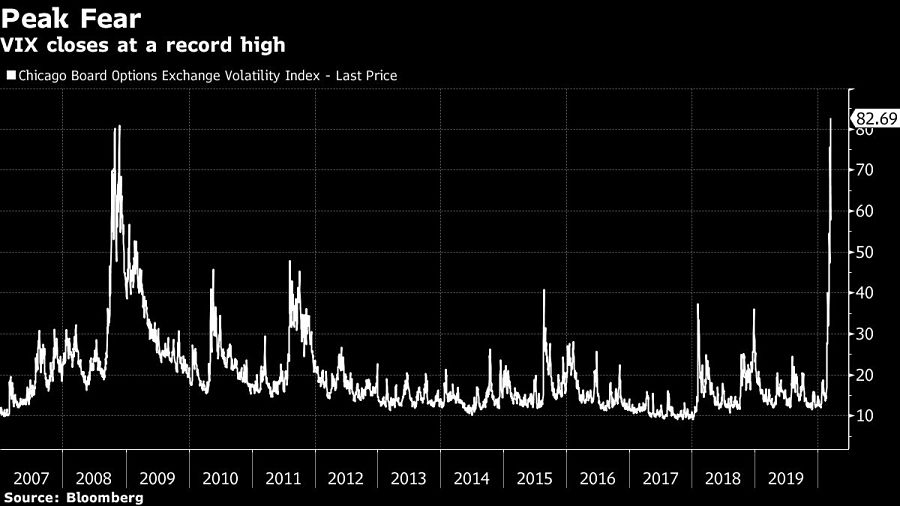

Volatility in U.S. stocks surged to a record after benchmark indexes suffered the biggest rout since 1987.

The Cboe Volatility Index ended Monday at 82.69 as the S&P 500 Index tumbled 12%. The fear gauge’s prior closing high was 80.86 on Nov. 20, 2008, after lawmakers postponed a vote on a plan to save the auto industry.

The gauge’s rose as high as 83.56 during Monday's session, short of its intraday record of 89.53 reached on Oct. 24, 2008.

“In 2008, you pretty much knew it was banking system breaking down, but didn’t know exactly how, and now it’s everything breaking down and how that spills over,” said Steve Sosnick, chief strategist at Interactive Brokers. “The latter is worse, I’d argue -- this is dislocating everything.”

The VIX Index measures the 30-day implied volatility of the S&P 500 Index based on out-of-the-money options prices. The current level implies daily swings of more than 5% are in the offing for the benchmark equity gauge, which is lower than what’s been realized over the past 10 sessions.

Integrated Partners is adding a mother-son tandem to its network in Missouri as Kestra onboards a father-son advisor duo from UBS.

Futures indicate stocks will build on Tuesday's rally.

Cost of living still tops concerns about negative impacts on personal finances

Financial advisors remain vital allies even as DIY investing grows

A trade deal would mean significant cut in tariffs but 'it wont be zero'.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.