For the last couple of years, women have been making significant strides in the financial advice industry.

InvestmentNews' upcoming Women Advisor Summit will celebrate those women who dominate their respective firms and are paving the way for others.

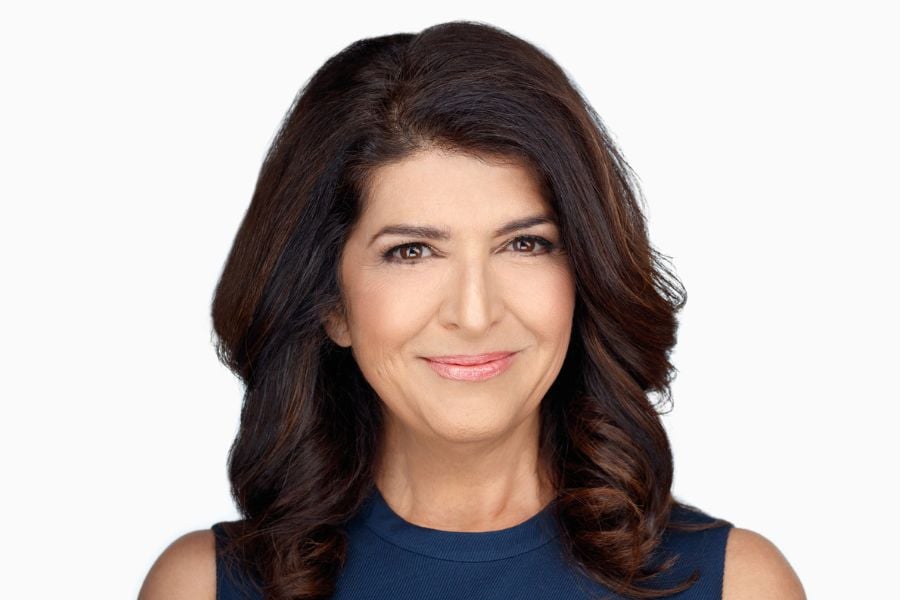

When it comes to being a successful woman, Haleh Moddasser says failure is not an option. Her methodology involves determination and fate.

“I always start with an end game in mind, so I have a big hairy audacious goal and I put it out there,” Moddasser said. “I hope to educate, interest and galvanize people to follow it along. I try to get from A to Z and if the first route doesn’t work, I take another and another until I get there, because I’m not going to not get there.”

In her role as senior wealth advisor, senior vice president and partner at Stearns Financial Group, a $2 billion advisory firm, Moddasser works primarily with boomer women. As a boomer woman herself, she adds that they control much of the wealth right now.

“I just started to notice some trends with boomer women … and it kind of made me realize that something dramatic had changed in a generation so I started researching that, wrote a book, and that has been a primary driver of my business, which is mostly working with women and many divorcing women,” she said.

Although women pursue careers in the financial services industry, they are still underrepresented in the industry. As Moddasser says, one in five or six advisors is a woman. That’s why she’s working so hard at her firm to ensure fellow women advisors and clients support each other.

“I think the strategy for working more effectively with women is to meet women where they are and change the standard from what men like and are excited about, which is alpha and chasing return, to what women are excited about, which is chasing security and building a legacy,” she said.

“As women advisors in particular, we're especially well suited to work with women because we pretty much think the same way,” Moddasser added. “Men in the industry need to adapt in working with women because they're motivated by different things.”

Her advice for women is that they should be looking to embrace who they are and be innovators, making themselves stand out.

“We have to take some risks and do something that's not been done before,” she said. “You've got to put yourself out there and try new things. I really believe in thinking outside the box and approaching things from different angles that haven’t been looked at before, maybe more creatively.”

Moddasser was one of InvestmentNews’ Women to Watch in 2020.

She'll be one of the speakers at the Women Advisor Summit that is taking place on Nov. 8 at Tribeca 360° in New York City. Registration is ongoing. Click here for more details and to attend.

Looking to refine your strategy for investing in stocks in the US market? Discover expert insights, key trends, and risk management techniques to maximize your returns

The RIA led by Merrill Lynch veteran John Thiel is helping its advisors take part in the growing trend toward fee-based annuities.

Driven by robust transaction activity amid market turbulence and increased focus on billion-dollar plus targets, Echelon Partners expects another all-time high in 2025.

The looming threat of federal funding cuts to state and local governments has lawmakers weighing a levy that was phased out in 1981.

The fintech firms' new tools and integrations address pain points in overseeing investment lineups, account monitoring, and more.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.