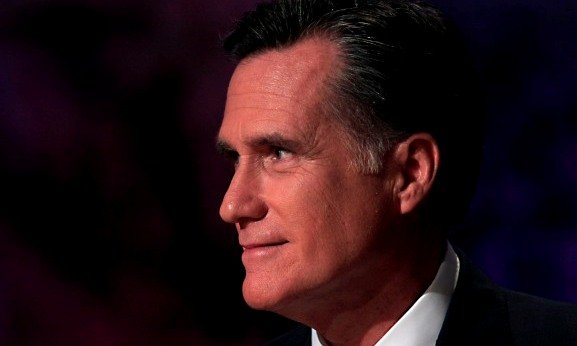

Nobel laureate Joseph Stiglitz says Mitt Romney's austerity program would stifle the economy -- and 'significantly' raise the likelihood of another recession.

Nobel Prize-winning economist Joseph Stiglitz said the election of Mitt Romney as president in November would “significantly” raise the odds of a recession because it would herald a shift to a much tighter budget.

History shows that the adoption of fiscal austerity when an economy is weak can have disastrous consequences, as happened in the U.S. in 1929 on the eve of the Great Depression, Stiglitz told Bloomberg editors and reporters in New York yesterday. Republican candidate Romney risks making that same sort of mistake by backing a plan to slash the budget deficit, he said.

“The Romney plan is going to slow down the economy, worsen the jobs deficit and significantly increase the likelihood of a recession,” said Stiglitz, who served as chairman of President Bill Clinton's Council of Economic Advisers from 1995 to 1997.

In contrast, President Barack Obama “recognizes the need to stimulate the economy,” Stiglitz said.

He listed two other “very big differences” between the Democratic and Republican presidential candidates: Obama sees inequality as a “significant problem” for the country and is committed to raising taxes on the rich to help address it. Romney does not, according to Stiglitz, author of a new book entitled, “The Price of Inequality: How Today's Divided Society Endangers Our Future.”

Misguided Austerity

The Columbia University professor argued that European nations are also misguided in pursuing fiscal austerity as a way to resolve the region's sovereign debt crisis and said there was a “very high probability” that more than one country will drop out of the 17-nation euro zone.

In the longer run, the New York-based professor sees a “rump” of countries led by Germany and possibly France retaining the euro as their common currency.

“It probably means that the euro is going to go up” eventually because of the strength of the economies that will remain in the currency compact, he added.

The euro rose for a second day versus the dollar after falling to its lowest level in almost two years last week. The euro rose 0.5 percent to $1.2499 at 5 p.m. New York time yesterday. It fell to as low as $1.2288 on June 1, the weakest level since July 1, 2010.

Federal Reserve

Stiglitz said that there is little that Federal Reserve Chairman Ben S. Bernanke can do to help the slow-growing U.S. economy through monetary policy. Instead, the Fed chief should focus on efforts to get banks to provide more credit to the economy.

“Providing more liquidity doesn't force them to lend,” he said.

The U.S. central bank has cut its federal funds rate target to zero to a quarter percentage point and more than tripled the size of its balance sheet since the start of September 2008 in an effort to promote a rapid recovery of the economy from the worst recession since the Great Depression. Gross domestic product grew at an annual pace of 1.9 percent in the first quarter, after expanding 3 percent in the final three months of 2011.

Stiglitz said the Fed should use its regulatory powers to limit the ability of banks to make profits through trading of derivatives and other means so as to encourage them to “focus on lending,” including to small and medium-sized businesses.

“You want them to have to go back to the boring business of lending,” the economics professor said.

Dodd-Frank

He criticized the Dodd-Frank financial services legislation that Obama signed into law in 2010.

The legislation, named after former Connecticut Senator Chris Dodd and Massachusetts Congressman Barney Frank, does not correct the problem of too-big-to-fail banks that the government feels compelled to rescue, according to Stiglitz.

“We need to do more to reduce excessive risk-taking” by the banks, Stiglitz said, adding that was highlighted by the $2 billion trading loss reported last month by JPMorgan Chase & Co.

--Bloomberg News--