LPL has once again extended its reach in New York state with the addition of a three-decade veteran advisor from Osaic.

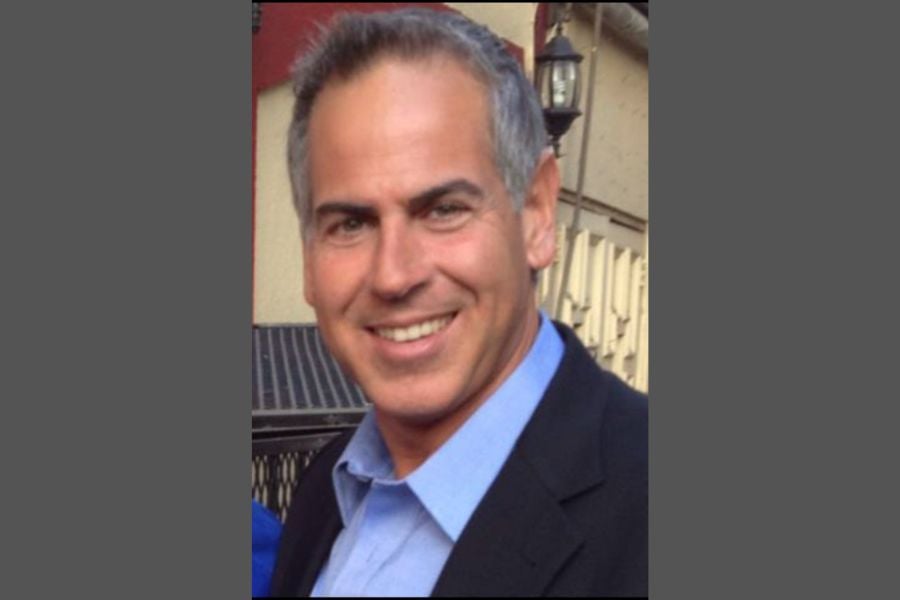

On Monday, the firm announced that financial advisor Jerry Rizza has joined its broker-dealer, RIA, and custodial platforms. Rizza previously worked with Osaic, where he reportedly oversaw approximately $250 million in advisory, brokerage, and retirement plan assets.

With a diverse background spanning 31 years in financial services, Rizza’s career includes a stint in the Oakland A’s minor league baseball system and over three years as an accountant in New York City.

He shared his passion for financial planning, stating, “As I learned more about the financial services industry, I fell in love with the idea of helping families plan for a more secure financial future,” the veteran advisor said in a statement Monday.

Based in Melville, New York, Rizza leads Rizza Financial Services with the support of two experienced assistants, Rachel Beneventano and Jessica Weich. His practice focuses on retirement planning and behavioral investment counseling, aimed at helping clients build and manage wealth for retirement.

His decision to affiliate with LPL was motivated by a desire for improved service, efficiency, and advanced technology, with an “advisor-centric model [that] offers the support we need to serve our clients more efficiently and effectively.”

Beyond day-to-day operations, Rizza believes the transition will benefit his practice in the long term.

“This move has been years in the making, and I believe it’s a strategic investment in our future,” he said.

The news of Rizza’s transition to LPL comes shortly after the firm welcomed another veteran-led team from Osaic, Investment Advisors Financial Group. That team, headquartered in New Jersey, reportedly managed $1 billion in assets.

Canadian stocks are on a roll in 2025 as the country prepares to name a new Prime Minister.

Two C-level leaders reveal the new time-saving tools they've implemented and what advisors are doing with their newly freed-up hours.

The RIA led by Merrill Lynch veteran John Thiel is helping its advisors take part in the growing trend toward fee-based annuities.

Driven by robust transaction activity amid market turbulence and increased focus on billion-dollar plus targets, Echelon Partners expects another all-time high in 2025.

The looming threat of federal funding cuts to state and local governments has lawmakers weighing a levy that was phased out in 1981.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.