Inflation expectations among U.S. consumers over the medium term rose to the highest level on record in the Federal Reserve Bank of New York’s surveys, according to the latest edition published Monday.

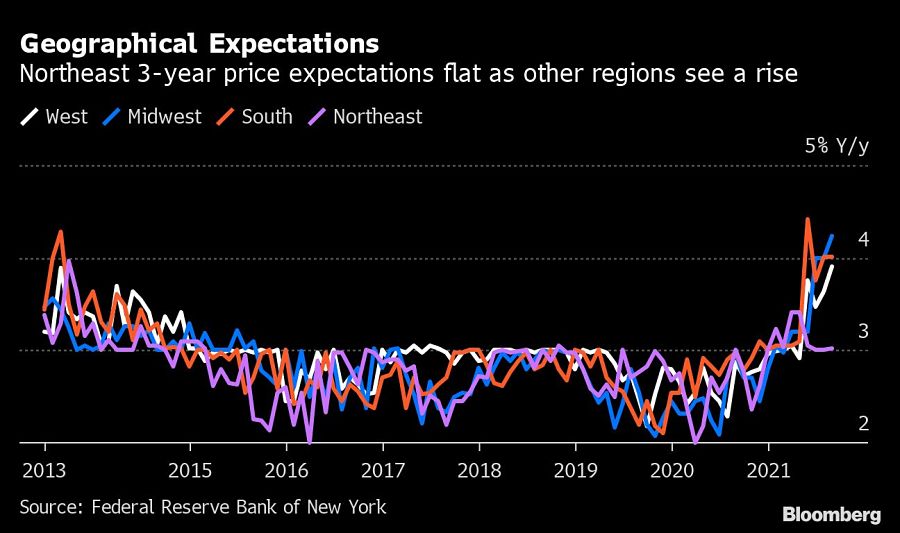

Consumers said they expect inflation at 4% over the next three years, up 0.3 percentage point from a month earlier.

The median expectation for the inflation rate in a year’s time also rose by 0.3 percentage point to 5.2% in August, the tenth consecutive monthly increase and a new high in the series, which goes back to 2013.

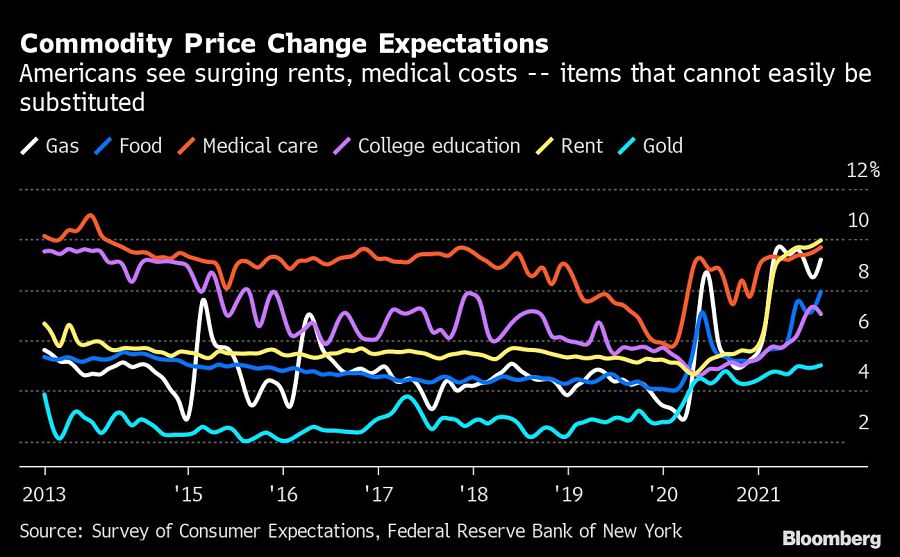

The Fed survey showed that Americans are expecting higher rates of price increases for items like rent and food that make up a big chunk of the consumer price basket and can’t easily be substituted.

Economists surveyed by Bloomberg expect slightly lower rates of inflation. The latest poll, published on Sept. 10, forecast an average increase in prices of 4.3% this year and 3% in 2022.

Meanwhile, expectations that wages will keep pace with the acceleration in prices are starting to cool. The median one-year-ahead expectation for earnings growth dropped 0.4 percentage point to 2.5%, with respondents over the age of 40 largely driving the decline.

Still, overall expectations for household incomes rose by 0.1 percentage point to 3%, a new series high.

Canadian stocks are on a roll in 2025 as the country prepares to name a new Prime Minister.

Two C-level leaders reveal the new time-saving tools they've implemented and what advisors are doing with their newly freed-up hours.

The RIA led by Merrill Lynch veteran John Thiel is helping its advisors take part in the growing trend toward fee-based annuities.

Driven by robust transaction activity amid market turbulence and increased focus on billion-dollar plus targets, Echelon Partners expects another all-time high in 2025.

The looming threat of federal funding cuts to state and local governments has lawmakers weighing a levy that was phased out in 1981.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.