Federal Reserve Chair Jerome Powell stressed that the economy needs more fiscal and monetary policy support, and warned that mounting coronavirus infection rates are a risk.

“I think we’ll have a stronger recovery if we can just get at least some more fiscal support,” Powell told reporters Thursday after the Fed kept interest rates near zero and made no change to its pace of asset purchases. “The recent rise in new COVID-19 cases, both here in the United States and abroad, is particularly concerning.”

The Fed earlier kept the federal funds target rate in a range of zero to 0.25%, where it’s been since March, and maintained bond purchases at $120 billion a month. Powell spoke about the outlook for the economy as the results of the U.S. presidential election remain uncertain.

“Economic activity and employment have continued to recover but remain well below their levels at the beginning of the year,” the Federal Open Market Committee said in a statement following its two-day meeting, largely repeating language on the economy they’ve employed since July.

“The ongoing public health crisis will continue to weigh on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term,” the FOMC said in language identical to the prior statement in September.

Ten-year Treasury yields were little changed after the statement was released, hovering at about 0.77%. The yield curve, as measured by the gap between 5- and 30-year yields, also held steady at about 121 basis points.

While vote counting continues in closely contested U.S. states, the two major parties could split control of Washington. Democrat Joe Biden is on the brink of capturing the White House from Donald Trump, and his party will retain the House of Representatives. But control of the Senate may hinge on runoff elections in Georgia.

A split outcome would reduce the chances for a big fiscal stimulus package from Congress in the new year, even as the COVID-19 pandemic continues to threaten the economy. That may put more pressure on the Fed to ramp up its bond buying, or at least change the composition of its purchases, in an attempt to lower borrowing costs and further boost the recovery.

Powell deflected a question about the election, noting that it “comes up now and again but it is not at all a central focus of the meeting.”

“With fiscal support looking both smaller and less likely, the Fed will have to think harder about what it can do to steer the economy in the desired direction,” Roberto Perli, a former Fed economist and partner at Cornerstone Macro, said before the meeting.

Fed officials, however, made no change to monthly purchases Thursday and gave no signal they might do so when they meet again Dec. 15-16.

Powell sounded a bit more hopeful, noting, “There are plenty of people on Capitol Hill who see a need for further fiscal action.”

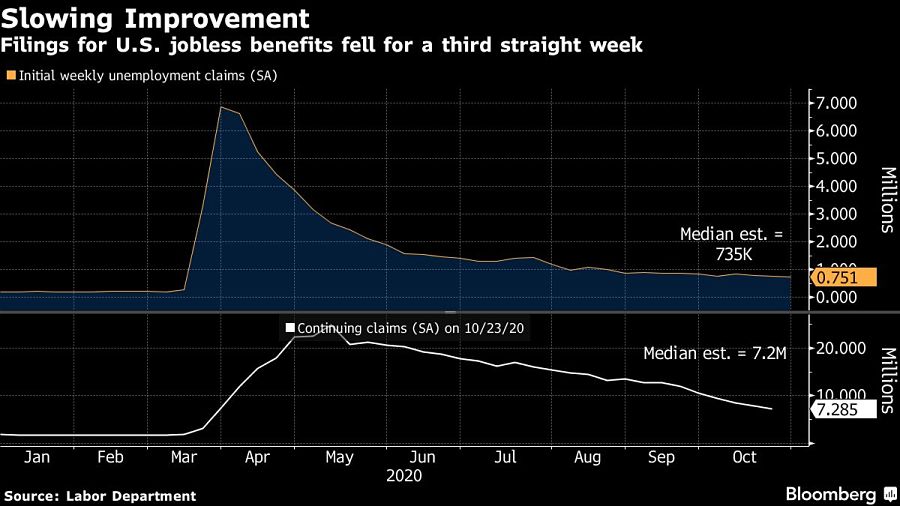

The economic recovery remains uneven against a backdrop of surging COVID-19 cases, with more than 12 million Americans still out of work. October’s employment report, due Friday, is expected to show the jobless rate continuing to edge down to 7.6%, while the pace of new hiring probably cooled for the fourth consecutive month.

The vote was unanimous. Minneapolis Fed President Neel Kashkari, a voter this year, did not attend the meeting following the birth of a child. San Francisco Fed President Mary Daly voted as an alternate.

The looming threat of federal funding cuts to state and local governments has lawmakers weighing a levy that was phased out in 1981.

The fintech firms' new tools and integrations address pain points in overseeing investment lineups, account monitoring, and more.

Canadian stocks are on a roll in 2025 as the country prepares to name a new Prime Minister.

Carson is expanding one of its relationships in Florida while Lido Advisors adds an $870 million practice in Silicon Valley.

The approval of the pay proposal, which handsomely compensates its CEO and president, bolsters claims that big payouts are a must in the war to retain leadership.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.