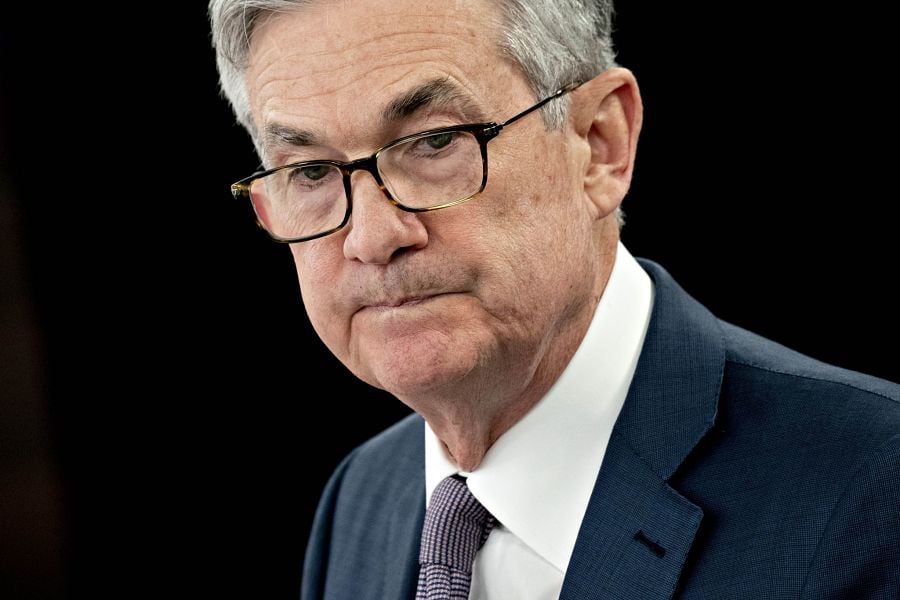

Federal Reserve Chair Jerome Powell unveiled a new approach to setting U.S. monetary policy, letting inflation sometimes run faster than the central bank has traditionally allowed, in a shift that will likely keep interest rates low for years to come.

Powell said the Fed will seek inflation that averages 2% over time, a step that implies allowing for price pressures to overshoot after periods of weakness. It also adjusted its view of maximum employment to allow labor market gains to run more broadly.

“Our revised statement emphasizes that maximum employment is a broad-based and inclusive goal,” Powell said in a speech delivered virtually for the central bank’s annual policy symposium, which is traditionally held in Jackson Hole, Wyoming. “This change reflects our appreciation for the benefits of a strong labor market, particularly for many in low- and moderate-income communities.”

During the longest U.S. economic expansion on record until the pandemic hit earlier this year, many groups benefited -- including minorities and women -- in their ability to find work. With unrest breaking out across the U.S. over racial inequality, questions have been raised about how the Fed’s policy helps communities broadly.

In its new statement on longer-run goals, the Fed said its decisions would be informed by its assessment of “shortfalls of employment from its maximum level.” The previous version had referred to “deviations from its maximum level.” The change deemphasizes previous concerns that low unemployment can cause excess inflation.

The markets took Powell’s remarks as another indication that the Fed is in no rush to raise interest rates. Bonds and U.S. stocks rose along with gold prices.

Regarding price pressures, the document says the committee will target “inflation that averages 2% over time” and will aim to bring inflation above the 2% target following periods when inflation runs below that level.

The shift Powell announced represents the product of an unprecedented review of the Fed’s strategies, tools and approach to communications that began in early 2019.

Since the central bank officially set its inflation target at 2% in 2012, the Fed’s preferred measure of price increases has consistently fallen short of that objective, averaging just 1.4%.

Low inflation contributes to low interest rates, reducing the Fed’s ability to fight off economic downturns and potentially making them deeper and longer. Powell noted a risk, saying that “if excessive inflationary pressures were to build or inflation expectations were to ratchet above levels consistent with our goal,” the central bank wouldn’t hesitate to act.

He called the changes “a robust updating of our monetary policy framework.”

The latest annual survey from EBRI and Greenwald Research sheds light on anxieties around living costs, volatility, and the future of federal income support in retirement.

It's a showdown for the ages as wealth managers assess its impact on client portfolios.

The Merrill Lynch defectors expand RBC's reach in Texas while LPL bolsters its New York presence.

Separately, Cleveland Fed President Beth Hammack said the central bank could make a move by June if data show a clear economic trajectory.

After onboarding 26 new advisors in the first three months of 2025, the independent wealth platform is looking forward to continued momentum in Q2.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.