Sure, LPL Financial Holdings' $2.7 billion purchase this year of rival Commonwealth Financial Network has grabbed plenty of headlines.

But it turns out the staff at LPL has been plenty busy quietly buying the practices of much smaller firms, with an annual war chest in the neighborhood of $800 million to do so, according to one analyst.

In a research note published last night, Jeff Schmitt, an analyst with William Blair, wrote that LPL was continuing to invest heavily in its liquidity and succession planning program, which buys the books of businesses or client base from retiring advisors, with another advisor taking over for clients.

All large brokerage firms like LPL have a version of such programs to buy the practices of retiring advisors. What’s notable about LPL’s focus on succession planning is its scope, according to Schmitt. With LPL, which works with close to 30,000 financial advisors, it pays on average close to $12 million per business.

“Since launching a few years ago, the company has closed 56 deals and deployed $690 million of capital,” Schmitt wrote in the note, which came in the wake this week of a William Blair conference featuring LPL and other growth companies.

“Purchase multiples are generally around 6 to 8 times EBITDA, [or earnings before interest, taxes, depreciation and amortization,] similar to its M&A framework,” Schmitt noted.

Using EBITDA to value a registered investment advisor firm is a long-standing and common practice in the financial advice industry.

“Management indicated the company has the capacity to complete 30 to 40 deals per year, at an average size of $10 million to $20 million, which should be another factor helping it sustain its strong organic growth levels.”

That means LPL expects to spend between $300 million to $800 million annually going forward to buy the businesses of financial advisors, many of whom are reaching an age to consider retirement.

“Our program is more than a transaction; it’s a customized strategic partnership that supports advisors in all aspects of their practice,” wrote Jeremy Holly, executive vice president, business and lifecycle solutions, in an email.

Independent broker-dealers like LPL and its competitors Osaic and Cetera Financial Group in the past have relied on the acquisition of large brokerage firms or recruitment of teams of advisors for growth.

But those firms over the past few years have branched out to invest directly in registered investment advisors, with many targeted firms already using the brokerage firm in some capacity, as a way to hang onto revenue in an extremely competitive market for advisors and their clients’ assets.

Meanwhile, LPL’s acquisition of Commonwealth Financial Network, with close to 3,000 advisors and $285 billion in assets, appeared on track, Schmitt noted, with LPL’s management continuing to expect it will hit its target of retaining close to 90% of those assets.

LifeMark Securities has faced scrutiny in the past for its sales of GWG L bonds.

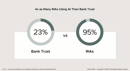

New data from F2 Strategy shows 95% of RIAs are using AI - four times the adoption rate of banks. Trust companies account for 90% of firms not using AI, raising alarms about their ability to stay competitive.

The ex-registered broker facilitated a series of transactions, including nine trades totaling nearly $130,000 and eight withdrawals amounting to $85,000, for a fourteen-month period after the client's death.

The wealth tech giant is offering advisors a natural, intuitive way to use AI through its new business intelligence and insights engine features.

Sometimes letting clients lead conversations, rather than having all the answers, can be the most powerful trust-builder.

How intelliflo aims to solve advisors' top tech headaches—without sacrificing the personal touch clients crave

From direct lending to asset-based finance to commercial real estate debt.