Heading into the U.S. election, two potential outcomes were giving investors heartburn: a contested election, or a Joe Biden presidency with a Republican Senate.

Now both scenarios look more likely than they did 24 hours ago.

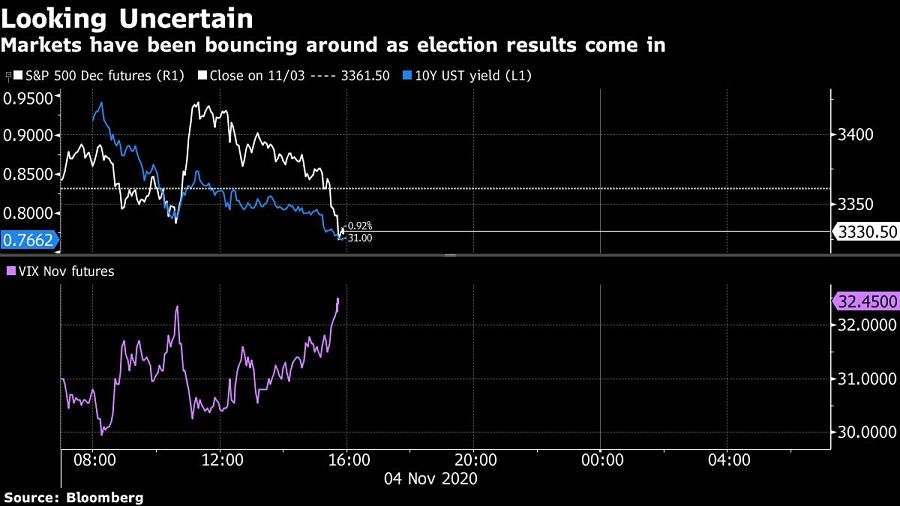

President Donald Trump falsely called himself the victor and said he would ask the Supreme Court to intervene as results look too close to call in many battleground states. U.S. stock futures swung between gains and losses, Treasuries jumped and cross-asset volatility rose on renewed fears of protracted post-election wrangling.

“The key inflection point for markets will be whether the government -- be it Biden- or Trump-led -- is divided,” said Peter McCallum, rates strategist at Mizuho International in London. “As things stand, this is the most likely outcome, hence stocks being a little lower and the Treasury curve bull flattening.”

The Senate, which had been seen by many transferring to Democratic leadership, broke toward Republicans throughout the night, while the House of Representatives is going to remain in Democratic hands.

The main worry related to divided government: Markets have been hoping for a large fiscal stimulus package that will be less likely if the two parties need to work together.

“With Republicans still in charge in the Senate, we’d be surprised to see a stimulus bill early next year much in excess of $500 billion, far less than the $2 trillion we expected if Democrats had won,” said Ian Shepherdson, chief economist at Pantheon Macroeconomics in New York.

“A Democrat president with a Republican Senate would likely be forced into a fiscal contraction which is not spectacularly helpful for growth,” said Sebastien Galy, a macro strategist at Nordea Investment Funds, which oversees the equivalent of $255 billion in assets.

The even bigger worry for money managers -- lack of a resolution for weeks -- also doesn’t look far-fetched in the current scenario. Investors had been making bets recently on volatility declining soon after the election.

“The results are close enough to be challenged or contested,” said Elsa Lignos, global head of FX strategy at RBC Capital Markets. “The fear of a contested outcome has not really materialized in risk-off yet, but it does unfortunately seem more likely in the day ahead.”

With no “blue wave” for Democrats on Tuesday night, volatility will likely remain elevated.

“The odds have increased that the election comes down to one state now (particularly after Arizona was called for Biden by FOX), which means a still-heightened chance of litigious outcome,” said strategist Charlie McElligott of Nomura Securities International Inc.

McCallum advises buckling up for continued drama. “We would marginally favor going long risk assets here and fading the Treasury bull flattening,” he said. “But clearly this will be volatile.”

Still, stock bulls can find plenty of ammo in this scenario, said Kelvin Tay, the Asia Pacific chief investment officer for UBS Group’s wealth management unit. He reasoned that legislative gridlock in Washington would prevent significant changes to the tax code and support corporate earnings growth.

“I would remain positive on equities because of interest rates at these levels, negative real yields and because the economy is recovering,” Tay said. “Equities are the right asset class to be in.”

Integrated Partners is adding a mother-son tandem to its network in Missouri as Kestra onboards a father-son advisor duo from UBS.

Futures indicate stocks will build on Tuesday's rally.

Cost of living still tops concerns about negative impacts on personal finances

Financial advisors remain vital allies even as DIY investing grows

A trade deal would mean significant cut in tariffs but 'it wont be zero'.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.