Allworth Financial has added two advisory firms, one in California and the other with offices in Illinois and Florida, that have a combined $621 million in assets under management, the RIA announced Wednesday.

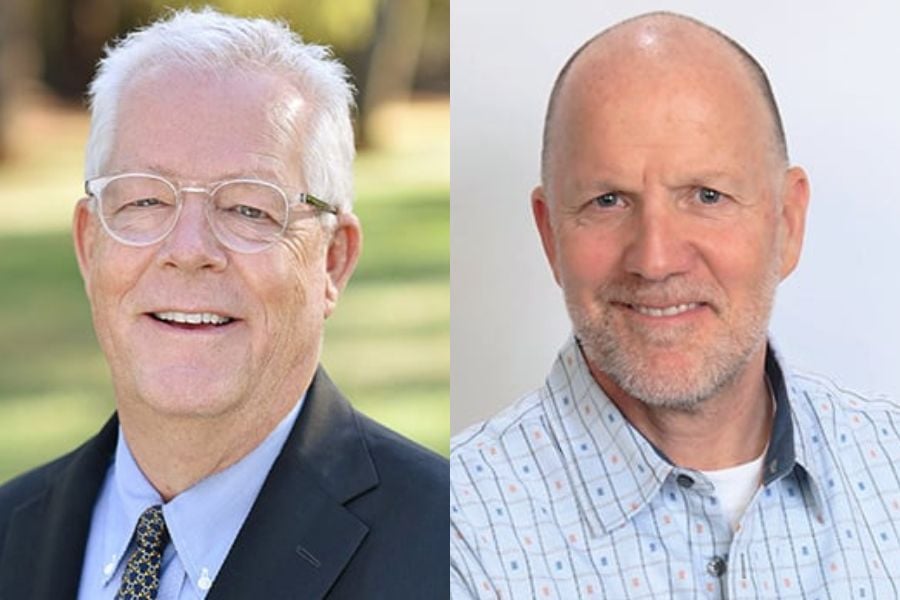

Roseville, California-based Tridea Advisors has three advisors overseeing $341 million in client assets: its founder, Steve Eklund, who will be a partner and advisor at Allworth; Eklund’s daughter, Allison Scoggin, who will be an equity partner and advisor; and Allison’s husband, Wesley Scoggin, who will be an advisor. Two staffers at the firm will also join Allworth.

“We’ve followed Allworth Financial closely since its inception over 30 years ago,” Eklund said in a statement. “By joining forces now, we can benefit from Allworth’s infrastructure which will enable us to continue to prioritize our clients’ needs while letting go of many of the day-to-day operational responsibilities that running a thriving advisory practice requires.”

At Capital Point Financial Group, which has offices in Glenview, Illinois, and Sarasota, Florida, founder John M Selzer Jr. oversees $280 million in assets with the assistance of two staffers.

“To continue to grow and add additional services, we sought out a partner that has an established culture of caring about clients every bit as much as we do,” Selzer said in the statement.

Terms of the transactions were not disclosed.

Folsom, California-based Allworth now has roughly $19 billion of assets under management; its 120 advisors operate out of 40 offices spread over 20 states.

Looking to refine your strategy for investing in stocks in the US market? Discover expert insights, key trends, and risk management techniques to maximize your returns

Driven by robust transaction activity amid market turbulence and increased focus on billion-dollar plus targets, Echelon Partners expects another all-time high in 2025.

The looming threat of federal funding cuts to state and local governments has lawmakers weighing a levy that was phased out in 1981.

The fintech firms' new tools and integrations address pain points in overseeing investment lineups, account monitoring, and more.

Canadian stocks are on a roll in 2025 as the country prepares to name a new Prime Minister.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.