Despite fast-evolving digital technology, online marketing opportunities, and the potential of social media influencers, the majority of financial advisors still rely on traditional referrals to attract new clients.

Even though it goes against the grain of what many industry consultants suggest as the best way to expand an advisory firm’s client base, Cerulli Associates finds that a “reliance on referrals continues to expand.”

In his latest research, Stephen Caruso, associate director in the wealth management practice at Cerulli, found that nearly two-thirds of new client acquisitions are coming via referrals.

Broken down, Caruso says 55% of new advisory firm clients are the result of referrals from the friends and family of existing clients. An additional 14% of new clients are referred by so-called centers of influence, including lawyers and tax specialists.

“The remaining one-third of new business is coming from a variety of things, including inbound inquiries, digital marketing, and clients leaving other advisors,” he says.

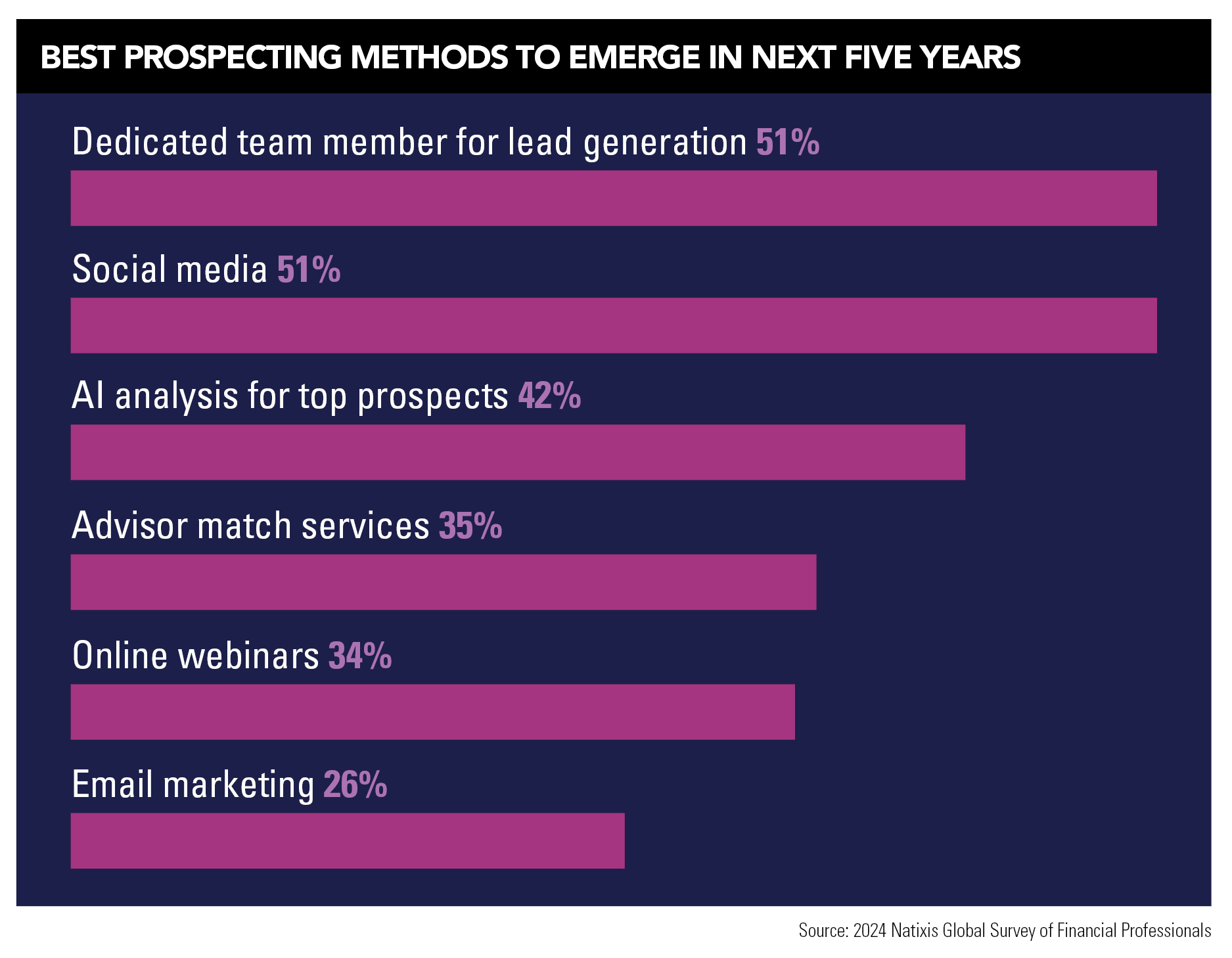

In some ways, this flies in the face of the popular opinion that digital marketing and various forms of artificial intelligence are sweeping across the wealth management industry and leveling the playing field for smaller advisory firms looking to compete with deep-pocketed Wall Street firms and mega RIAs.

“Digital marketing is growing, but we’re not seeing it crack 10 percent yet in terms of sources of new clients,” Caruso says. “We also haven’t seen social media have a strong impact on recruiting clients, despite the more relaxed marketing rules from the SEC.”

Jared Chase, a financial advisor who runs the referral program at Signature Estate & Investment Advisors, says the advisory firm is benefiting from being part of the referral programs at Fidelity Investments and Charles Schwab Corp.

But, he adds, the client relationship always requires a solid in-person connection.

“Nothing replaces being face to face with clients,” Chase says. “We have a digital marketing strategy, we do webinars and educational events, and we publish white papers, but the vast majority are coming from referral programs and normal marketing efforts.”

Rishi Bharathan is chief executive of Wiser Advisor, a platform connecting consumers with financial advisors, and he is using customer reviews to boost referrals.

“When it comes to getting new clients, number one is still the old-school method of referrals,” he says. “Ultimately, consumers tend to believe individuals over brands, and 68 percent of consumers start their search for a financial advisor online − that’s why the reviews are so important.”

Even as Bharathan taps into the potential of referrals, he also leverages evolving technologies to help advisors of all sizes fine tune their marketing efforts.

“A lot of advisors will put out their own content, showing their specializations and using social media to engage the audience,” he says. “The firms that will win in the future will have multichannel marketing, infrastructure, and the data to measure success.”

That advice is right in line with Allworth Financial’s targeted efforts to recruit new clients.

“You need to have the infrastructure in place to handle leads to help advisors acquire new clients,” says John Bunch, chief executive of Allworth.

In some respects, the Allworth model might be described as the opposite of a referral strategy.

Allworth, which has been in the financial services industry for 34 years and in the RIA space since 2012, started marketing through its own radio shows, which led to podcasts, which evolved into a “modern, digital, niche-focused approach,” Bunch says.

“You are online searching for an advisor, you fill out a lead form, those leads go to a centralized team within Allworth, and we try to have the first contact with that person within two minutes,” he explained. “The longer it takes to set up that first appointment, the harder it is to convert those leads into clients.”

As Bunch sees it, the best marketing strategy has a narrow focus on a specific type of client or niche category. But all market strategies, he believes, need to leverage four primary channels, including social media, paid media advertising, traditional digital leads, and webinars, which he describes as the modern-day seminar.

“At the end of the day, this is a math equation,” he says. “How much time and effort are you putting in, and what is the payback?”

Greg Cornick, executive vice president of advice and wealth management at Osaic, also subscribes to the idea that a “niche specialization” is key to attracting new clients.

“Client segmentation is essential,” he says. “‘We’re seeing success when firms tailor their service models based on client net worth, life stage, and complexity.”

At Mercer Advisors, client recruiting success has been the result of having people dedicated to bringing on new business.

“Many years ago, we decided to separate sales and service so that our wealth advisors can focus exclusively on serving clients, not finding the next one,” says Alisa Maute, Mercer’s head of client development.

“Our client development professionals work to identify prospective clients and thoughtfully pair them with an advisor best suited to solve for the complexities of their financial lives,” she adds. “These are important roles in our organization as different families have different needs, and they are more likely to be happier with an advisor that understands their unique context.”

Financial services compliance consultant ACA Group told InvestmentNews it had four clients report receiving emails that impersonated David Bottom, the SEC's chief information officer, with smaller firms being targeted.

Financial advisor Derek Wittjohann shares the lessons he learned after leaving a major wirehouse to set up his own practice in the second installment of InvestmentNews' new 'Independence Stories' series.

Whether a firm manages $50 million or $5 billion in client assets, building a succession strategy needs to be a priority at least a decade out from retirement.

RIA assets are key for broker-dealers right now.

The former investment advisor misled clients in a decade-long scheme to fund international travel expenses, country club fees, and other personal expenses, according to three government agencies.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.