U.S. stocks are staging a furious rally on Tuesday but top strategists at Societe Generale SA and Goldman Sachs Group Inc. warn of more declines ahead as equities have yet to fully price in the risk of a recession.

The technology-heavy Nasdaq 100 and the S&P 500 each surged more than 2.6% on Tuesday following a sharp rout last week that sent the U.S. benchmark index into a bear market. While the sell-off is luring investors chasing cheaper valuations, SocGen’s Manish Kabra says a “typical” recession will see the S&P 500 Index falling to 3,200 points — nearly 13% below its Friday close before the holiday.

And a 1970’s-style inflation shock could send the index crashing about 30% from current levels amid stagnation with higher inflation, the strategist wrote in a note. The key read-across from the 1970s is when investors start to believe that inflation will stay high for longer, equity markets begin to focus on real instead of nominal earnings-per-share rate, which for this year is likely to be negative, SocGen said.

“We have still not seen the true bottom for equities yet,” Kabra said.

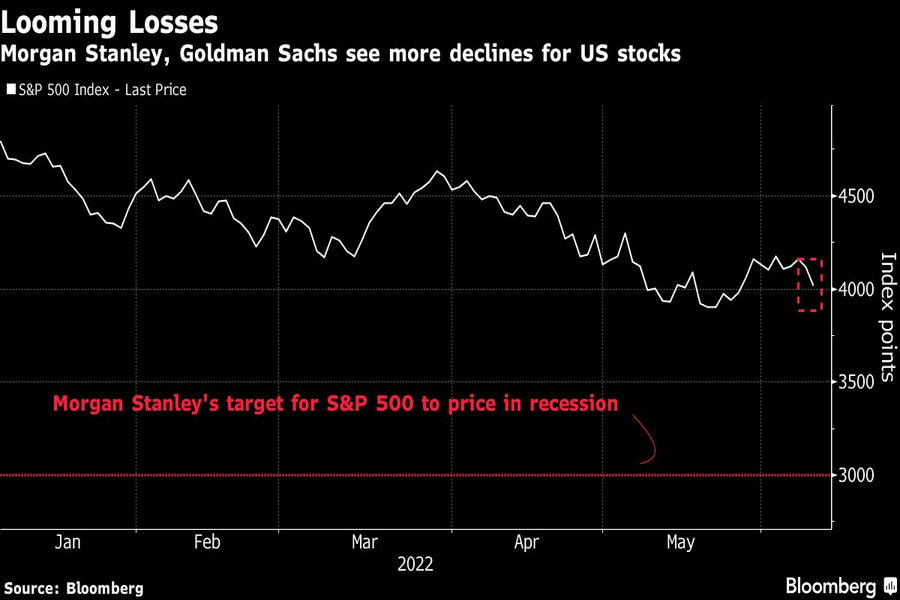

His counterpart Michael J. Wilson at Morgan Stanley, one of Wall Street’s most vocal bears and who correctly predicted the latest market sell-off, agrees that the S&P 500 needs to drop another 15% to 20% to about 3,000 points for the market to fully reflect the scale of economic contraction.

“The bear market will not be over until recession arrives or the risk of one is extinguished,” the Morgan Stanley team said.

The calls from Wall Street’s top strategists underline how investor sentiment on risk assets has soured in recent weeks as runaway inflation and a hawkish Federal Reserve raised the specter of a prolonged economic contraction. Wilson said that should a full-blown recession become the market’s base case, the S&P 500 could bottom near to 2,900 index points — more than 21% below its last close.

Over at Goldman Sachs, strategists led by Peter Oppenheimer said stocks were only pricing in a mild recession, “leaving them exposed to a further deterioration in expectations.” The team said they view the current bear market as cyclical, with stronger private sector balance sheets and negative real interest rates cushioning against systemic risks associated with structural bear markets.

Berenberg strategists also said on Tuesday it was too early to call a bottom for equities with earnings downgrades just beginning amid expectations of a recession.

Integrated Partners is adding a mother-son tandem to its network in Missouri as Kestra onboards a father-son advisor duo from UBS.

Futures indicate stocks will build on Tuesday's rally.

Cost of living still tops concerns about negative impacts on personal finances

Financial advisors remain vital allies even as DIY investing grows

A trade deal would mean significant cut in tariffs but 'it wont be zero'.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.