Fast-money hedge funds are rushing to cover their bearish U.S. stock bets even as the equity rally threatens to break down.

Speculative investors bought a net 206,227 S&P 500 Index E-mini contracts in the week ended June 23, the most since 2007, according to the latest Commodity Futures Trading Commission data.

Net short positions in the contracts were at their highest in almost a decade as the U.S. equity rebound pushed the benchmark back toward record territory.

The surge in short-covering comes as traders wrestle with what to do after a pause in one of the most unloved rallies in recent financial history. The S&P 500 had climbed more that 40% from its late-March low to early June, despite concerns that investors were overly optimistic about the pace of the U.S. economic recovery.

U.S. stocks fell almost 3% last week as the coronavirus spread showed no signs of slowing down.

Other measures of trader positioning also point to an increase in short-covering activity.

Short interest as a percentage of shares outstanding in the $266 billion SPDR S&P 500 ETF Trust had fallen to 4.9% Friday from 6.7% at the end of May, according to data from IHS Markit.

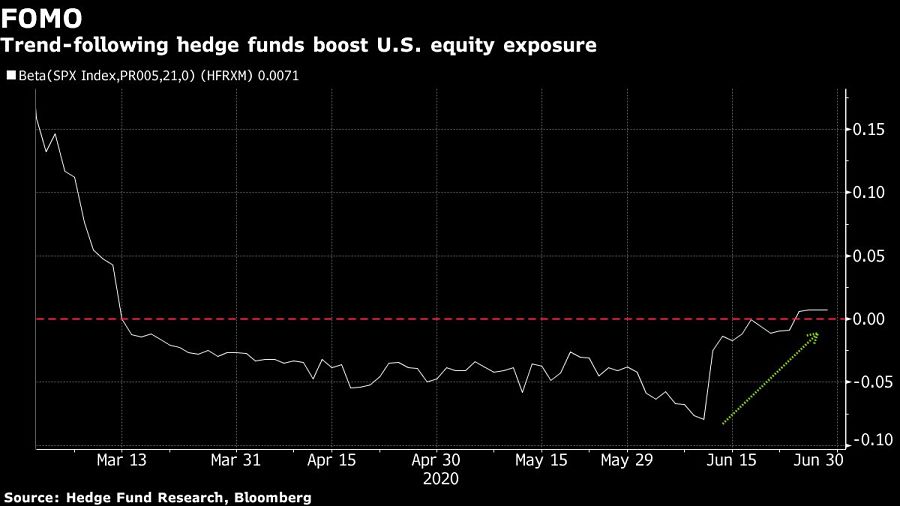

Meanwhile, the beta of the Hedge Fund Research Macro/CTA Index -- which tracks funds synonymous with trend-following quant strategies -- to the S&P 500 is back above zero for the first time since March. That suggests CTA funds have been boosting their exposure to U.S. equities and closing short positions.

“The CTA short base in global equities futures now looks tilted toward a ‘cover’ now,” Nomura Securities strategist Charlie McElligott wrote in a note Friday.

Driven by robust transaction activity amid market turbulence and increased focus on billion-dollar plus targets, Echelon Partners expects another all-time high in 2025.

The looming threat of federal funding cuts to state and local governments has lawmakers weighing a levy that was phased out in 1981.

The fintech firms' new tools and integrations address pain points in overseeing investment lineups, account monitoring, and more.

Canadian stocks are on a roll in 2025 as the country prepares to name a new Prime Minister.

Carson is expanding one of its relationships in Florida while Lido Advisors adds an $870 million practice in Silicon Valley.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.