even with the S&P 500 Index continuing to beat records, many are wondering how long the bull market in U.S. equities -- now entering its 11th year -- can last.

Technical indicators suggest stocks have been overbought for much of the past three weeks, while an RBC Capital Markets survey of institutional investors in December found the fewest people describing themselves as “bearish” since the third quarter of 2018, just before the S&P’s 19.8% rout.

In addition, the onslaught of diverging headlines about U.S. and China trade talks and Brexit negotiations have given investors whiplash, while growing tensions with Iran may reignite a search for havens. Throw in mixed economic data from countries around the world and it’s little wonder that bonds remain attractive to many.

“There’s increasingly concerns we’re in late cycle,” said David Perlman, ETF strategist at UBS Global Wealth Management. “If we are, fixed income can help to buffer some of the risk of equities.”

Nifty uses

But these traditional allocations could be just the tip of the iceberg. Adding to the popularity of fixed-income ETFs is a spurt of creativity in how they can be used.

Banks are employing bond ETFs to facilitate portfolio trades that allow investors to seamlessly move large numbers of bonds on and off their balance sheets. Other users are relying on fixed-income ETFs as a hedge, to earn returns on money they’re waiting to allocate elsewhere, or as a tool to adjust their portfolios.

It helps that the fee-compression wave sweeping the ETF industry has made fixed-income strategies cheaper than ever. For instance, BlackRock, State Street Corp. and Deutsche Bank AG’s DWS Group all slashed the costs of their high-yield debt funds in 2019. That trend is likely to spread in 2020, further bolstering ETF demand.

“Transaction costs in fixed-income bonds can be sizable, but in ETFs, they’re relatively low,” said Matt Bartolini, managing director at State Street Global Advisors. “As we continue to have these risk events and the structures continue to be tested, that’s just going to lead to more people becoming more comfortable with the structure.”

Driven by robust transaction activity amid market turbulence and increased focus on billion-dollar plus targets, Echelon Partners expects another all-time high in 2025.

The looming threat of federal funding cuts to state and local governments has lawmakers weighing a levy that was phased out in 1981.

The fintech firms' new tools and integrations address pain points in overseeing investment lineups, account monitoring, and more.

Canadian stocks are on a roll in 2025 as the country prepares to name a new Prime Minister.

Carson is expanding one of its relationships in Florida while Lido Advisors adds an $870 million practice in Silicon Valley.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.