Ray Dalio came out with a gloomy prediction for stocks and the economy after a hotter-than-expected inflation print rattled financial markets around the globe this week.

“It looks like interest rates will have to rise a lot (toward the higher end of the 4.5% to 6% range),” the billionaire founder of Bridgewater Associates LP wrote in a LinkedIn article dated Tuesday. “This will bring private sector credit growth down, which will bring private sector spending and, hence, the economy down with it.”

A mere increase in rates to about 4.5% would lead to a nearly 20% plunge in equity prices, he added.

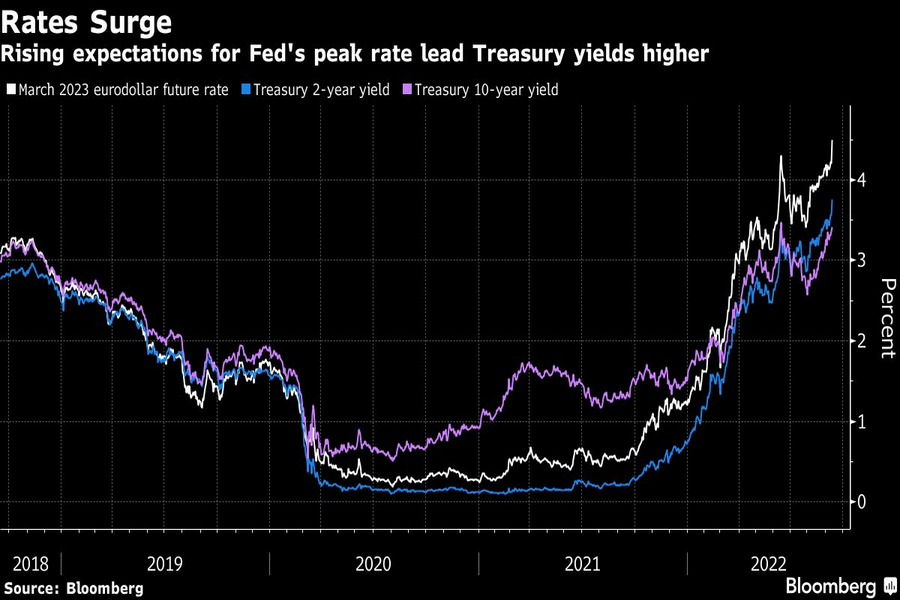

The rate market suggests traders have fully priced in a 75-basis-point hike next week by the Federal Reserve, with a slight chance for a full percentage point move. Traders expect the Fed fund rate to peak at about 4.4% next year, from the current range of 2.25% and 2.5%.

Dalio noted investors may still be too complacent about long-term inflation. While the bond market suggests traders are expecting an average annual inflation rate of 2.6% over the next decade, his “guesstimate” is that the increase will be around 4.5% to 5%. With economic shocks, it may be even “significantly higher,” he added.

Dalio said the U.S. yield curve will be “relatively flat” until there is an “unacceptable negative effect” on the economy.

A deepening inversion of key curve measures — seen by many as a potential harbinger of recession — has helped reinforce a more downbeat view about economic activity among investors.

Investors, speculating that the Fed will tip the economy into recession next year in the fight to curb inflation, already see policy makers easing rates in the later stages of 2023.

The S&P 500 is heading for its biggest annual loss since 2008, while Treasuries have suffered one of their worst beatings in decades.

Integrated Partners is adding a mother-son tandem to its network in Missouri as Kestra onboards a father-son advisor duo from UBS.

Futures indicate stocks will build on Tuesday's rally.

Cost of living still tops concerns about negative impacts on personal finances

Financial advisors remain vital allies even as DIY investing grows

A trade deal would mean significant cut in tariffs but 'it wont be zero'.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.