In the age of Rockefeller, Carnegie and Morgan, a young man named Hotze “Harry” Koch struck out for America to seek his fortune in the nation's free-wheeling markets.

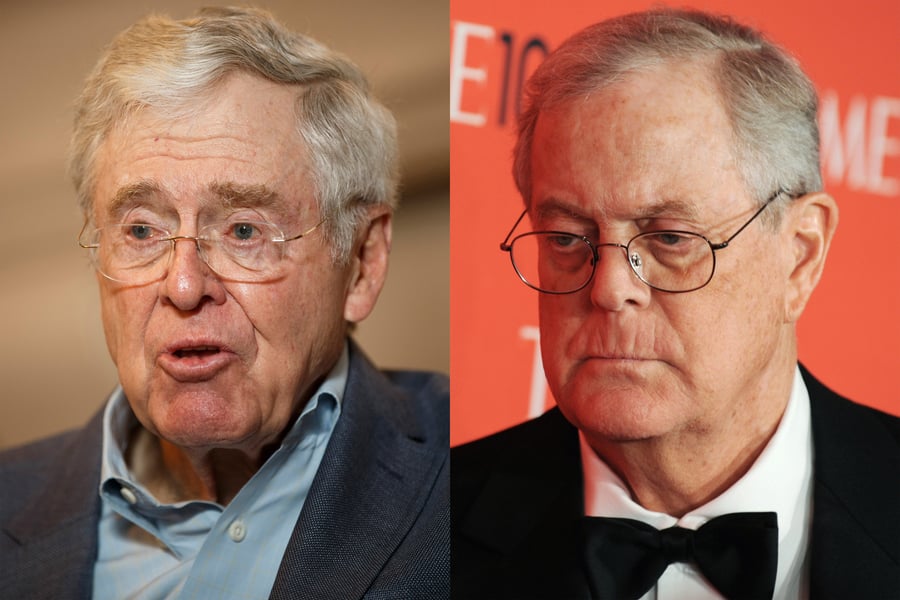

The year was 1888 — a figure that is now taking on new significance for Koch's billionaire grandsons, Charles and David.

With little fanfare, the Kochs are building an operation called 1888 Management LLC to manage part of their personal wealth. Initially tucked inside the private Koch Industries Inc., 1888 has been quietly scouting for personal investments for the Kochs, whose money and influence have helped shape the modern conservative movement in the U.S.

Harry Koch, a newspaper publisher in Texas with a libertarian bent, laid the foundations of what is now one of the nation's most influential families. Today, with interests ranging from oil to ranching, Charles Koch, 80, and David Koch, 75, are worth about $100 billion combined, according to the Bloomberg Billionaires Index.

It's unclear how much the family office is managing. A person familiar with 1888 put the current figure at more than $2 billion, although regulatory filings show less than $100 million is in publicly traded stocks. Originally operated out of the treasury division of Koch Industries, 1888 incorporated in Delaware in 2014 and has since registered to do business in California, Florida and the Koch's base of Kansas.

DIRECT INVESTMENTS

The man behind 1888 is Trent May, who joined the Kochs in 2011 from the $6 billion Wyoming Retirement System. In Wyoming, one of the most politically conservative states in the nation, May helped steer public pension money toward hedge funds, allocating millions of dollars to firms like Raymond Dalio's Bridgewater Associates and Louis Bacon's

Moore Capital Management.

At 1888, Mr. May is focusing in part on making direct investments in companies in which the Kochs can take a sizable stake, according to people with knowledge of the operation. Among 1888's other investments is a stake in a telecommunications company called X5 OpCo LLC, which provides voice and data services to businesses and governments. A family investment company of Pierre Omidyar, a billionaire founder of EBay Inc., has also disclosed an interest in the Seattle-based company.

A spokesman for the Kochs declined to comment on 1888. A representative for Mr. Omidyar's Ohana Holdings LLC also declined to comment.

Family offices like 1888 are used for any number of purposes, from handling taxes to estate planning.

'BRIGHTEST MINDS

Mr. May, 52, has a reputation as a savvy investor. "He's among the brightest minds that I've ever met," said Thomas Williams, who hired May in 2009 while executive director of the Wyoming system. "He's a real student of the markets."

Mr. May helped the Wyoming fund bounce back following the 2008 financial crisis, said Mr. Williams, who now runs the Hawaii Employees' Retirement System. Mr. May pushed to stay invested in the stock market, encouraged using low-cost index funds, and argued that hedge funds were worth a try, too, despite their high fees.

His strategy worked. In 2009, Mr. May's first year at the Wyoming system, the investment portfolio posted a 23% return, net of fees, compared with its 15% target, according to the system's annual report. It returned 13% in 2010, compared with a benchmark of 10%. It lost 1.2% in 2011 compared with a 1.1% loss for its target benchmarks.

When a recruiter for the Kochs called saying he'd heard good things about Mr. May, Mr. Williams said he supported his candidacy, even though it would be a loss for Wyoming.

WEALTHY CONSERVATIVES

The Koch's family office has seven managers on its board, including three executives at Koch Industries — Controller Richard Dinkel, Chief Financial Officer Steven Feilmeier and Treasurer David May — as well as family members David H. Koch, Anna B. Koch and Elizabeth B. Koch, according to a filing in Florida last year. Family offices often use boards, with a mix family and non-family members, to decide on investments and settle disputes more efficiently.

Outside business circles, the Kochs are best-known for forming a network of wealthy conservatives to back mostly Republican candidates who push for lower taxes and less regulation. The Kochs have yet to publicly back a candidate for the 2016 presidential election.

A search of political-donation records compiled by OpenSecrets.org and the Federal Election Commission didn't reveal any contributions through 1888. Mr. May donated a combined $2,300 to the Koch Industries Inc. Political Action Committee in 2014 and 2015, according to FEC records.

DEER CREEK

Prior to investing for Wyoming's pension plans, Mr. May ran his own hedge fund, called Deer Creek Capital Partners in Colorado, which is still registered with the U.S. Securities and Exchange Commission. It had gross assets of $2.9 million as of the latest regulatory filing.

As chief investment officer of 1888, Mr. May works out of the Denver area, while the family office's principal office is in Kansas, according to public filings. Mr. May has taken some talent from Wyoming with him. He hired Jeffrey Straayer, who invested in private equity at the Wyoming Retirement System, according to Mr. Williams.

Starting in 2013, Mr. Straayer led private-market investing including co-investments, direct and limited-partner investments at Koch Industries, and in January last year he transitioned to portfolio manager of private markets for 1888, according to his LinkedIn profile.

Information is scant on the private deals the team has struck. A filing with the Federal Communications Commission in March 2015 shows that KFF Investments, a unit affiliated with 1888 Management, held a 22% indirect interest in X5 OpCo through a fund run by NewSpring Capital, an investment firm based in Radnor, Pennsylvania.

Other employees of 1888 have roles including an estate technology manager, investment analyst and portfolio manager, according to LinkedIn profiles.

One thing is sure: Mr. May has a lot of money to work with.

"He was an astute investor," Laura Ladd, chairwoman of the Wyoming Retirement System, said of Mr. May. "He helped organize the way we thought about risk."