Mom-and-pop investors have long been staple retail buyers of state and local debt. Now that’s changing, with fewer and fewer directly purchasing muni bonds in the $4 trillion market.

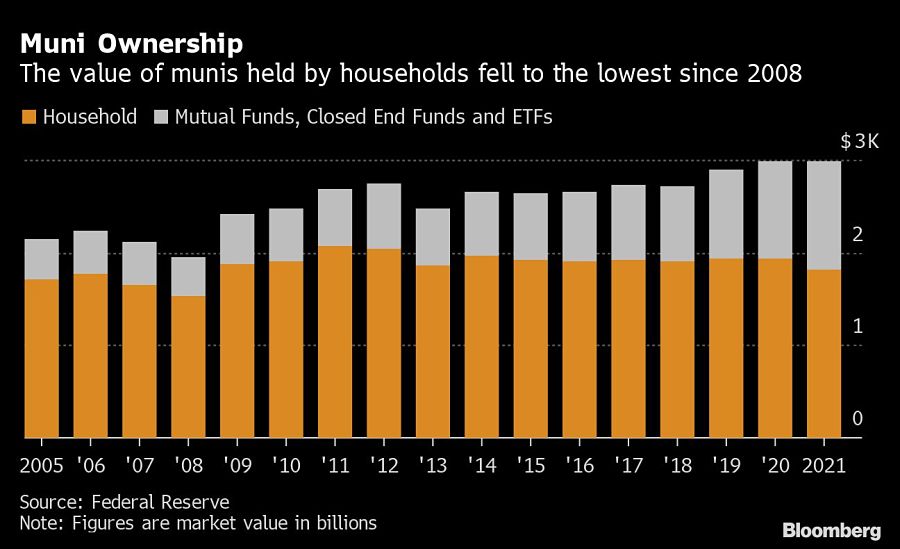

The value of municipal bonds directly owned by households fell by $18 billion in the fourth quarter of 2021, dropping to the lowest level since 2008, according to Federal Reserve data.

Instead, those buyers are moving toward mutual funds and exchange-traded funds, which have roughly doubled their muni holdings over the last decade.

Managed accounts offer buyers more liquidity and diversification, and their rise has put a spotlight on fund flow data as a key bellwether of the market’s health. The shift also has homogenized the market by condensing individuals’ investment strategies into the hands of account managers looking to beat a benchmark.

“When individual investors were the drivers of the market, every investor is different and you had this incredible diversity for buyers and sellers,” said Patrick Luby, municipal strategist at CreditSights. “Munis will maintain their appeal to individual investors, but I think the way they access munis will continue to shift.”

Together, direct and indirect retail account for almost three-quarters of the muni market’s total value, dwarfing the holdings of insurance companies and U.S. banks, which each held about 12% in the fourth quarter.

As interest rates fell over the last few decades, the risk-reward trade-off of buying individual bonds shifted, Luby said. Investors still ran the risk of losing principal, but smaller yields made mistakes more costly. It also become harder for financial advisers to squeeze out profits educating investors about individual deals.

Investors aren’t necessarily selling individual bonds, but as their bonds mature, they’re not putting as much money into new bonds. The Federal Reserve data isn’t a perfect measure because it estimates households residually, or by subtracting all other reported holdings from the total market size. Still, it’s one of the closest approximations of how much muni debt individuals hold directly.

“Mutual funds are becoming larger, over the last decade, their holdings pretty much doubled,” said Mikhail Foux, head of municipal strategy at Barclays. “Right now, they’re the most important institutional player in the municipal space.”

Foux expects the reallocation of retail muni holdings to continue, and pointed to a similar trajectory in the corporate market.

“There has been a lot of M&A activity in the mutual fund business and acquisitions of the separately managed account shops,” said Sweta Singh, portfolio manager at City Different Holdings. “Our market is getting more concentrated with bigger players, because there is bottom-line pressure on margins.”

Markets digest latest words on trade war, Fed chair’s position.

More advisors are using subscription models for financial planning services.

From Powell to China, president eases back rhetoric.

And profit guidance is set to weaken further in coming quarters.

Gold trades above $3,330 amid mixed tariff signals.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.