Two tech and advisory-focused firms are expanding their leadership teams with new appointments aimed at improving operations and client service amid ongoing demand from advisory firms.

Future Capital has named Hannah Wilson as chief operating officer, tasking the former investment banking director with strengthening the firm’s internal operations and advisor-facing infrastructure. Wilson will lead initiatives to streamline workflows, scale technology, and enhance the firm’s support for financial advisors managing held-away 401(k) assets.

“Hannah’s appointment comes at a pivotal time as we continue to expand our services to meet the growing demand for integrated retirement guidance,” Jay Jumper, founder and chief executive of Future Capital, said in a statement announcing Wilson's appointment.

Prior to joining the firm, Wilson was a director at Raymond James, where she led operational improvements in its investment banking unit. Her experience in financial services and tech operations is expected to contribute to Future Capital’s efforts to simplify retirement account management for advisory clients.

“With retirement accounts representing a significant portion of household wealth, financial advisors need reliable, efficient tools to provide truly comprehensive guidance,” Wilson said. “I look forward to strengthening our operational framework to support advisors in delivering exceptional service to their clients.”

Since the rollout of its Construct 401(k) asset management tool for advisors last June, Future Capital has spent the last year forging integration partnerships with several firms including AssuredPartners Investment Advisors, SS&C, and Axos Clearing.

In addition to Wilson’s appointment, Future Capital will also benefit from the product expertise of Karl Matthews, who was recently named chief product officer at sister company SIGNiX. Matthews will serve as a shared resource between the two firms, drawing on his background in fintech and product development to support Future Capital’s offering.

Meanwhile, Advyzon has added Clark Richards as vice president of client success. Richards, who joined the firm in May, will oversee the client-facing teams responsible for support, onboarding, and relationship management. The firm’s leadership said his hire aligns with its commitment to improving the advisor experience.

“Clark’s depth of experience and thoughtful leadership approach aligns perfectly with our mission to provide both powerful technology and an exceptional experience,” said Hailin Li, founder and CEO of Advyzon.

Richards brings more than 14 years of experience in fintech client relationship management. He previously spent 12 years at Tamarac within Envestnet, including time leading strategic relationship teams, before moving to Juniper Square to help scale its client engagement functions.

“I’m so excited to join Advyzon and to lead our client-facing teams during this period of exponential growth,” said Richards.

A well established provider, Advyzon occupies several key domains within the broader kingdom of wealth technology, including CRM systems, trading and rebalancing solutions, and document management software.

Last August, it rolled out an integrated back-end solution developed jointly with Innovayte, an up-and-coming custodial and clearing firm. In November, it announced Auria, a suite of tools geared towards ultra-high-net-worth investors and family offices.

Advyzon serves over 2,100 advisory firms with its technology platform and portfolio management solutions.

LifeMark Securities has faced scrutiny in the past for its sales of GWG L bonds.

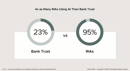

New data from F2 Strategy shows 95% of RIAs are using AI - four times the adoption rate of banks. Trust companies account for 90% of firms not using AI, raising alarms about their ability to stay competitive.

The ex-registered broker facilitated a series of transactions, including nine trades totaling nearly $130,000 and eight withdrawals amounting to $85,000, for a fourteen-month period after the client's death.

The wealth tech giant is offering advisors a natural, intuitive way to use AI through its new business intelligence and insights engine features.

Sometimes letting clients lead conversations, rather than having all the answers, can be the most powerful trust-builder.

How intelliflo aims to solve advisors' top tech headaches—without sacrificing the personal touch clients crave

From direct lending to asset-based finance to commercial real estate debt.