As the global pandemic intensifies the surge in ethical investing, Citigroup Inc. now projects ESG stock ETFs in the U.S. alone will boast more than $1 trillion in assets by 2030.

Analysts at the bank say the global pandemic has stirred investor demand for companies doing good, especially those with strong labor practices. Add the frenzy for tech-focused thematic funds -- many of which fall within the environmental, social and governance category -- and the sustainability boom is smashing Wall Street projections.

“The past year’s Covid circumstance has accelerated equity ESG ETF adoption,” the team led by Scott Chronert wrote in a note. “Increased social awareness, and a growing interest in related structural themes, is causing us to rethink the appropriate road map for assessing the ESG ETF opportunity.”

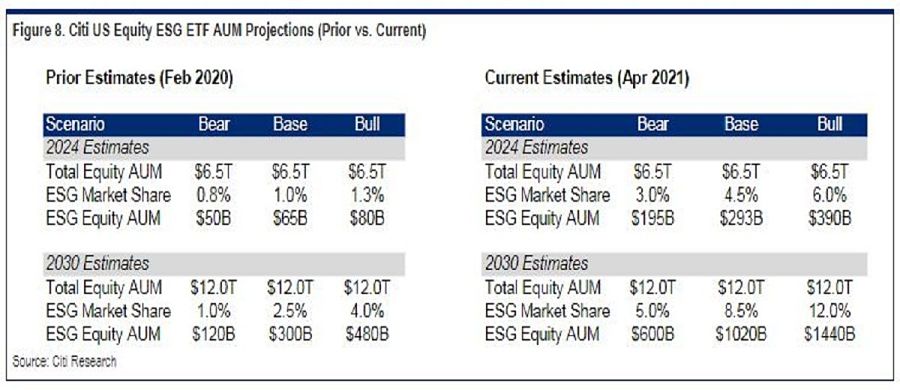

A little over a year ago, Citigroup expected $65 billion of assets in equity ESG exchange-traded funds by 2024 and $300 billion by the end of the decade. Both projections looked ambitious at the time. But the total is already at $112 billion, according to the U.S. bank.

The pandemic isn’t the only thing to draw attention to investments with a conscience. Democratic control of Congress has triggered a rush into green funds as investors seek to front-run a potential wave of new environmental policies.

Another big reason for the accelerated growth is the increasing convergence between thematic and ESG categories. Thematic funds, which invest according to market niches like robotics or artificial intelligence, have been one of the past year’s hottest trends thanks to the high-profile success of firms like Ark Investment Management.

The categorization for certain funds is tricky and often comes down to a matter of labeling. But futuristic themes like genomics and cybersecurity are often considered ESG since they address social and governance concerns. A fund like BlackRock’s iShares Self-Driving EV and Tech ETF (IDRV), for instance, ticks both thematic and ESG boxes.

Chronert and team predict that ESG ETFs will account for 4.5% of total equity ETF market share by 2024 and 8.5% by 2030, which assumes about $4 billion per month of flows with zero market appreciation factored in. In the past year, monthly inflows have averaged closer to $5 billion, according to Citigroup.

These kind of bullish projections find support across the industry.

“It’s our view this next decade will all be about action, and this action will be driven by what we’re observing everyday -- the pandemic, climate change, social issues,” said Michael Arone, chief investment strategist for the U.S. SPDR exchange-traded fund business at State Street Global Advisors.

AI is no replacement for trusted financial advisors, but it can meaningfully enhance their capabilities as well as the systems they rely on.

Prudential's Jordan Toma is no "Finfluencer," but he is a registered financial advisor with four million social media followers and a message of overcoming personal struggles that's reached kids in 150 school across the US.

GReminders is deepening its integration partnership with a national wealth firm, while Advisor CRM touts a free new meeting tool for RIAs.

The Texas-based former advisor reportedly bilked clients out of millions of dollars, keeping them in the dark with doctored statements and a fake email domain.

The $3.3 trillion tax and spending cut package narrowly got through the upper house, with JD Vance casting the deciding vote to overrule three GOP holdouts.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.