An exchange-traded fund is in the works that's looking at brandishing the made-in-the-USA label. But it’s an American fund with a twist — it will remove any companies the firm deems “activist.”

The God Bless America ETF, advised by the Toroso Investments and sub-advised by Curran Financial Partners, will seek to invest in U.S.-listed companies with a “track record of creating American jobs,” according to a filing Tuesday with the Securities and Exchange Commission. The actively managed ETF, which will trade under the ticker YALL, will screen out firms that have “emphasized political activism and social agendas at the expense of maximizing shareholder return.”

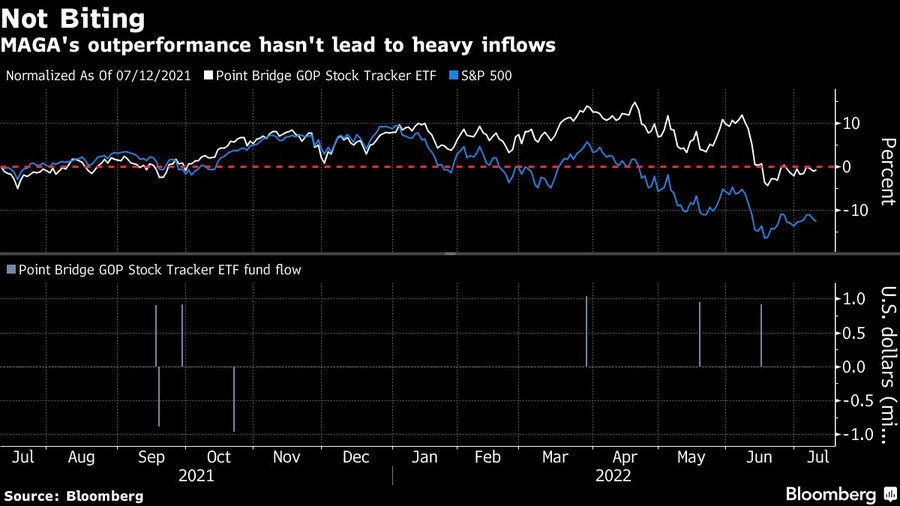

Previous principles-based ETFs have met with muted demand. The Point Bridge GOP Stock Tracker ETF (MAGA), which invests in companies that support the Republican party, has attracted just $15 million in assets despite handily outperforming the S&P 500 over the past year. Meanwhile, assets in environmental, social and governance-focused ETFs declined in the first quarter — a rare drop that Bloomberg Intelligence sees continuing as performance suffers.

“These things are hard to sell as an investment,” said Eric Balchunas, Bloomberg Intelligence ETF analyst. “I just think they’re probably overestimating how much people will actually move their investments into this. Even people who care a lot — people like cheap, they like liquid.”

Michael Venuto, Charles Ragauss and Adam Curran will manage the God Bless America ETF, which will hold 30 to 40 companies, according to the filing. Fees are not yet listed.

The average expense ratio for actively managed equity ETFs is roughly 68 basis points, versus about 50 basis points for passive equity ETFs, Bloomberg data show.

Driven by robust transaction activity amid market turbulence and increased focus on billion-dollar plus targets, Echelon Partners expects another all-time high in 2025.

The looming threat of federal funding cuts to state and local governments has lawmakers weighing a levy that was phased out in 1981.

The fintech firms' new tools and integrations address pain points in overseeing investment lineups, account monitoring, and more.

Canadian stocks are on a roll in 2025 as the country prepares to name a new Prime Minister.

Carson is expanding one of its relationships in Florida while Lido Advisors adds an $870 million practice in Silicon Valley.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.