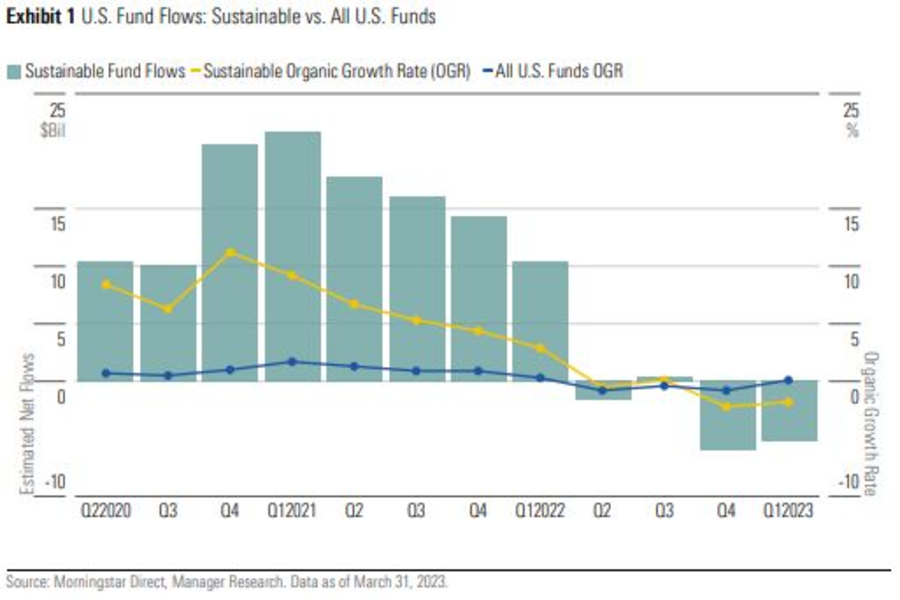

U.S. funds that choose stocks based on environmental, social and governance criteria posted outflows for the second consecutive quarter as investors fled to safer assets amid Federal Reserve rate hikes.

Investors yanked $5.2 billion from U.S.-domiciled sustainable funds in the first quarter of this year, according to a report by Morningstar Inc. The exodus was driven by the $13.6 billion iShares ESG Aware MSCI USA ETF (ESGU), which shed $6.5 billion over that period.

A steady drop in fund flows came as Russia’s invasion of Ukraine boosted oil prices and consequently shares of companies involved in the production of fossil fuels, which tend to be excluded from ESG portfolios.

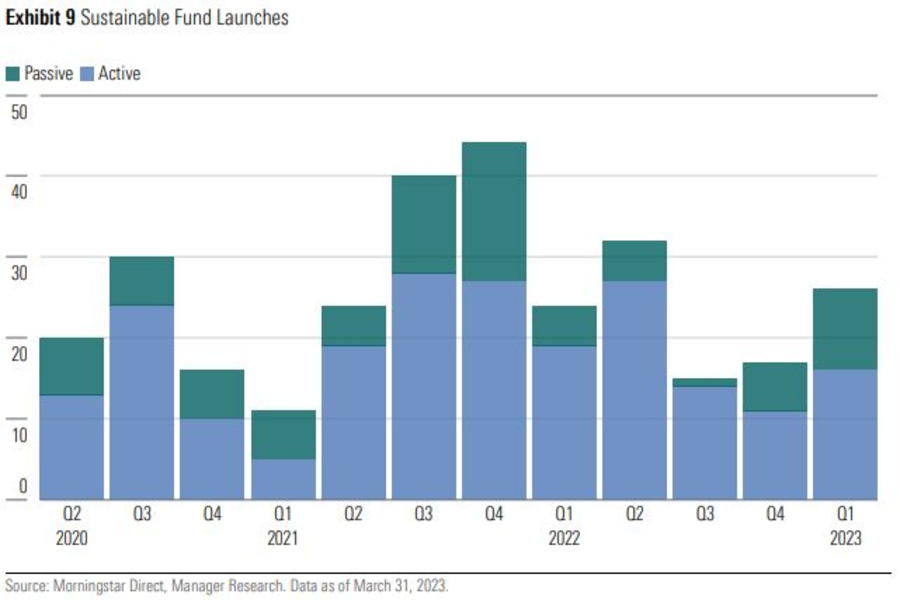

But the outflows didn’t seem to deter asset managers, as 27 sustainable funds debuted in the first quarter, up from the number of launches in the fourth quarter of 2022. And sustainable-fund assets climbed to almost $296 billion — the highest they’ve been since the first quarter of 2022 — thanks, in part, to higher equity and bond valuations, Morningstar’s report said.

It has still paid to be a stock-picker in the ESG arena during this tough market. Actively managed sustainable funds broke a three-quarter outflow streak to post inflows for the first time in a year. Passive sustainable funds, meanwhile, saw an outflow of $6.1 billion in the first quarter, with ESGU’s losses weighing on the group.

Last week's layoffs totaled at least 130 Cetera employees, according to a senior industry executive.

Four of the Magnificent Seven will report this week.

Easing anxiety has seen the haven asset slide from record high.

Uncertainty remains challenging for Treasuries traders.

Move will raise concerns of inflationary impact of tariffs.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.