History suggests the post-election day rally in U.S. stocks bodes well for further gains over the next three months.

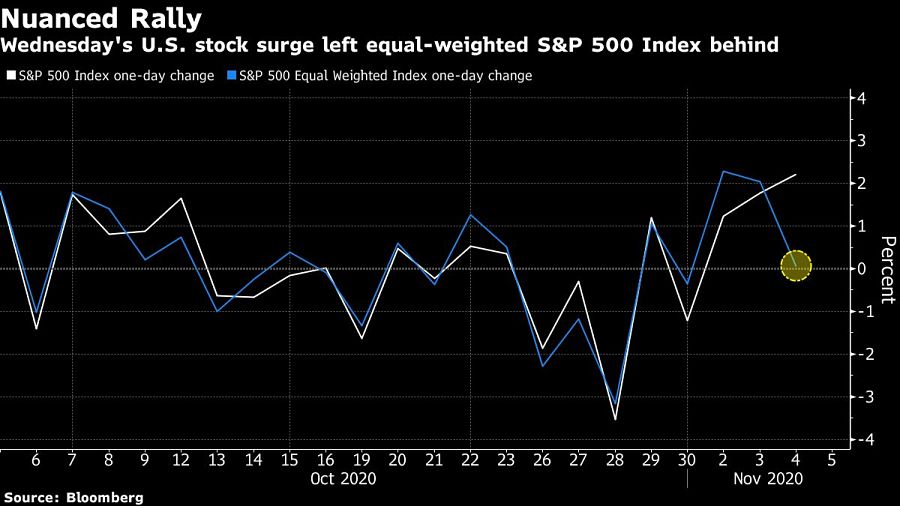

The S&P 500 Index jumped 2.2% Wednesday, its best performance the day after a U.S. presidential vote in data going back to 1932, according to Sundial Capital Research Inc. The benchmark’s median gain over the following three months has been 4.4%, its analysis shows.

“A good initial reaction following the election has been a very good sign,” Sundial president Jason Goepfert wrote in a note, adding that this was the first time the S&P 500 rose over 1.5% on both the day of and the day after an election.

The election outcome is still undecided. Democratic nominee Joe Biden is on the brink of defeating President Donald Trump, whose team has opened legal fights to stop vote counting in at least two states.

The Senate seems set to stay in Republican control, pointing to a reduced scope for fresh policy steps like huge stimulus, but also a lower likelihood of tax hikes or more regulation -- an outcome some investors view positively.

“If the Biden/split Congress scenario materializes, markets should be happy,” said Esty Dwek, head of global market strategy at Natixis Investment Managers. “We wouldn’t get the biggest fiscal package, but we also wouldn’t get the tax hikes and regulation markets were worried about.”

Still, aspects of Wednesday’s equity rally gave pause for thought, such as a rush to defensive technology names and the fact that the S&P 500 Equal Weighted Index -- a gauge of the average stock move -- closed little changed.

While extrapolating very short-term returns to long-term ones is “always questionable,” the strong positive correlation between the S&P 500’s day-after performance and additional gains or losses over the next three months “should give a little comfort to the bulls,” Goepfert said.

As of 8:38 a.m. Thursday in London, S&P 500 futures were up 1.4%, while Nasdaq 100 contracts were 2.3% higher. Asian and emerging market stocks climbed toward their highest since 2018.

Integrated Partners is adding a mother-son tandem to its network in Missouri as Kestra onboards a father-son advisor duo from UBS.

Futures indicate stocks will build on Tuesday's rally.

Cost of living still tops concerns about negative impacts on personal finances

Financial advisors remain vital allies even as DIY investing grows

A trade deal would mean significant cut in tariffs but 'it wont be zero'.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.