There’s so much money chasing after the bonds sold by America’s high-tax states that buyers don’t seem to care too much about what credit-rating companies think.

The heavy demand has driven municipal yields to their lowest level in more than six decades. And with rates so low, the yield penalties that would typically differentiate a deeply indebted state from a thrifty one have become little more than rounding errors that in some cases contrast with their standing in the ratings pecking order.

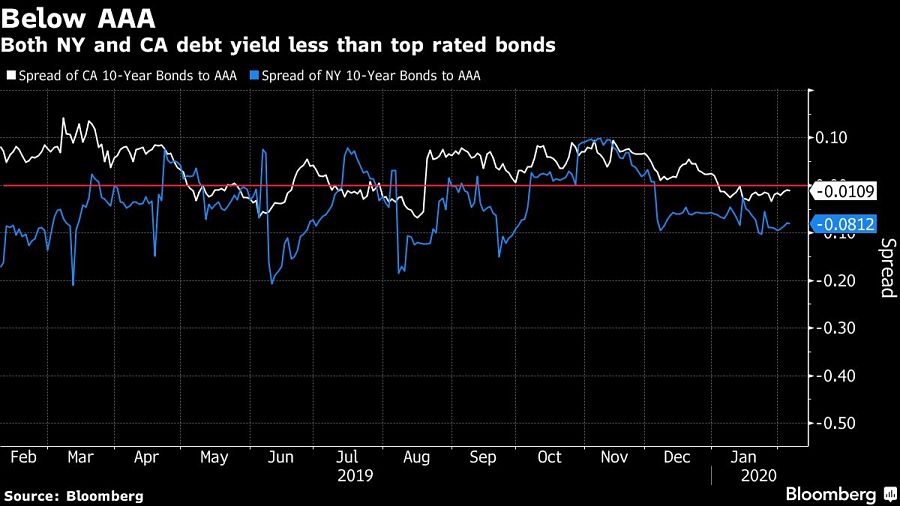

California’s general obligation debt, for example, is yielding about 1 basis point less than the AAA benchmark, even though the state is rated as many as four steps below that, according to data compiled by Bloomberg. New York, one step below AAA, is paying about 8 basis points less than top-rated borrowers. Over the past year, New Jersey’s yield premium has been cut nearly in half even though its rating hasn’t changed. Connecticut’s is roughly a third of what it was.

By contrast, bonds issued by AAA rated Texas and Florida, where there’s no state income tax, pay above-benchmark yields.

This dynamic shows how dramatic the demand has become for tax-exempt securities since President Donald J. Trump’s 2017 tax law limited state and local deductions. That change drove investors in high tax-states like California, New York and New Jersey into municipal bonds as an alternative way to drive down what they owe.

“To boil it down, it’s 99.999% because of the SALT cap,” said James Iselin, portfolio manager at Neuberger Berman Group. “Because there is so much demand in the market, there is less of a credit differentiation that the market is making.”

Looking to refine your strategy for investing in stocks in the US market? Discover expert insights, key trends, and risk management techniques to maximize your returns

The RIA led by Merrill Lynch veteran John Thiel is helping its advisors take part in the growing trend toward fee-based annuities.

Driven by robust transaction activity amid market turbulence and increased focus on billion-dollar plus targets, Echelon Partners expects another all-time high in 2025.

The looming threat of federal funding cuts to state and local governments has lawmakers weighing a levy that was phased out in 1981.

The fintech firms' new tools and integrations address pain points in overseeing investment lineups, account monitoring, and more.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.