The idea that you can’t go wrong investing in brick and mortar is robustly dismissed by new research that shows just how risky these assets can be.

Among residential real estate investors, 90% said that they have lost money on their investments, with 52% revealing that they have lost at least $100,000 on a single investment and 42% losing at least $200,000.

The poll by education resource Clever Real Estate found that 45% of respondents have been almost ruined financially by a residential real estate investment and 40% with they had never invested in the asset class.

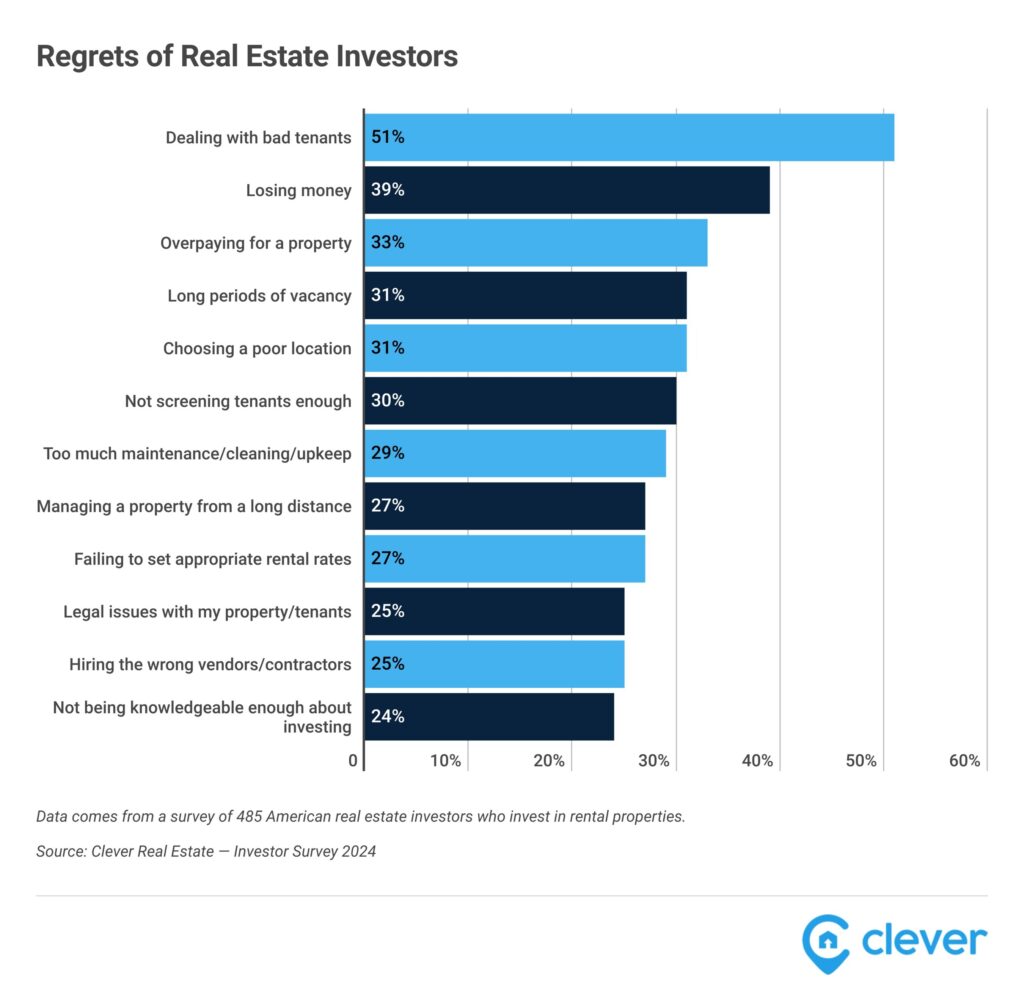

Almost nine in ten of those who took part in the poll said they have regrets about their investments with dealing with bad tenants and severe property damage cause by tenants among the main issues.

Almost two thirds of investors said they have to deal with complaints about their tenants from neighbors at least once a week, 56% have had to evict a tenant, and 61% say they have to track down missed rent payments every month.

That said, four in ten respondents said they rely on their real estate investment income and 75% are making at least as much in 2024 as they were last year with 41% making more compared to 14% who are making less.

Most respondents are investing in more than one type of residential real estate investment, including traditional long-term rentals (51%), buying land for future development (45%), house-flipping (42%), and short-term or vacation rentals (40%).

High interest rates, high home prices, and inflation are the top concerns identified by the study.

Fraud losses among Americans 60 and older surged 43 percent in 2024, led by investment schemes involving crypto and social manipulation.

The alternatives giant's new unit, led by a 17-year veteran, will tap into four areas worth an estimated $60 trillion.

"It's like a soap opera," says one senior industry executive.

The latest annual survey from EBRI and Greenwald Research sheds light on anxieties around living costs, volatility, and the future of federal income support in retirement.

It's a showdown for the ages as wealth managers assess its impact on client portfolios.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.