Sam Walton would probably be bewildered by the businesses his grandchildren have chosen to pursue, but the late founder of the world's largest family fortune would likely have applauded their initiative.

[

More: Estate tax pretty much 'optional,' but GOP still trying to kill it]

Grandson Ben Walton, 44, owns Zoma Capital, which makes investments in areas such as energy and water. His cousins Steuart and Tom bought Rapha, a high-end British cycling brand, for a reported $225 million in 2017. Tom's Ropeswing Group operates an assortment of restaurants in Bentonville, Arkansas, that target millennials.

"The Walton family has groomed the next generation as a generation of entrepreneurs," said Byron Trott, founder of merchant bank BDT Capital Partners, who advises some of the world's richest families.

Their high-profile investments mark a change from the previous generation, who are now in their late 60s and 70s. Despite their staggering wealth, Alice, Jim, Rob and the late John Walton kept their investments and ventures largely under wraps. But that's changing as the younger Waltons exert more influence.

The most visible signs are in the family's hometown. Bentonville features a clutch of trendy bars and eateries, including the Holler, a warehouse-size establishment featuring shuffleboard lanes and plant-based burgers, and Undercroft, a speakeasy below a historic church that's now a high-end restaurant.

They're all part of Ropeswing, which aims to remake Bentonville into a destination for young workers and their families. Bicycle trails that crisscross the town's outskirts are the first step in plans by Tom and brother Steuart, both in their 30s, to turn Bentonville into a cycling mecca, while Steuart co-founded a company that makes aerobatic and touring airplanes. An unnamed Walton family member now sits on the board of FoodMaven, a startup that sells discounted surplus food, in which the family has an investment.

[

More:

The Trump family used this strategy to save on taxes]

There are other signs of the younger generation's growing influence. Three of the five members of the family foundation's board now hail from that cohort. They include Lukas Walton, 32, who has the right to vote the general and limited partner units in Walton Enterprises of his father's estate, court documents show. Steuart replaced his father Jim, 71, on the board of Walmart Inc. in 2016.

Kiki McLean, a spokeswoman for the family, declined to comment.

Managing such generational transitions is one of the top priorities for the world's richest families. About $3.4 trillion of billionaire wealth is expected to be transferred over the next two decades, PwC said in a 2018 report, and succession planning is a dominant concern.

"Family succession is difficult," said Quentin Marshall, head of private banking at Weatherbys. "As the family expands, interests diverge."

There's no common template. While other wealthy dynasties like the Kochs have sought to keep family members atop the business, the Waltons have long outsourced the running of Walmart to professional managers. Steuart and his uncle Rob, 74, sit on the retailer's board, but most of the extended family focus their energies outside the company.

Any diversification away from Walmart would no doubt be applauded by the family's risk managers. The stock declined 3% this month through Wednesday amid a wider market swoon, knocking about $5 billion from the family fortune before shares bounced back 6% on Thursday, buoyed by strong second-quarter sales.

For now, the family's holdings outside of Walmart are a fraction of their overall wealth, which is still anchored by the retailer Sam Walton founded in 1950. Bentonville-based investment vehicle Walton Enterprises holds a 50% stake in Walmart — valued at about $160 billion.

That is shifting. The family's Walmart stake paid out about $3 billion of dividends over the past year, while the Walton Family Holdings Trust has sold $10 billion of Walmart shares in the past three years. Today about $40 billion of the family's wealth is held outside of Walmart stock, according to calculations by Bloomberg.

[

More: 10 richest people on the planet]

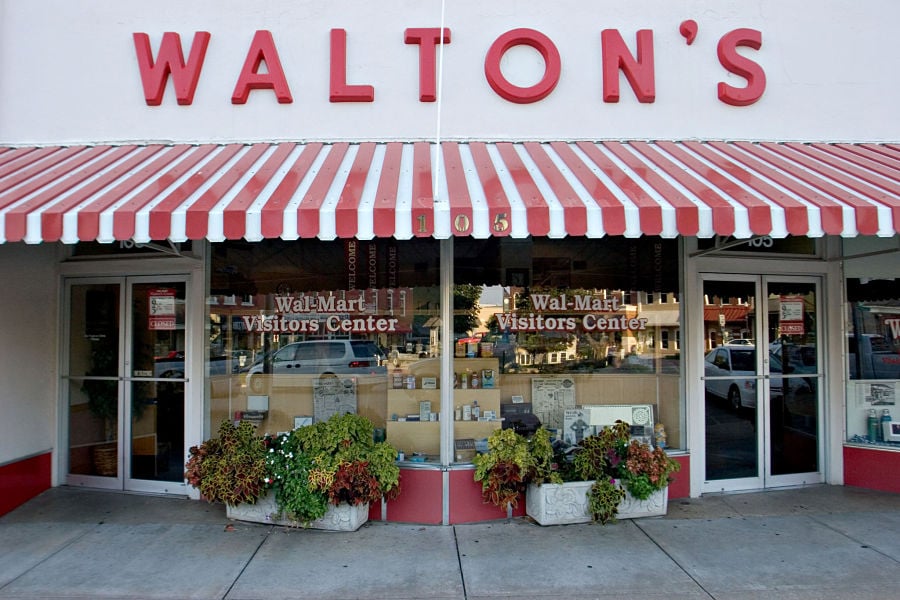

Walton's 5&10, the forerunner to today's Walmart stores, in Bentonville, Arkansas. Photographer: JB Reed/Bloomberg

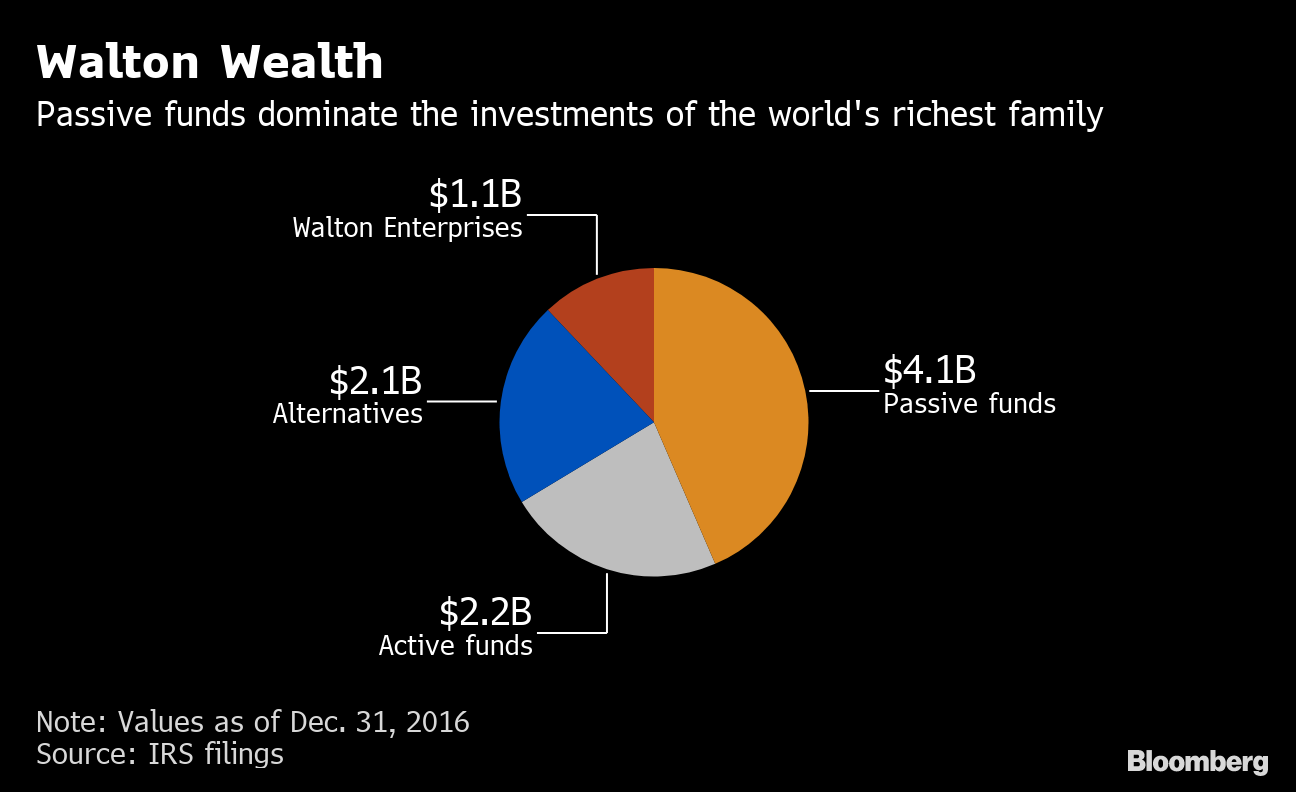

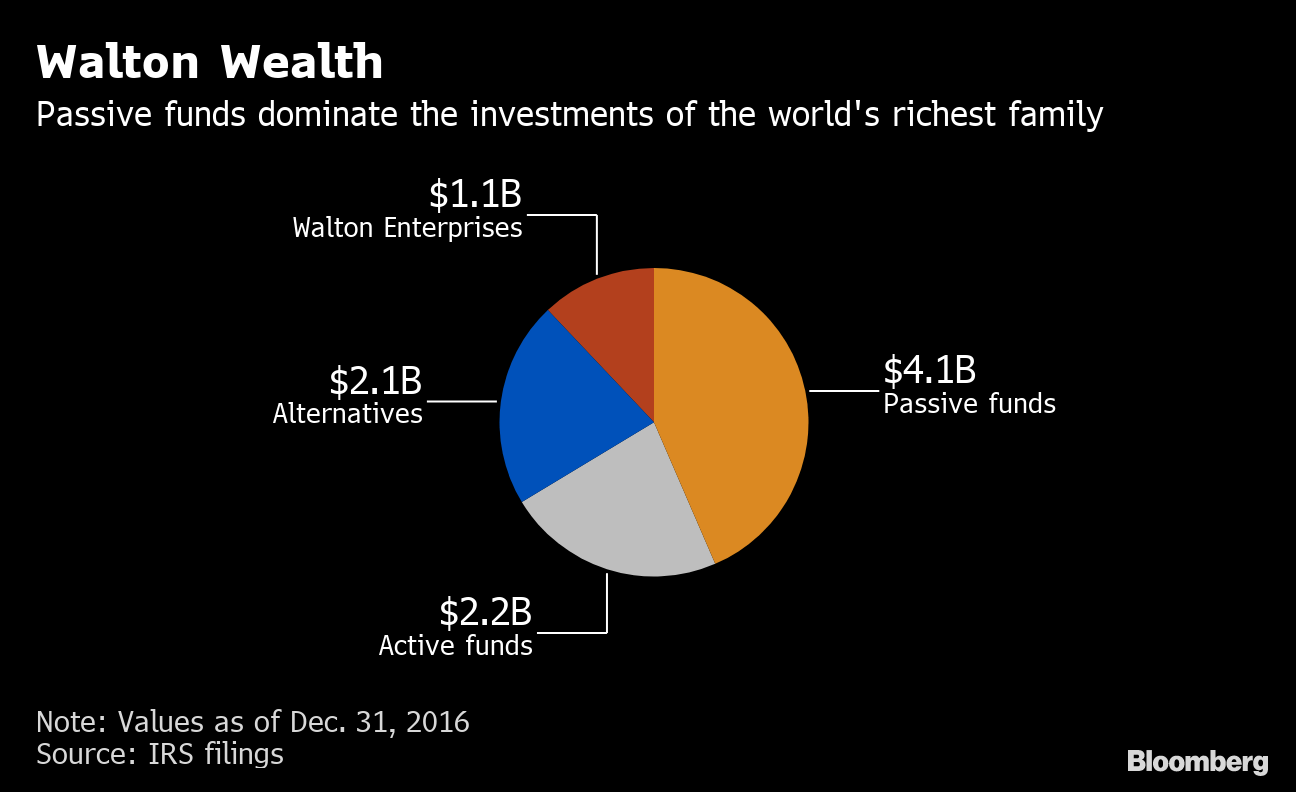

Internal Revenue Service filings show how $9 billion of the Walton fortune was deployed at the end of 2016. They detail the investments of 21 trusts set up by the estates of Sam's widow Helen and son John.

In some ways, their investments are a microcosm of trends sweeping the wider market. Passive funds predominate, with about $4 billion stashed in vehicles such as Vanguard Emerging Markets ETF or Northern Trust Russell Index. A further $2 billion is in active funds.

About $2 billion is in private equity, venture and hedge funds. The money is spread across a host of star names, including $81 million in Cliff Asness' AQR Capital Management, $190 million in Chase Coleman's Tiger Global Management and $71 million in Ole Andreas Halvorsen's Viking Global Investors.

The younger generation is investing some of those returns in their own varied ventures. It's all part of an approach that enables the family to reposition itself for the future, according to Trott.

"You have family leadership at the board level, nonfamily management leading the operating company and other family members working as innovative investors and entrepreneurs," he said.

[

Recommended video:

John Rogers strengthened diversity and inclusion efforts well beyond asset management]

About $2 billion is in private equity, venture and hedge funds. The money is spread across a host of star names, including $81 million in Cliff Asness' AQR Capital Management, $190 million in Chase Coleman's Tiger Global Management and $71 million in Ole Andreas Halvorsen's Viking Global Investors.

The younger generation is investing some of those returns in their own varied ventures. It's all part of an approach that enables the family to reposition itself for the future, according to Trott.

"You have family leadership at the board level, nonfamily management leading the operating company and other family members working as innovative investors and entrepreneurs," he said.

[Recommended video: John Rogers strengthened diversity and inclusion efforts well beyond asset management]

About $2 billion is in private equity, venture and hedge funds. The money is spread across a host of star names, including $81 million in Cliff Asness' AQR Capital Management, $190 million in Chase Coleman's Tiger Global Management and $71 million in Ole Andreas Halvorsen's Viking Global Investors.

The younger generation is investing some of those returns in their own varied ventures. It's all part of an approach that enables the family to reposition itself for the future, according to Trott.

"You have family leadership at the board level, nonfamily management leading the operating company and other family members working as innovative investors and entrepreneurs," he said.

[Recommended video: John Rogers strengthened diversity and inclusion efforts well beyond asset management]