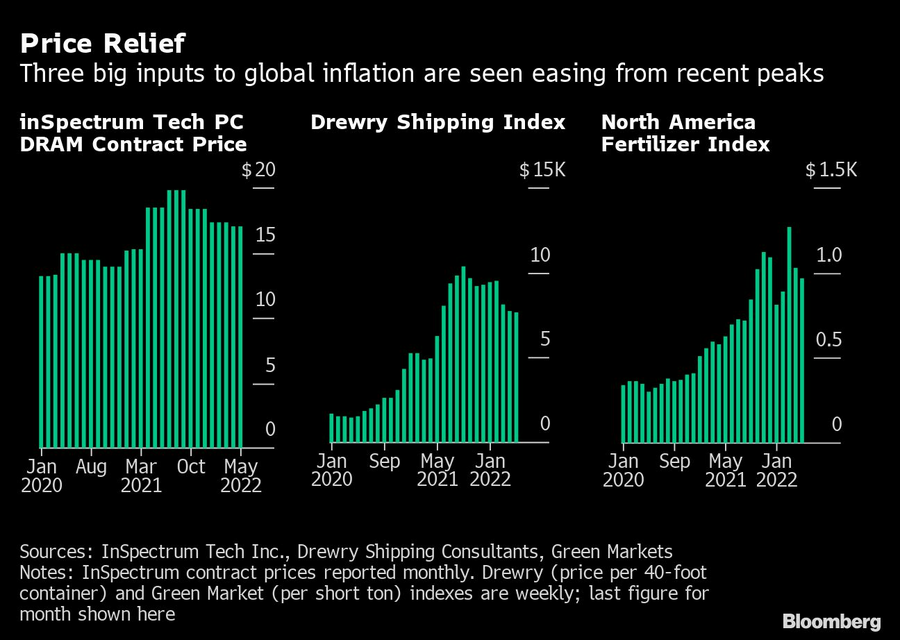

Three of the key supply-side factors driving today’s global inflation levels have already turned around, meaning relief could arrive for shoppers worldwide. A bellwether semiconductor price — a barometer of costs of finished electronics products as diverse as laptops, dishwashers, LED bulbs, and medical devices delivered worldwide — is now half its July 2018 peak and down 14% from the middle of last year.

The spot rate for shipping containers — which tells us more about expenses we can expect later in the pipeline for apparel in Chicago, luxury items in Singapore or home furnishings in Europe — has declined 26% since its September 2021 all-time high.

North America’s fertilizer prices — an indicator of where global food inflation is going, including bills for tomatoes in London or onions for sale in a Johannesburg market— is 24% below its record high in March.

With inflation now exceeding 8% in the euro area, expected to stay above that level in the US when May data comes out on Friday and on the march in Asia too, central bankers around the world are scrambling to contain it.

Even as central bankers raise rates, more economists are coalescing around the idea that peak inflation is behind us — though there will be a lag before the lower costs of raw materials filter through to the prices shoppers see.

Though few forecasters are predicting a return to pre-pandemic prices in the short run, global retail giants like Walmart Inc. are now struggling to unload bloated inventory to a less enthusiastic shopper. So a moderation in those supply-side pressures could eventually allow central bankers to slow their tightening cycles.

“While inflation in some parts of the world are yet to peak, there are at least some signs emerging that we may not be too far off in terms of a turning point at which we start to see the annual inflation rate start to head lower,” said Khoon Goh, Singapore-based head of Asia research at Australia & New Zealand Banking Group.

China’s producer prices peaked in late 2021 and are beginning to moderate. Economists are forecasting a 6.5% rise in factory prices in May from a year earlier, down from 8% in April.

That’s a promising development for relief in imported-goods inflation worldwide, said Goh. In addition, lower container freight rates and improving supplier delivery times in purchasing managers indexes point to easing bottlenecks that should curb price pressures later this year, he said.

Integrated Partners is adding a mother-son tandem to its network in Missouri as Kestra onboards a father-son advisor duo from UBS.

Futures indicate stocks will build on Tuesday's rally.

Cost of living still tops concerns about negative impacts on personal finances

Financial advisors remain vital allies even as DIY investing grows

A trade deal would mean significant cut in tariffs but 'it wont be zero'.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.