It’s hard to ask clients to invest in non-public companies that may not prove profitable years from now. And, it’s even harder to do it when the S&P 500 is up 25 percent year-to-date.

Still, financial advisors are indeed finding audiences ready to put money toward venture capital (VC) investments. Moreover, they are finding it’s not as hard a sale as one may think, considering the AI fervor and the decrease in public companies to invest in.

The Wilshire 5000 index was launched in 1974 and covers the whole of the US investable market. At the height of the dot-com boom in the late 1990s, the index included more than 7,500 stocks. Fast forward to the end of 2023, and the Wilshire 5000 contained about 3,400 stocks.

The steep drop in publicly-listed companies, according to Christian Munafo, chief investment officer at Liberty Street Funds, is in large part due to more companies seeking to stay private longer to avoid the regulation and volatility that comes with a public listing. Also helping to keep more companies on the sideline is the increase in opportunities for management to gain liquidity prior to an IPO. Finally, advisors say it’s a reaction to the dot-com days when companies went public well before they were ready.

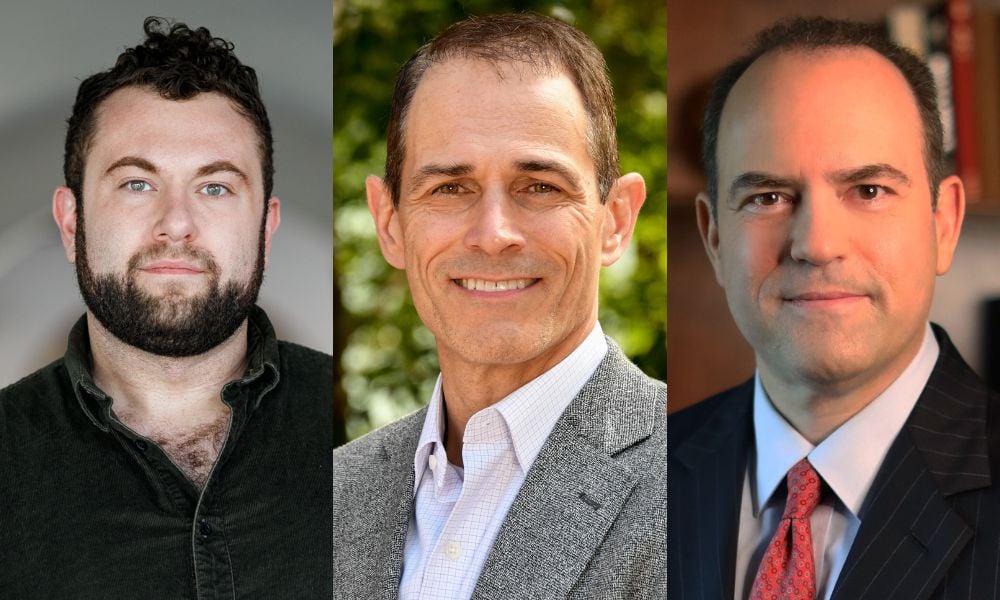

“If your average company in the '90s would go public in about four years from inception, much younger in its development, those companies today are staying private for 10, 15, 20 years, because they have that access now to private capital. And so they're scaling now inside the private markets, outside the listed markets,” said Munafo, who manages Liberty’s Private Shares fund (Ticker: PRIVX), a $1 billion closed-end interval fund that invests in a portfolio of private, late-stage growth companies.

Munafo's Private Shares fund is used by over 1,000 RIAs, a number he said continues to grow. And Munafo said he expects the new-issue market to pick up in 2025 due to the relative IPO drought, along with the increase in market "visibility" due to the clear election result.

As to the biggest opportunities, he starts of course with AI, but does not end there.

“We're buying into the space economy, aerospace, cybersecurity. All the digitization is happening across the economy. We're seeing AI, obviously artificial intelligence and machine learning. We like the infrastructure play there as opposed to some of the hype and frothy valuations we're seeing,” Munafo said.

Sevasti Balafas, CEO of boutique advisory firm GoalVest, recently launched a second venture fund investing in late-stage private companies. She agrees that the IPO market has been fairly depressed in recent years and also sees it bouncing back, along with price positive M&A, in response to the market’s greater clarity.

“It's been on hold for the last year or so, but with a friendlier rate environment and more clarity on the regime going forward, I think we're going to see more activity. And what that means is a lot of these private companies may be going in and having IPOs. You probably will see more M&A activity too, so that bodes well for a lot of these private companies,” Balafas said.

She also sees potential in and around the AI space and adds that clients should be cognizant that this is a longer-term investment, with many VC funds subject to multi-year lockups.

Meanwhile, Christopher Zook, chairman and chief investment officer of CAZ Investments, says he definitely plans to encourage investors to participate in VC across the CAZ investments platform in 2025. CAZ seeks partnerships with proven VC managers and typically looks to participate in growth stage companies that are no longer startups and have a better chance at “market disruption.”

“We see outstanding risk versus reward opportunities across the entire landscape of technology. We are on the cusp of more groundbreaking, life-altering innovation. From artificial intelligence, to robotics, to 3D printing, to astonishing advances in precision healthcare, the future is bright for mankind,” said Zook.

Elsewhere, Craig Robson, founding principal and managing director at Regent Peak Wealth Advisors, recommends investing across multiple vintage years to mitigate timing risk. He said he typically adds two to three venture strategies per year for client considerations.

“Due to the combination of trending lower interest rates, combined with 12-plus consecutive quarters of negative cash flow in private equity solutions - not seen since the Global Financial Crisis - our outlook is positive for VC investing going forward,” Robson said. “That said, as these are illiquid and higher volatility investments, we currently are maintaining the same allocation weightings in VC specific to one’s overall risk profile.”

Finally, Jake Miller, co-founder and chief solutions officer at private markets platform Opto Investments, does see a pickup in IPOs on the horizon thanks to “lower political uncertainty and lower short-term interest rates.” He adds that AI and related industries such as cybersecurity and fintech are all potential tailwinds to an IPO boom.

That said, he points out that these IPOs will benefit the 2018-2023 vintages of late stage VC managers who invested in the series C+ of these companies, and won't necessarily impact someone who decides to allocate to VC this year.

“Investment timelines range from eight to 12 years for early stage to three to five years in late stage, so investors need to be comfortable with the conditions of putting dollars to work today and partnering with a VC for at least that time period, rather than chasing VC because of today's positive IPO headlines.”

Canadian stocks are on a roll in 2025 as the country prepares to name a new Prime Minister.

Two C-level leaders reveal the new time-saving tools they've implemented and what advisors are doing with their newly freed-up hours.

The RIA led by Merrill Lynch veteran John Thiel is helping its advisors take part in the growing trend toward fee-based annuities.

Driven by robust transaction activity amid market turbulence and increased focus on billion-dollar plus targets, Echelon Partners expects another all-time high in 2025.

The looming threat of federal funding cuts to state and local governments has lawmakers weighing a levy that was phased out in 1981.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.