There is a crop of ETFs seeking to benefit from the new political reality in the US.

Already, so early in the second Trump administration, several products are seeking regulatory approval, and observers say more will almost certainly follow.

Such ETFs include a “MAGA Seven” fund, clearly a play on the Magnificent Seven, but with the twist that the fund would hold stocks poised to do well under Trump. Another focuses on deregulation. One even hopes to invest similarly to Trump’s proposed sovereign wealth fund.

And that’s to say nothing of a line of funds from Trump Media & Technology Group subsidiary Truth.fi, which has filed trademarks for three ETFs and corresponding separately managed account strategies.

In the vast world of exchange-traded funds, it’s not much of a stretch to say there is a product for anything. But there is a question of whether the wave of proposed ETFs is just riding a meme or offers genuine opportunities.

“We’ve seen a lot of thematic ETFs, a lot of effort and marketing [of] thematic ETFs, and developing themes that investors might be interested in. Obviously, politics is all over the news right now, so people have some level of focus on it,” said Bryan Armour, Morningstar’s director of passive strategies research for North America.

In the past, some funds have pursued political affiliations or opportunities, but those have seen limited success, Armour said.

“I don’t think there’s been a significant uptake by investors for a politically driven ETF,” he said.

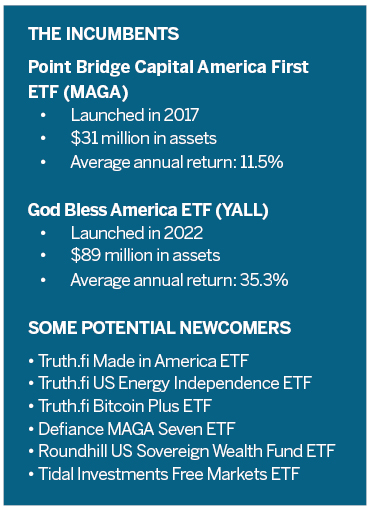

One example is Point Bridge Capital’s America First ETF, with the ticker MAGA, which launched in 2017 and currently represents less than $31 million in assets.

One example is Point Bridge Capital’s America First ETF, with the ticker MAGA, which launched in 2017 and currently represents less than $31 million in assets.

That ETF, according to the company, “is the first ETF of its kind, providing investors with the opportunity to make investment decisions based on their Republican political beliefs.” It tracks an index of 150 S&P 500 companies “whose employees and political action committees (PACs) are highly supportive of Republican candidates.”

That product has returned an average of 11.46 percent per year since inception, compared with the index’s 12.3 percent returns. Although it has outperformed peer funds in its category, it has lagged behind the S&P 500, Armour noted.

Another existing product, the God Bless America ETF, with the ticker YALL, says it caters to “God-fearing, flag-waving conservatives.” It launched in 2022 and represents a modest $89 million in assets. The subadvisor, Curran Financial Partners, picks stocks with at least $1 billion market capitalizations, excluding those of companies that “have emphasized politically left and/or liberal political activism and social agendas at the expense of maximizing shareholder returns.”

While YALL ranked in the top one percent and three percent for performance in 2023 and 2024, it is in the bottom one percent so far in 2025, data from Morningstar show.

But perhaps the best-known firm in the broader category of so-called anti-woke investing is Strive Asset Management. That firm, which was cofounded by former presidential hopeful Vivek Ramaswamy, counts 13 ETFs in its product line, with a total of about $2 billion in assets.

That makes the firm the 72nd-largest US ETF issuer, said Aniket Ullal, head of ETF research and analytics at CFRA Research.

“That’s pretty good,” Ullal said.

Still, as investors have responded to policy changes, both in the first and now second Trump administrations, they haven’t necessarily sought politically themed funds, he said.

In part, that’s because funds in that broad category have exposure across sectors, whereas using sector-specific ETFs can be more efficient for investing in response to policy changes, he said.

Even so, ETF issuers aren’t shy about bringing new ideas to the market.

“It wouldn’t surprise me to see more products around political themes,” Ullal said. “But it is a very competitive market.”

The president has long offered a range of branded products, and his companies have recently expanded to meme coins. It may be of little surprise to observers that there may soon be Trump-affiliated ETFs. But Truth.fi has yet to file an initial prospectus with the Securities and Exchange Commission, so it’s unclear what those funds will look like. The pending trademarks are for Truth.fi Made in America, US Energy Independence, and Bitcoin Plus ETFs and SMAs. As much as $250 million would be custodied by Charles Schwab, and New Jersey-based Yorkville Advisors would be the RIA responsible for building them.

Some of the forthcoming funds not affiliated with Trump include the Defiance MAGA Seven ETF, the Roundhill US Sovereign Wealth Fund ETF, and Tidal Investments’ Free Markets ETF.

The first, an actively managed ETF, would invest in seven stocks and “provide targeted exposure to companies that appear positioned to benefit from the economic, regulatory, and policy environment shaped by the Trump administration and its potential future impact,” its prospectus reads.

“It would be very challenging to define what the seven most MAGA companies are,” Morningstar’s Armour said.

Accurately following the forthcoming sovereign wealth fund’s investing strategy in an ETF is also a tall order, in part because public filings happen after positions are taken.

“At a minimum it would be delayed, but potentially also would not capture the full portfolio,” Armour said. That ETF acknowledges such limitations, citing potential regulatory constraints and availability of public information as hurdles.

Thematic ETFs must do three things correctly to be successful, Armour said. The first is picking the right theme – one that proves lasting. The second is whether the fund accurately represents the theme – a trickier point, as highlighted by the different ways ETFs seek to invest in AI, he said. The last condition is getting in on the theme at a good price.

“You really need a lot of things to go right, and it’s really hard for thematic funds to outperform the market in the long run,” Armour said. “I would always look at any new ETF through an investment lens and not let emotions dedicate decisions.”

Clearly, ETF issuers see a market for political investing in various forms. But here is one advisor’s thoughts on the temptation to invest in line with political beliefs, fads, or memes: Stay away. There is an ocean of ETFs on the market, as issuers can create obscure indexes and curate their holdings to follow them – and such themes are often a distraction for serious investors, said Kash Ahmed, president of American Private Wealth.

“Your money is too important – especially if you don’t have enough – to be throwing it at something that is shiny or a red dot,” he said. “Investing should just be investing. You shouldn’t try to mix your politics or emotions with investing.”

Canadian stocks are on a roll in 2025 as the country prepares to name a new Prime Minister.

Two C-level leaders reveal the new time-saving tools they've implemented and what advisors are doing with their newly freed-up hours.

The RIA led by Merrill Lynch veteran John Thiel is helping its advisors take part in the growing trend toward fee-based annuities.

Driven by robust transaction activity amid market turbulence and increased focus on billion-dollar plus targets, Echelon Partners expects another all-time high in 2025.

The looming threat of federal funding cuts to state and local governments has lawmakers weighing a levy that was phased out in 1981.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.