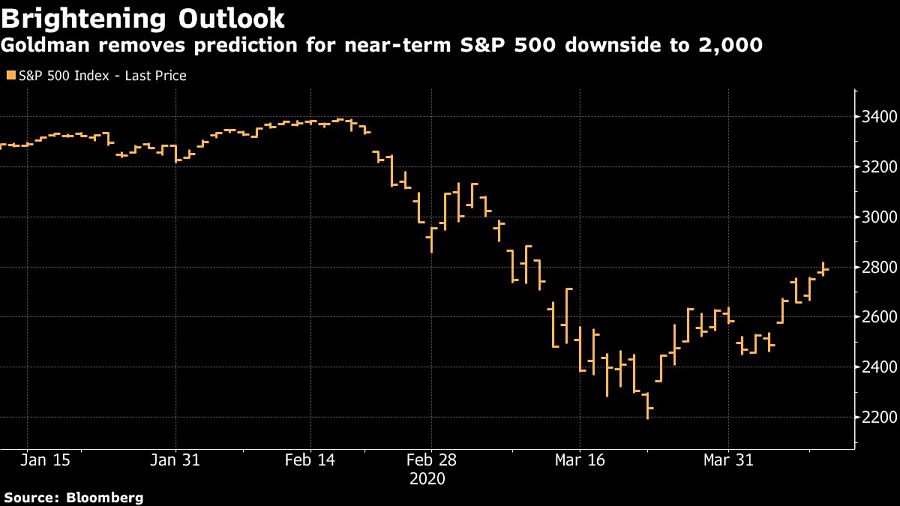

U.S. stocks are unlikely to make fresh lows thanks to the “do whatever it takes” approach of policymakers, according to Goldman Sachs Group Inc.

A combination of unprecedented policy support and a flattening viral curve has “dramatically” cut risks to both markets and the American economy, strategists including David Kostin wrote in a note Monday. If the U.S. doesn’t have a second surge in infections after the economy reopens, equity markets are unlikely to make new lows, they said.

“The Fed and Congress have precluded the prospect of a complete economic collapse,” the strategists wrote. “These policy actions mean our previous near-term downside of 2,000 is no longer likely” for the S&P 500 Index.

The U.S. benchmark closed last Thursday around the 2,790 level, having hit a three-year low of 2,237 on March 23.

Goldman cited policy measures including rate cuts, the Federal Reserve’s Commercial Paper Funding Facility and fiscal stimulus such as the $2 trillion Cares Act among the “numerous and increasingly powerful” actions that have spurred equity investors to take a risk-on view.

Meanwhile, the strategists expect investors to look through first-quarter results from the upcoming earnings season, and focus instead on the outlook for 2021, according to the note.

“Despite the likely steady stream of weak earnings reports, 1Q earnings season will not represent a major negative catalyst for equity market performance,” they wrote. “Our year-end S&P 500 target remains 3,000.”

Driven by robust transaction activity amid market turbulence and increased focus on billion-dollar plus targets, Echelon Partners expects another all-time high in 2025.

The looming threat of federal funding cuts to state and local governments has lawmakers weighing a levy that was phased out in 1981.

The fintech firms' new tools and integrations address pain points in overseeing investment lineups, account monitoring, and more.

Canadian stocks are on a roll in 2025 as the country prepares to name a new Prime Minister.

Carson is expanding one of its relationships in Florida while Lido Advisors adds an $870 million practice in Silicon Valley.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.