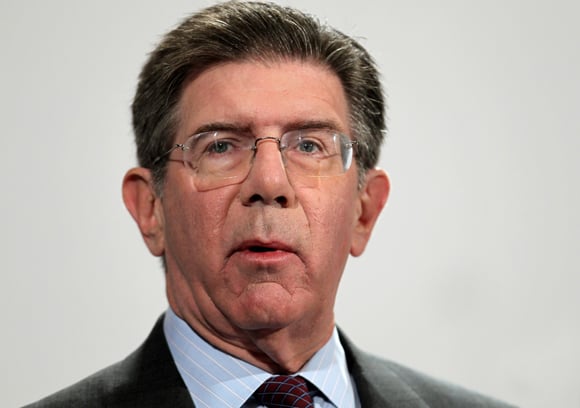

Advocates for imposing a universal fiduciary duty for retail investment advice are questioning both the motives and the timing behind a study released by the Securities Industry and Financial Markets Association that raised concerns about a single standard of care. SIFMA released the study last week . In it, the group noted that a flawed fiduciary standard — that is, one that doesn't accommodate a commission-based business model — could drive broker-dealers out of business. That, the report claimed, would deprive investors of a low-cost alternative to seeking guidance on investments. But backers of a single standard of care say the report represents a sharp break from SIFMA's stance in support of a fiduciary standard during months of congressional debate over financial reform. “This is SIFMA reverting to arguments that only insurance agents have been making,” said Barbara Roper, director of investor protection at the Consumer Federation of America. Ms. Roper attributes what she calls a shift in SIFMA's stance to the changing political climate. She noted that SIFMA released the report just before the midterm elections, which saw Republicans take control of the House and make gains in the Senate. The new political atmosphere may be catalyzing a metamorphosis in SIFMA's position on fiduciary duty, she said. “It's hard to ignore the timing of the conversion to support of a fiduciary duty [when Democrats held power] and their reversion to more extreme opposition [now that Republicans are ascendant],” Ms. Roper said. At the organization's annual meeting in New York on Monday, SIFMA officials stressed that the elections are not affecting its approach to shaping hundreds of Dodd-Frank regulations. “Let me be clear. SIFMA will continue to work with the administration, regulators and Congress to continue to restore faith and confidence in our financial markets, including effectively implementing the Dodd-Frank Act,” said Tim Ryan, SIFMA's president and chief executive. “Our focus is to share SIFMA members' broad expertise and experience through thoughtful analysis, information and comment as the process moves forward.” Apparently, the statement failed to convince critics of SIFMA's allegiance to a single fiduciary standard. The day Mr. Ryan gave his speech, the Committee for the Fiduciary Standard sent a letter to the SEC criticizing the SIFMA study. In it, the committee noted that the study was based on the false assumption that commissions would be outlawed by a fiduciary duty. The Dodd-Frank measure gives safe harbor to the charging of commissions and the selling of proprietary products, and limits the timeframe that for a fiduciary duty to continue after the sale of an investment product. The group's letter also questioned the sample size and scope of the SIFMA studay, saying that it was heavily weighted toward broker-dealers and failed to provide sufficient data for credible analysis. Officials at SIFMA, however, insist that the group merely is trying to ensure that a single standard of care will protect investors without being biased toward registered investment advisers. Such advisers must now meet a fiduciary duty, while broker-dealers adhere to a less stringent suitability test. “Our position has never been clearer, and we have never wavered from it,” said Kenneth Bentsen Jr., SIFMA's executive vice president for public policy and advocacy. “The study underscored the important data the regulators need in establishing a new uniform standard of care.” Under Dodd-Frank, the Securities and Exchange Commission must submit a report to Congress by January analyzing the differences in oversight of investment advisers and broker-dealers. The agency then has the option of writing a universal fiduciary rule. Mr. Bentsen, a former Democratic member of Congress from Texas, said that a Republican-controlled House will not affect the creation of a new fiduciary standard because the topic typically is nonpartisan. He noted that the provision received support from Democrats and Republicans during the congressional debate. SIFMA does not play to either side of the political aisle, according to Mr. Bentsen. “It's not a Democratic or Republican issue,” he said. “It's an issue of what's the best market structure to meet where the world is today.”

"Im glad to see that from a regulatory perspective, we're going to get the ability to show we're responsible [...] we'll have a little bit more freedom to innovate," Farther co-founder Brad Genser told InvestmentNews.

Former advisor Isaiah Williams allegedly used the stolen funds from ex-Dolphins defensive safety Reshad Jones for numerous personal expenses, according to police and court records.

Taking a systematic approach to three key practice areas can help advisors gain confidence, get back time, and increase their opportunities.

Meanwhile, Osaic lures a high-net-worth advisor from Commonwealth in the Pacific Northwest.

The deals, which include its first stake in Ohio, push the national women-led firm up to $47 billion in assets.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.