Election results are pointing toward a divided and potentially gridlocked government, which could slow any attempt to change investment advice policies established during the Trump administration.

It’s not clear whether President Donald Trump will obtain a second term or will be defeated by Democratic presidential nominee Joe Biden. In addition, several key Senate races that will determine the majority in that chamber haven’t been called.

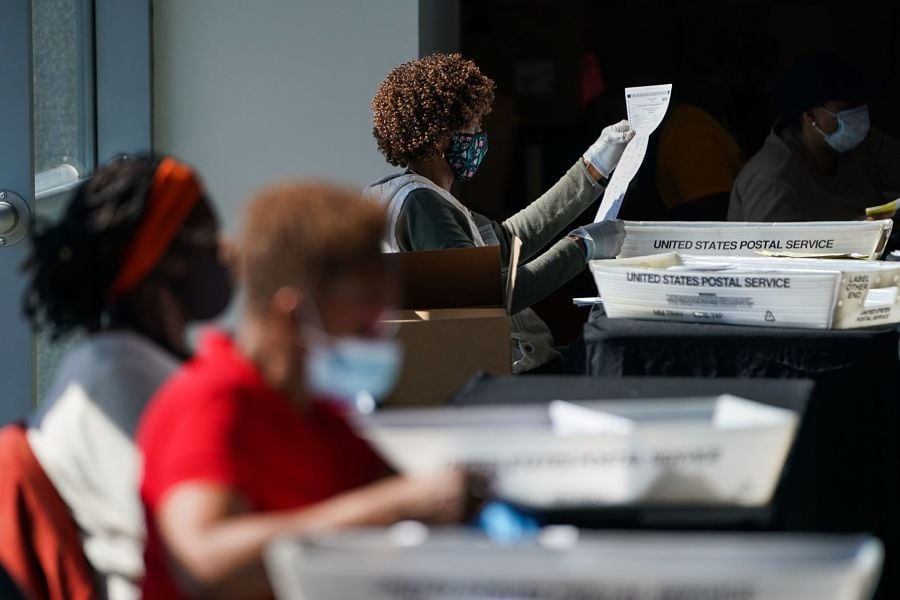

But, for now, Biden seems to be gaining on Trump as mail-in ballots are counted in swing states such as Michigan and Wisconsin. Biden also captured Arizona, a state that Trump won in 2016.

Neither candidate has achieved the 270 electoral votes needed to win the election. But early this morning Trump declared victory and asserted any votes counted after that point would be fraudulent.

“As of right now, Biden is on a more likely path for victory, but that’s not certain,” said Jason Rosenstock, a partner at the government relations firm Thorn Run Partners.

It looks as if Republicans are poised to maintain a slim Senate majority -- which was 53-47 going into the election -- and gain seats in the Democratic-majority House.

“If you end up with a Biden presidency, a Republican Senate and a narrow House margin of Democratic control, that portends bipartisan agreement to get anything done,” Rosenstock said.

But it also could mean that nothing gets done.

“It’s looking like divided government and a lot of gridlock over the next two years at least,” said Duane Thompson, senior policy analyst for Fi360, a fiduciary training and technology firm.

Under that scenario, a Biden administration could not count on help from Congress in overturning Trump administration rules that have recently been adopted, such as a Labor Department regulation that would curb socially responsible investing in retirement accounts.

A Republican Senate would block a resolution of disapproval from the House before it gets to the White House, assuming that Biden is in the Oval Office.

“It’s only realistic if one party controls both chambers and the White House,” Thompson said.

A Biden DOL would have to institute a new rulemaking process to overturn the ESG rule.

Robert Ix, managing partner at Crestwood Advisors in Boston, welcomes Democrats and Republicans continuing to share power in Washington because the parties can serve as a check on each other.

“If we have balanced government, that’s not bad for investors long term,” Ix said. “You don’t have extreme changes. Investors don’t like uncertainty.”

Rosenstock said Biden’s policy ambitions could be curbed without Democratic control of all parts of the government.

“A regulatory agenda envisioned under a blue wave will likely be constrained based on [the current] potential election outcome,” Rosenstock said.

While uncertainty about the presidency and control of the Senate grips national attention, financial advisers say they are trying to keep their clients calm and prevent them from making rash investment decisions.

“Bottom line is we’re going to get through this,” said Lisa A.K. Kirchenbauer, founder of Omega Wealth Management in Arlington, Virginia. “The key is to get clients to be patient, stay invested and focus on what they can control.”

Russ Story, president of Story Wealth Management Group in Douglas, Georgia, said he has heard from several clients today who are concerned about the election. He’s trying to keep their unease from spilling over to their portfolios.

“It’s a classic case of rhetoric versus reality,” Story said. “A client who is going to retire in four or five years needs to stay invested. I just remind them we’re not going to allow short-term emotion to dictate the allocation model or strategies we’re using now.”

The votes for the presidential race and two Senate races are still up in the air in Georgia. Story is not getting caught up in the political tension.

“I’ll get up tomorrow and go to work,” he said. “It is what it is.”

Fi360's Thompson lives Sedona, Arizona, where voters swung a red state to blue in the presidential race and a Senate race.

“There’s a lot of shock and surprise here in Arizona with the results,” he said.

Driven by robust transaction activity amid market turbulence and increased focus on billion-dollar plus targets, Echelon Partners expects another all-time high in 2025.

The looming threat of federal funding cuts to state and local governments has lawmakers weighing a levy that was phased out in 1981.

The fintech firms' new tools and integrations address pain points in overseeing investment lineups, account monitoring, and more.

Canadian stocks are on a roll in 2025 as the country prepares to name a new Prime Minister.

Carson is expanding one of its relationships in Florida while Lido Advisors adds an $870 million practice in Silicon Valley.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.