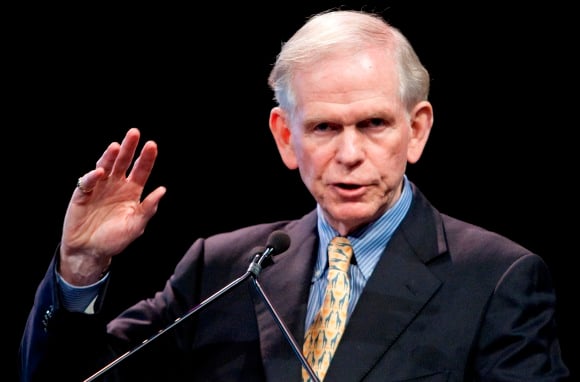

The following is an excerpt from Part 2 of the quarterly letter written by Jeremy Grantham, chief investment officer at GMO. To read the full letter,

click here. To read Part 1 of the letter,

click here.

What to Buy?

- For those with a long horizon, I am sure well-managed forestry and farmland will outperform the average of all global assets.

- I think it is likely that resources in the ground, hydrocarbons, metals, and fertilizer will also win on a 10-year horizon. I am not certain, though, because of the remarkable gains in so many of these in the last five years. I would put the odds at 2 to 1. As mentioned last quarter, many commodities have the potential for very sharp declines in the short term. If that occurs, then the odds would, of course, rise.

- On a regular time horizon, I would continue to overweight quality stocks, which may well be on a roll. They are not priced to make a fortune, but they are priced to give approximately 4.5% to 5% real return, which I think is acceptable for low-risk assets. They have also delivered dependable downside – risk off – relative performance for several years, which is a characteristic generally in short supply.

- Emerging markets are hard to evaluate because they are clearly going through many phases of development in a real hurry. So what is normal profitability? Probably not the old levels. They are moving toward developed status and probably toward our developed world's level of profitability. (Yes, James Montier, that would be a change and, therefore, I admit, far from certain.) In a global financial crisis it is also important to remember that their cumulative foreign reserves are remarkable, twice that of the developed countries. But, all things considered, I believe they will outperform other non-high-quality equities for the next seven years and are likely to produce a semi-respectable return for a risky group of about 4% to 5% a year real.

- We at GMO also believe that Japan is likely to “regress,” in the mathematical sense, toward levels of profitability that would be considered normal in other developed countries. We expect the progress to be very slow and uneven.

- If it does not happen at all, then Japanese stocks are priced like the average of all other developed equities, or a bit cheaper. If, however, by some chance margins improve quite fast, then Japanese stocks will likely be the best performing stocks around and could hit double-digit real returns for seven years. Japan's remarkable resilience in the face of electricity shortages gives some inkling of what they are capable of. How quickly we have forgotten their obvious talents of 20 years ago. Can all of those talents really be lost forever?

- As for the rest of global equities, they range from unattractive (August 2) to very unattractive. The S&P 500, for example, is worth no more than 950 on our estimates.

- In general, risk avoidance looks like a good idea. Cash – despite its manipulated low rate, deliberately designed to make us reach for risk – should be seen as a safe haven replete with important optionality: dry powder to take advantage of possible opportunities.

- As mentioned in previous quarterlies, the main long-term risk is that after two massive bubbles and two equally massive resurrection programs, the Fed may be out of ammunition. Should more building blocks fall (government bond downgrade and further market declines have missed my deadline) and a serious global double-dip develop, then the pattern of market behavior this time may be more historically typical. That is, instead of quickly

recovering, markets will become cheap and stay below long-term averages for several years as was the case pre-Greenspan.

- Twenty years is a long time, so most investors think that dipping to fair value for a minute and bouncing is normal. It is, in fact, highly aberrant historically. Markets staying down and washing away a whole generation's false expectations, high animal spirits, and excessive risk-taking – that would be normal. In the long run, a prolonged period of lower priced assets would lead to a much-improved, less risky, and less bubble-prone environment. In short, a more manageable world. It would also mean much higher returns from investing at lower prices. Long-term benefits from short-term pain. Just the kind of trade-off that the children in charge now would never make deliberately.

But it may well happen anyway.