Federal Reserve Chairman Jerome Powell beat back the market’s most aggressive predictions for the path of interest rates Wednesday, setting off a dovish surge in stocks and bonds.

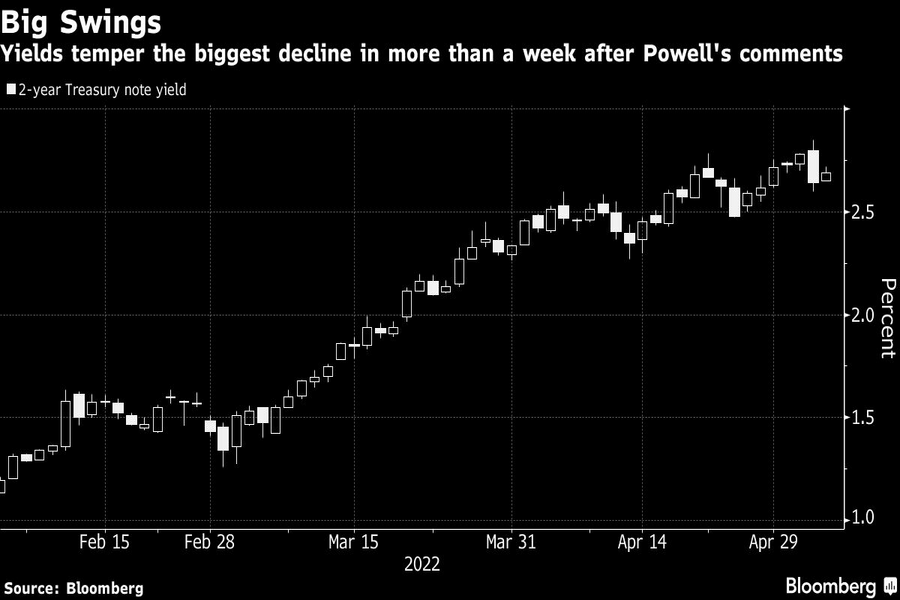

But in pouring cold water on the prospect for a jumbo-sized 75 basis point rate hike next month, he may have inadvertently set the stage for more turbulence going forward if inflationary pressures increase. Treasuries reversed some of the post-Fed gains on Thursday before trading steady.

The Fed was “trying to send a message of sustained expectations for 50 basis point increases,” but “unintentionally gave a very dovish message,” Jeffrey Rosenberg, senior portfolio manager for systematic multi-strategy at BlackRock Inc., said on Bloomberg Television. That caused an “easing of financial conditions, at least for today.”

That’s the opposite of what most would ordinarily want in order to slow inflation that’s at the highest level in decades. It’s already prompting some market watchers to wonder just how long the Fed can stick to such an approach.

For now, traders have moved firmly back toward pricing a half-point increase for June — in line with Powell’s comments that several such hikes are on the table for the Fed’s upcoming meetings — and curtailed expectations for the longer-term path for rates.

Powell surprised some, including Rosenberg, by saying policy makers consider a neutral fed funds rate, the level at which the central bank would cease hiking, to be between 2% and 3%.

Even as the market capitulated to a more genteel pace of tightening, questions remain over how long those assumptions can last. It’s still a very rocky road ahead, with pivotal economic data and global developments due within days that could seed doubts about Powell’s steady approach.

“Inflation remains challenging for the Fed because in 2021, a complacent Fed let inflationary expectations escape the realm of being within its ability to comfortably manage,” said Stephen Miller, an investment consultant at GSFM, a unit of Canada’s CI Financial Corp. Financial markets “remain in a volatile phase as they assess the success of the Fed in reining in inflation without risking a substantial economic dislocation.”

Friday brings U.S. labor market data, with investors expected to focus on how wages are evolving. The government next week is set to release a new round of consumer-price index data. How the war in Ukraine and Covid lockdowns in China develop could add new wrinkles, especially after the Fed stressed Wednesday the inflationary effects of both.

The Fed could end up with a “stagflationary outcome” if supply shocks drive price pressures up further and that “places them in a bind” where they keep tightening and hurt demand, said Dec Mullarkey, managing director at SLC Management. And with Powell affirming the neutral policy rate is between 2% and 3%, “the market has done much of the heavy lifting, with rates seen ending the year around 2.75%.”

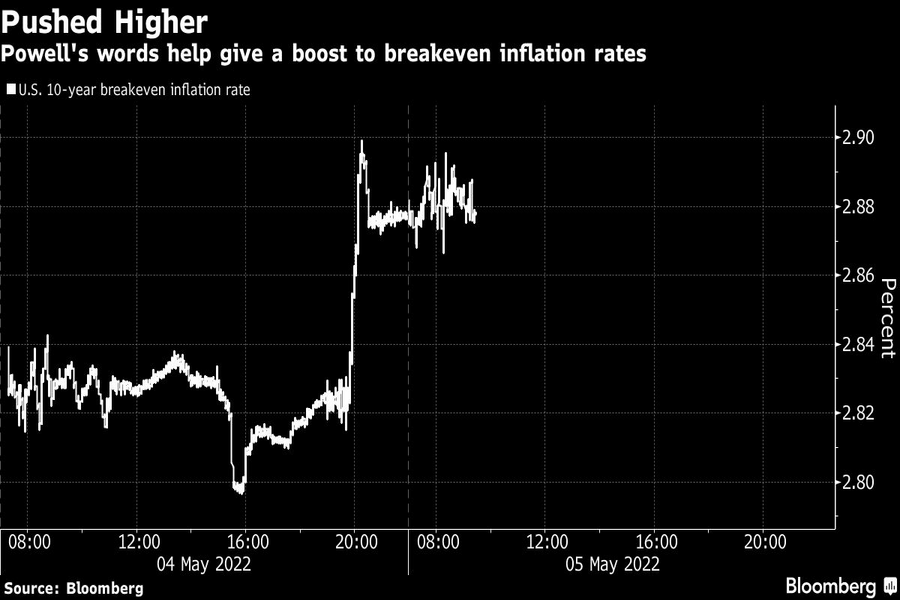

Market-based inflation expectations bubbled higher with the so-called breakeven rate on 10-year Treasuries, a proxy for price gain expectations, holding near 2.88% Thursday following a five-basis-point jump on Wednesday. Treasuries pared Wednesday’s big move, with short-end yields creeping higher.

“The FOMC can still change their mind if circumstances warrant,” Roberto Perli, the head of global policy at Piper Sandler, wrote in a note with his colleague Benson Durham. “We wouldn’t be surprised if the 75-basis-point idea resurfaces, as a contingency only in case inflation continues to surprise to the upside.”

The move to charge data aggregators fees totaling hundreds of millions of dollars threatens to upend business models across the industry.

The latest snapshot report reveals large firms overwhelmingly account for branches and registrants as trend of net exits from FINRA continues.

Siding with the primary contact in a marriage might make sense at first, but having both parties' interests at heart could open a better way forward.

With more than $13 billion in assets, American Portfolios Advisors closed last October.

Robert D. Kendall brings decades of experience, including roles at DWS Americas and a former investment unit within Morgan Stanley, as he steps into a global leadership position.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.