Commodities could surge by as much 40% — taking them far into record territory — should investors boost their allocation to raw materials at a time of rising inflation, according to JPMorgan Chase & Co.

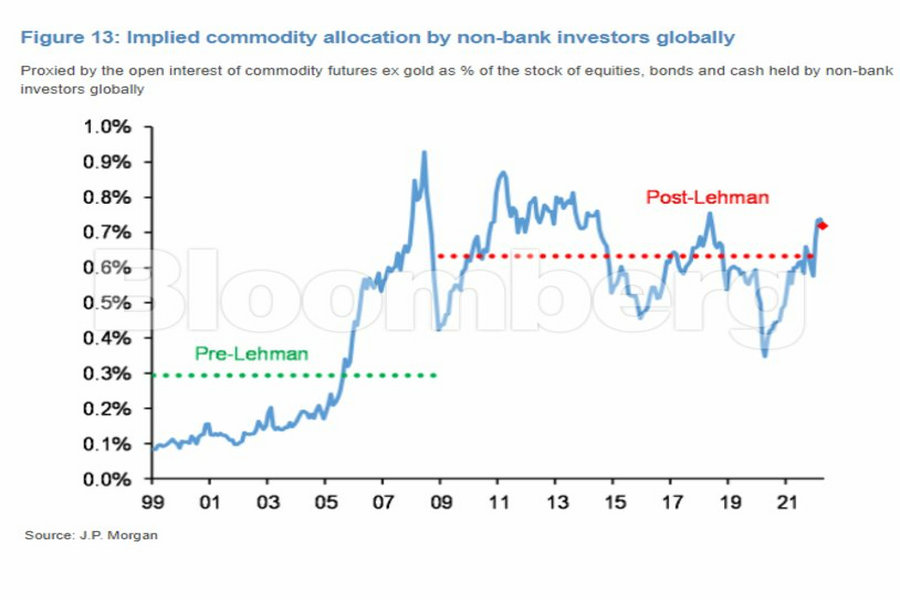

While allocations appear to be above historical averages on commodities, they are not very overweight, according to strategists led by Nikolaos Panigirtzoglou. That suggests scope for gains in raw materials, they said.

Commodities soared to a record last month as Russia’s invasion of Ukraine roiled markets, boosting the prices of everything from oil to wheat. That’s helped to spur already-elevated global inflation and a tougher response from the Federal Reserve, prompting investors to weigh reshuffling the weighting of assets between stocks, bonds and raw materials in their portfolios.

“In the current juncture, where the need for inflation hedges is more elevated, it is conceivable to see longer-term commodity allocations eventually rising above 1% of total financial assets globally, surpassing the previous highs,” the JPMorgan strategists wrote in an April 6 note. All else being equal, that “would imply another 30% to 40% upside for commodities from here,” they said.

Commodities have rallied across the board this year, with gains in energy, metals and crops. Among the gainers, Brent crude — the global oil benchmark — has surged more than 30% and hit the highest level since 2008 last month.

Among leading banks, Goldman Sachs Group Inc. has also been consistently bullish on raw materials, in part on their role as an inflation hedge. Goldman warned in an April 7 note that a global copper shock was under way.

Looking to refine your strategy for investing in stocks in the US market? Discover expert insights, key trends, and risk management techniques to maximize your returns

Driven by robust transaction activity amid market turbulence and increased focus on billion-dollar plus targets, Echelon Partners expects another all-time high in 2025.

The looming threat of federal funding cuts to state and local governments has lawmakers weighing a levy that was phased out in 1981.

The fintech firms' new tools and integrations address pain points in overseeing investment lineups, account monitoring, and more.

Canadian stocks are on a roll in 2025 as the country prepares to name a new Prime Minister.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.