The $2.4 trillion money manager's skeleton key to unlock ever-more complex and fitful markets also links the yield curve to the fate of stocks, and the latter with currency moves.

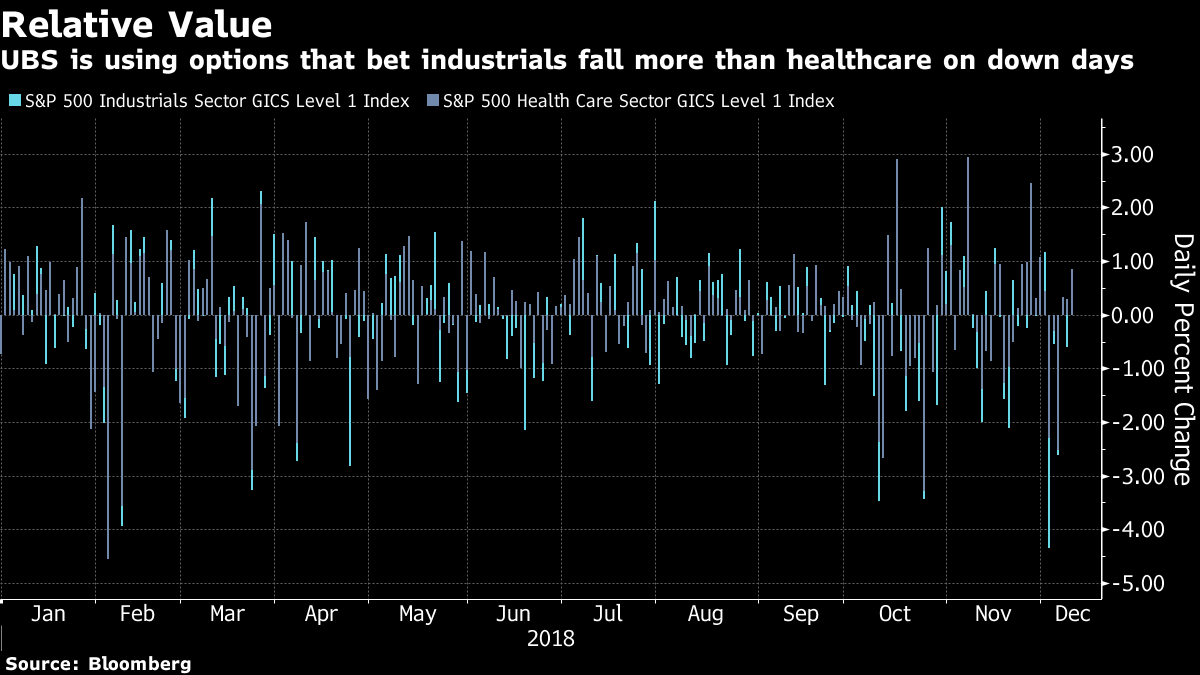

It's one solution to the investing conundrum facing its ultra-wealthy clients: How to navigate a multispeed world in which the global expansion looks long in the tooth and liquidity is tightening. As bearish forces grip assets unevenly, the strategy draws inspiration from fast-money investors who buy and sell related securities to profit from price distortions, or relative-value trades.

(More: Market volatility brings alternative investments back into focus)

"As the cycle ages, volatility tends to rise, and it rises because policy support starts to become a headwind in different countries and at different times," said Vinay Pande, head of trading strategies at UBS Global Wealth Management's Chief Investment Office. "Those are the reasons you have bigger relative swings across markets."

One hot strategy is to bet on stock performance in a shifting bond landscape. Though the relationship between the two is debated, Mr. Pande likes options that link a steepening yield curve to falling share prices.

"Owning options on the yield curve steepening out is the cheapest it's ever been," said Mr. Pande. "And you can cheapen that considerably if you make it conditional on the equity market performing poorly."

The $2.4 trillion money manager's skeleton key to unlock ever-more complex and fitful markets also links the yield curve to the fate of stocks, and the latter with currency moves.

It's one solution to the investing conundrum facing its ultra-wealthy clients: How to navigate a multispeed world in which the global expansion looks long in the tooth and liquidity is tightening. As bearish forces grip assets unevenly, the strategy draws inspiration from fast-money investors who buy and sell related securities to profit from price distortions, or relative-value trades.

(More: Market volatility brings alternative investments back into focus)

"As the cycle ages, volatility tends to rise, and it rises because policy support starts to become a headwind in different countries and at different times," said Vinay Pande, head of trading strategies at UBS Global Wealth Management's Chief Investment Office. "Those are the reasons you have bigger relative swings across markets."

One hot strategy is to bet on stock performance in a shifting bond landscape. Though the relationship between the two is debated, Mr. Pande likes options that link a steepening yield curve to falling share prices.

"Owning options on the yield curve steepening out is the cheapest it's ever been," said Mr. Pande. "And you can cheapen that considerably if you make it conditional on the equity market performing poorly."

Integrated Partners is adding a mother-son tandem to its network in Missouri as Kestra onboards a father-son advisor duo from UBS.

Futures indicate stocks will build on Tuesday's rally.

Cost of living still tops concerns about negative impacts on personal finances

Financial advisors remain vital allies even as DIY investing grows

A trade deal would mean significant cut in tariffs but 'it wont be zero'.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.