BlackRock is planning to expand its proxy voting choice program to some individual fund shareholders, announcing the move a day after Vanguard said it was doing something similar.

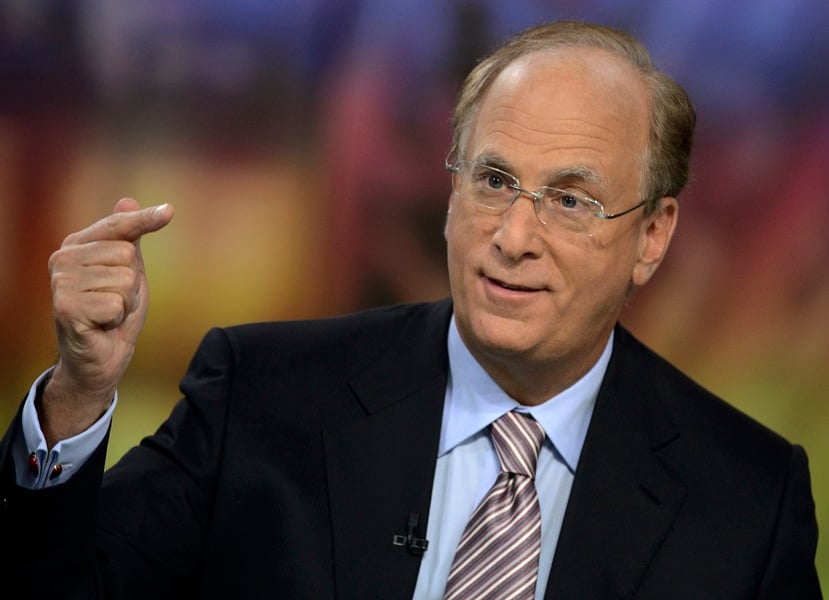

Initially, the program will be available to U.K. investors, but it could eventually expand to all fund shareholders, CEO Larry Fink said in a letter to client and corporate CEOs.

A year ago, BlackRock launched its voting choice option for institutional investors, allowing big clients such as pension funds, endowments and insurance companies to decide how their shares are voted. Since then, institutions holding a quarter of the assets that are eligible for that program, representing $295bn, have controlled how their shares are voted, the company said.

Beyond institutional asset owners, the only other eligible clients have been ultra-high-net-worth individuals in separately managed accounts through Aperio, which BlackRock acquired in early 2021.

However, the company is working to let some U.K. mutual fund shareholders vote how they please.

“We are working with a digital investor communications platform in the U.K. to enable investors in select mutual funds to exercise choice in how their portion of eligible shareholder votes are cast,” Fink said in today’s letter. “This is an industry first to translate individual investor views into voting instructions.”

“My hope is that in the future, every investor — ultimately including individual investors — has access to voting choice, if they want it,” Fink wrote.

Engagement is particularly important for index funds, he said, as those vehicles hold stocks for an average of 20 years, compared with the 18 months in actively managed funds.

However, the firm does not expect individual investors “to wade through thousands of proxy questions every year,” and it will almost certainly keep voting shares on their behalf in a way that it sees as maximizing long-term returns.

In addition, it would currently be too expensive to extend proxy voting choices to each individual fund investor without further technological advances that would reduce costs, Fink said.

In the future, “all investors should be able to pick from a range of voting policies to reflect their preferences and … it should be as easy to do so as it is to buy a mutual fund or ETF on your mobile phone today,” Fink said.

Such a change would require cooperation among policymakers, regulators, fund boards and asset managers, he noted.

Fink also tipped his hat to a peer company, presumably Vanguard, for its announcement that it would let some index fund shareholders weigh in on proxy voting issues.

Giving individual investors some autonomy over proxy voting could help deflate the attacks over ESG that BlackRock and other big asset managers have recently faced from some conservative politicians.

However, those campaigns have ramped up even as BlackRock has clarified its role as a major investor in the oil and gas business and stated that its primary interest is maximizing returns.

This story was originally published on ESG Clarity.

Looking to refine your strategy for investing in stocks in the US market? Discover expert insights, key trends, and risk management techniques to maximize your returns

Driven by robust transaction activity amid market turbulence and increased focus on billion-dollar plus targets, Echelon Partners expects another all-time high in 2025.

The looming threat of federal funding cuts to state and local governments has lawmakers weighing a levy that was phased out in 1981.

The fintech firms' new tools and integrations address pain points in overseeing investment lineups, account monitoring, and more.

Canadian stocks are on a roll in 2025 as the country prepares to name a new Prime Minister.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.