A prominent proxy advisory firm is telling shareholders to vote against Goldman Sachs Group Inc.’s executive pay plan after the Wall Street giant’s top leaders were given lofty raises in a year when profits slumped.

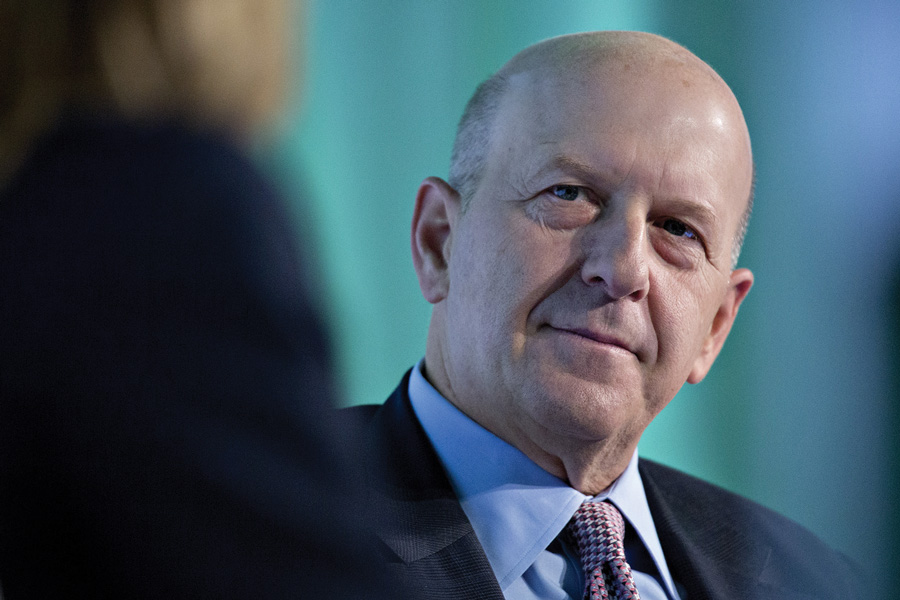

Glass Lewis & Co., a major voice on annual shareholder votes, cited the “significant disconnect between pay and performance” at New York-based Goldman in making its recommendation. The bank had boosted Chief Executive David Solomon’s compensation to $31 million, marking a 24 percent jump for a year when Goldman’s earnings plunged by a similar amount.

“This does not instill a sense of optimism that the ongoing disconnect will see improvement in the near term,” Glass Lewis said in its recommendation on the non-binding vote. “Given these factors, we believe that shareholders may reasonably withhold support from this proposal at this time.”

Other executive officers also recorded an increase in their 2023 compensation. Goldman chief operating officer John Waldron’s pay package jumped 28 percent to $30 million.

Glass Lewis said that Goldman shareholders should be wary of the continued disconnect between pay and performance, with the company receiving its second consecutive “F” grade. Despite Goldman receiving the same grade last year, Glass Lewis had recommended shareholders sign off on the pay plan then.

The board lifted Solomon’s pay as the firm spent much of the past year dousing internal rifts and pitching investors on a simplified strategy. After giving up on its retail banking ambitions, New York-based Goldman has returned its focus to business lines embraced by Solomon’s predecessors.

Goldman’s compensation committee cited the CEO’s “decisive leadership in recognizing the need to clarify and simplify the firm’s forward strategy,” according to a February filing. That reasoning drew private gripes from other Goldman executives, who pointed out that the firm was pulling back from a poorly executed retail-banking plan that the CEO had embraced over internal opposition.

The recommendation to vote down the pay proposal comes ahead of the bank’s annual meeting on April 24, where it’s seeking shareholder approval of executive pay.

Carson is expanding one of its relationships in Florida while Lido Advisors adds an $870 million practice in Silicon Valley.

The approval of the pay proposal, which handsomely compensates its CEO and president, bolsters claims that big payouts are a must in the war to retain leadership.

Integrated Partners is adding a husband-wife tandem to its network in Missouri as Kestra onboards a father-son advisor duo from UBS.

Futures indicate stocks will build on Tuesday's rally.

Cost of living still tops concerns about negative impacts on personal finances

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.