Harry Markowitz may not be a household name, but among asset allocators he is the undisputed king. Considered the father of modern portfolio theory (MPT), his foundational work (mostly done in the late 1950s–1960s) on multi-asset portfolio construction influenced and underpins almost all models in use today.

At the heart of MPT is the belief that by combining asset classes that move differently from each other, we can create a portfolio with a total risk that is less than the sum of its parts. The simplicity of MPT is both its greatest strength and, arguably, its greatest weakness. The 60/40 portfolio reflects the belief that stocks and bonds are not highly correlated over the long term.

This is not an unreasonable thesis. Nor is it wrong, per se. It is simply highly dependent on the time horizon over which it is measured and on getting the risk, return and correlation assumptions right.

The principle has not changed, but both investors and markets themselves have, necessitating a new approach to portfolio construction.

1 Diversification does not assure profit or protect against market loss.

Portfolios of the past, constructed using the guiding principles of Markowitz’s 60/40, relied heavily on returns of public equity to accumulate wealth.

Over-reliance on equity risk is a byproduct of a fundamental misunderstanding of the difference between capital allocation and contribution to risk. Though public equities are 60% of a typical 60/40 portfolio, they contribute a far greater proportion

of the portfolio’s risk. Since risk tends to come along with return, these portfolios have been overwhelmingly dependent on public equities for their wealth generation.

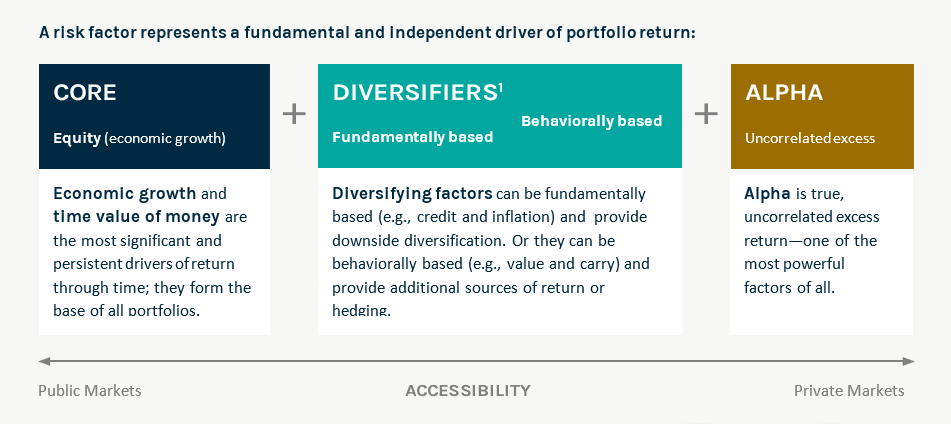

In order to build a more effective portfolio that takes into account the wide array of asset classes available to investors today, we need to look through the lens of return drivers (also called “risk factors”) before allocating among asset classes.

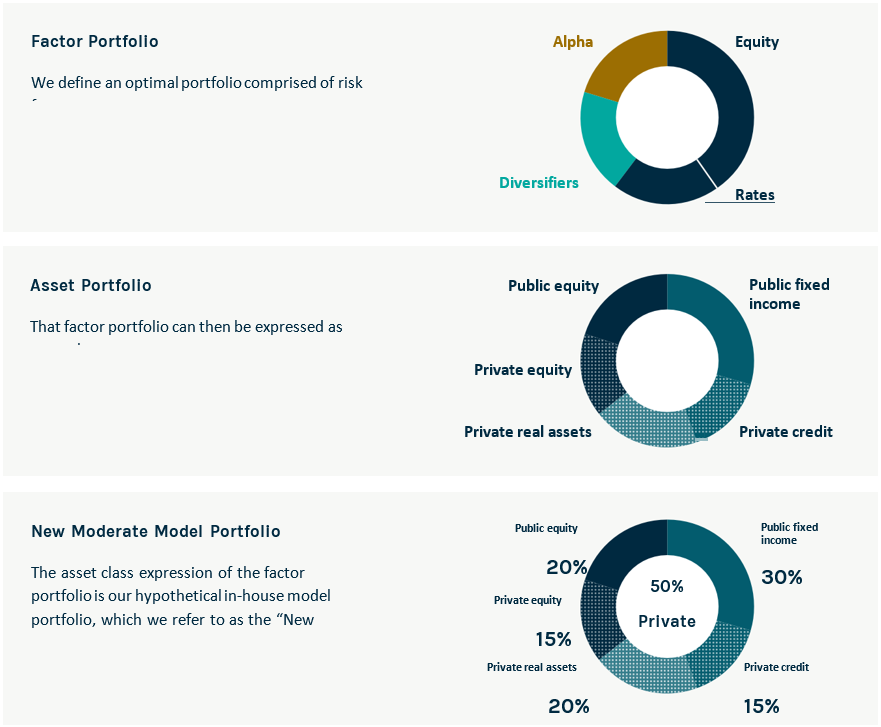

A 50% allocation to private markets is not an arbitrary choice.

It is the optimal outcome of a new approach.

Every risk factor, similar to an asset class, has a corresponding assumed return, risk and correlation. These assumptions are much more stable than asset class–specific assumptions. Balancing risk factors can help ensure diversified risk and avoid unintentional concentrations, most often in equity.

Fifty percent of this New Moderate Model is in private markets across the spectrum of private equity, private credit and private real assets.

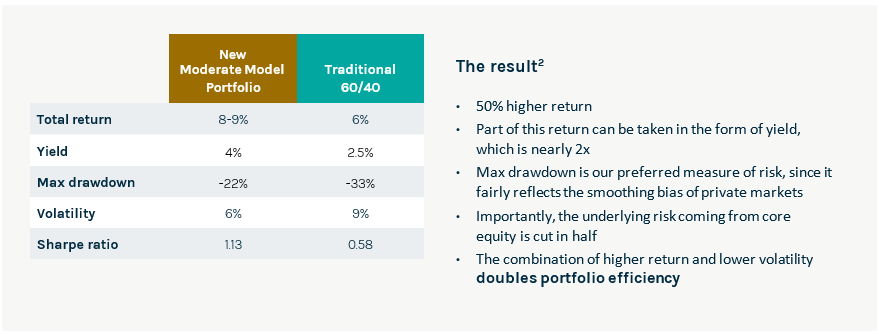

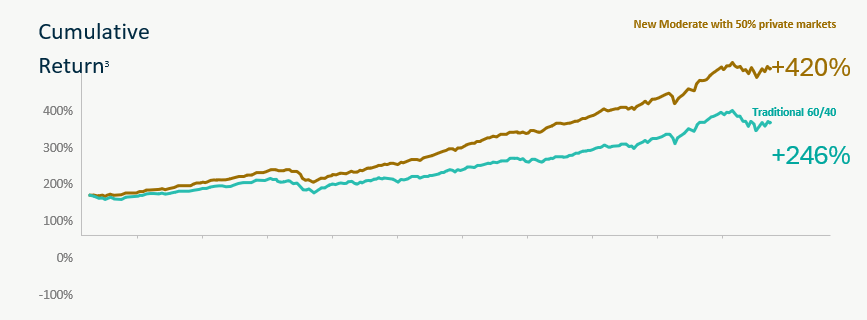

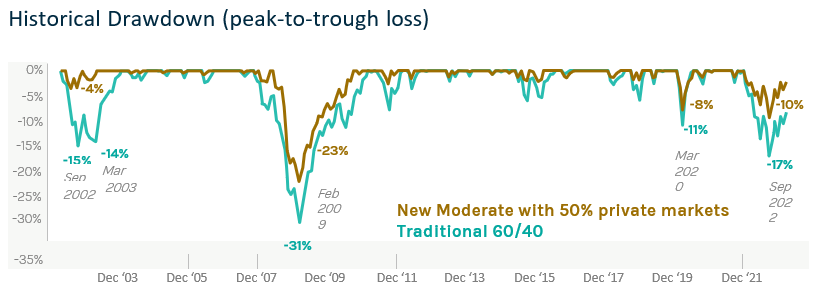

The power of a 50% allocation to private markets is in the historically higher returns and fewer and milder drawdowns specifically, nearly double the cumulative returns over the past 20 years and meaningfully fewer drawdowns than the traditional 60/40.

2. Based on a hypothetical portfolio over a 20-year period using index returns. Public equity represented by MSCI ACWI NTR. Public fixed income represented by Bloomberg 7–10-year government bond index. Private equity represented by Burgiss Buyout index. Private credit represented by Burgiss 1L index. Real assets represented by a 50/50 split of Burgiss Infrastructure index and NCREIF-NFI ODCE real estate index. Historical performance March 2002–March 2023. Past performance is no guarantee of future returns.

3. Past performance does not guarantee future results.

It's a showdown for the ages as wealth managers assess its impact on client portfolios.

CEO Ritik Malhotra is leveraging Savvy Wealth's Fidelity partnership in offers to Commonwealth advisors, alongside “Acquisition Relief Boxes” filled with cookies, brownies, and aspirin.

Fraud losses among Americans 60 and older surged 43 percent in 2024, led by investment schemes involving crypto and social manipulation.

The alternatives giant's new unit, led by a 17-year veteran, will tap into four areas worth an estimated $60 trillion.

"It's like a soap opera," says one senior industry executive.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.