Many are concerned that a deeply inverted yield curve signals a recession. When we look at the current yield curve, we see an opportunity to add exposure to fixed income.

The most direct implication of inverted yield curve is not a recession, but that yields will be lower in the future than they are today.

Of course, a recession could cause this, but it doesn't have to. It could simply reflect a slowdown or a normalization of interest rates.

Consider that the Fed has raised rates to over 5% and that its estimate of the long run “neutral” rate (i.e., the sweet spot where policy is neither easy or restrictive) is just 2.5%.

So just getting to neutral will require cutting rates. The lowest part of the yield curve is 3.7% (at 10-years), which is still significantly above neutral. To us, this might imply the inversion projects normalization rather than recession-fighting policy easing. This is supported by equity and corporate bond market valuations, which we do not believe are signalling a recession.

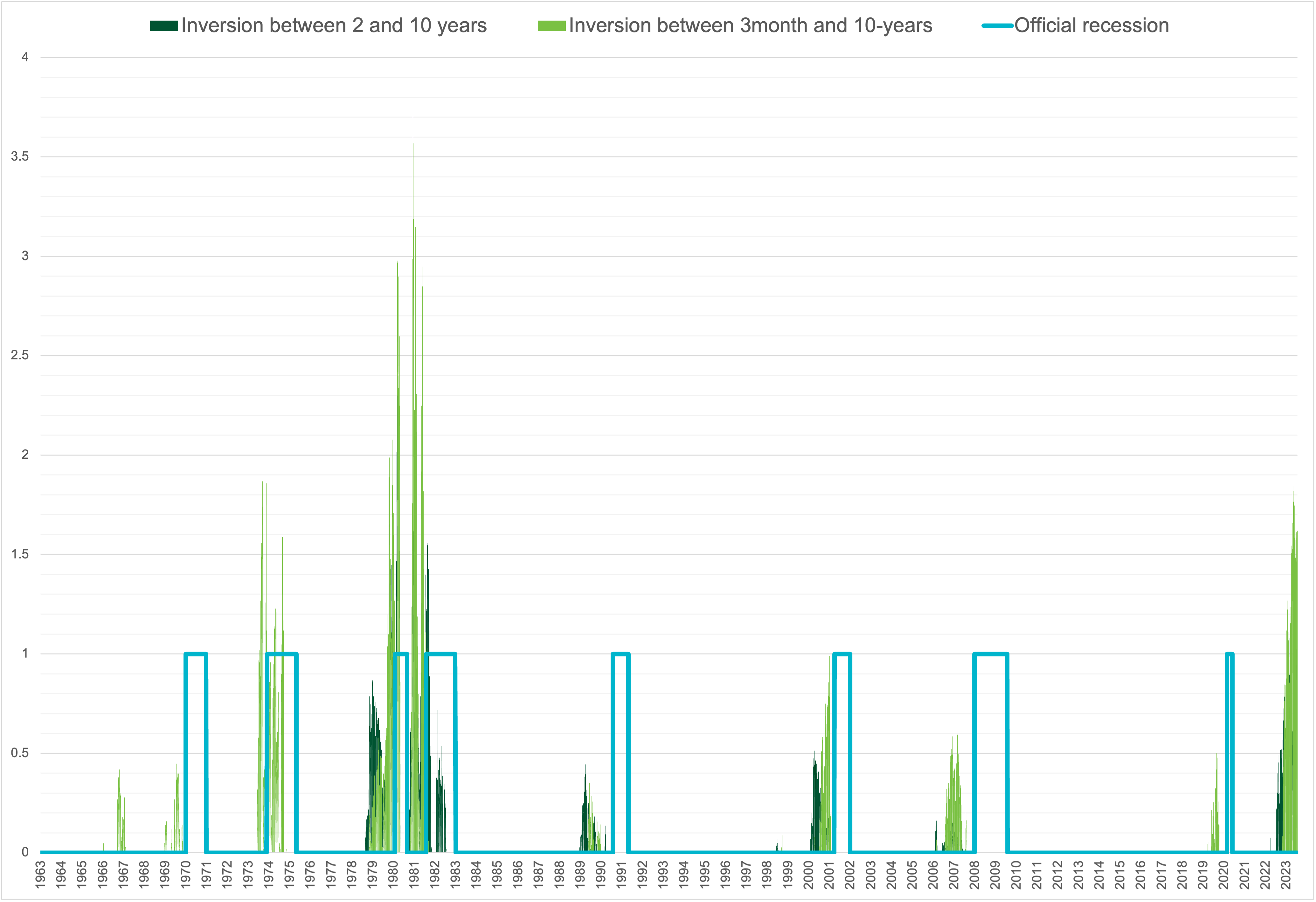

This is not to discount the possibility of a downturn. After all, it is true to say that yield curve inversions have typically preceded recessions, as the chart below shows.

The yield curve has been a good predictor of recession, but offers no clear insight as to severity

They have not been perfect, occasionally falsely flagging recessions, such as in the mid-1960s. But crucially, inversions offer little obvious signal as to the severity of a recession. For example, the yield curve inversion was deeper in the run-up to the mild 2001 recession than it was before the 2008 crisis.

Each episode is unique, but looking at the current environment, we believe a mild recession perhaps offers little to fear for investors. And the good news is we believe any upcoming recession will be shallow.

Consumer debt to GDP is currently around the lowest levels since 2001, a far cry from the mania of 2008. Further, about 85% of consumer mortgages are 30-year fixed-rate deals, so despite rising mortgage rates, the latest available data shows the average mortgage rate paid in the U.S. has only risen from a low of 3.3% last year to 3.5% at the end of 2022, when the 30-year mortgage rate was 6.4%.

Additionally, as inflation has fallen, it has pushed real wage growth back into positive territory, just as consumers’ pandemic-era savings buffers are being eroded.

It is perhaps no surprise that GDP for the first quarter was revised up from 1.1% to 1.3% and then to 2% last month, partly on the back of better-than expected consumption. Meanwhile nominal GDP is running at over 6%[6], which given steadying inflation, hardly signals crisis conditions to us.

The current market allows investors to source the two things they tend to prize from fixed income investment: income and diversification.

Therefore, we see two main themes to consider. The first is to make the most of high yields at the front end of the curve while they last. Higher spread assets with shorter maturities can offer considerable value for security-selection focused investors as corporate issuers’ cash flow visibility can be excellent over shorter time spans.

The second is to invest in longer-dated bonds for diversification. If rates fall over time, they may gain value from the “duration effect,” depending on where on the curve you invest. Further, we believe the inverse correlation between bonds and equities has returned, meaning duration exposure offers diversification against your riskier allocations like equities during “risk-off” periods.

The time to invest in fixed income may be now. Times have changed, and fixed income offers compelling yields after years at the zero-bound. An inverted curve implies the rate cycle will turn at some point, so now could be a good time to start locking in those yields.

Gautam Khanna is head of U.S. multi sector fixed income at Insight Investment, a BNY Mellon company.

Canadian stocks are on a roll in 2025 as the country prepares to name a new Prime Minister.

Two C-level leaders reveal the new time-saving tools they've implemented and what advisors are doing with their newly freed-up hours.

The RIA led by Merrill Lynch veteran John Thiel is helping its advisors take part in the growing trend toward fee-based annuities.

Driven by robust transaction activity amid market turbulence and increased focus on billion-dollar plus targets, Echelon Partners expects another all-time high in 2025.

The looming threat of federal funding cuts to state and local governments has lawmakers weighing a levy that was phased out in 1981.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.