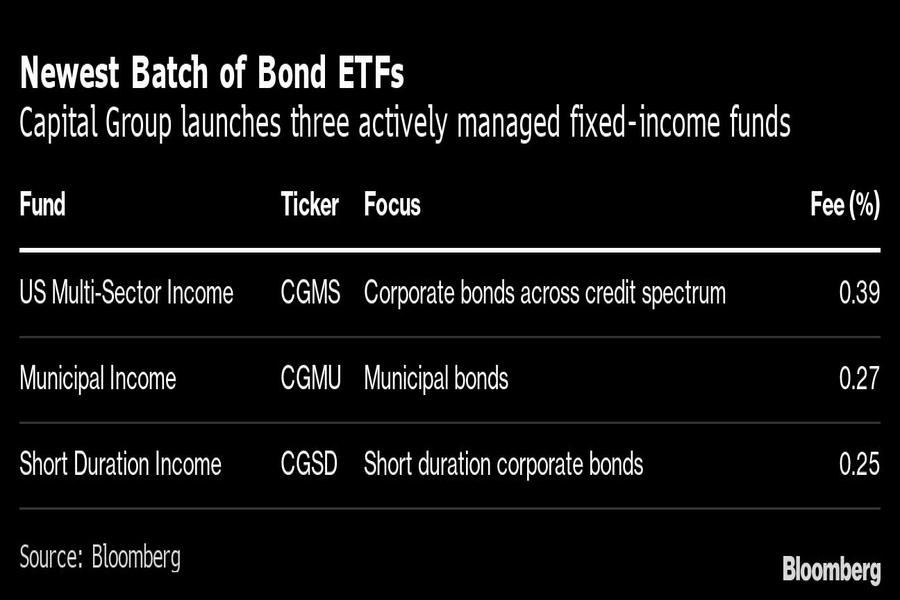

Capital Group is launching a fresh trio of exchange-traded debt funds, looking to cash in on the active-management mania that sent its ETF assets ballooning to $3.5 billion this year.

The new batch of bond funds started trading yesterday on the New York Stock Exchange, just eight months after the Los-Angeles based firm became the last major money-management firm to wade into the U.S.’ $6 trillion ETF market.

With focuses spanning from municipal bonds to short-duration debt, the ETFs are meant to offer access to high yields while managing risk linked to the Federal Reserve’s aggressive monetary policy, said Ryan Murphy, director of fixed income business development at Capital Group.

“We’re in an environment where you’re actually getting a very sizable amount of income out of fixed income,” he said.

Inflows into fixed-income ETFs nearly doubled in the past week to more than $9 billion, marking the fourth straight week of inflows, led by credit, according to data compiled by Bloomberg.

The funds, first filed for in July, join Capital Group’s lineup of existing exchange-traded products, which includes five stock ETFs and one fixed-income ETF. Investors have poured more than $3.5 billion into those six ETFs since they began trading in February, according to the firm’s data as of Oct. 25.

Capital Group has “a very strong distribution network that has relationships with many advisors,” said James Seyffart, an ETF analyst at Bloomberg Intelligence. “Their ability to garner these billions in such a historically bad market really speaks to the strength of those relationships.”

Driven by robust transaction activity amid market turbulence and increased focus on billion-dollar plus targets, Echelon Partners expects another all-time high in 2025.

The looming threat of federal funding cuts to state and local governments has lawmakers weighing a levy that was phased out in 1981.

The fintech firms' new tools and integrations address pain points in overseeing investment lineups, account monitoring, and more.

Canadian stocks are on a roll in 2025 as the country prepares to name a new Prime Minister.

Carson is expanding one of its relationships in Florida while Lido Advisors adds an $870 million practice in Silicon Valley.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.