With markets in tumult and inflation surging, the allure of high-dividend stocks is growing fast.

Exchange-traded funds that track the highest-yielding stocks have taken in about $25 billion in assets so far this year, a new record for the value-oriented category, and inflows could reach $50 billion by year-end, according to Bloomberg Intelligence senior ETF analyst Eric Balchunas.

Companies that pay big dividends to their holders have long been wallflowers compared to sexier tech stocks, but that’s changing as the Federal Reserve rapidly hikes interest rates, raising fears of a recession, sending growth stocks spiraling and causing bond prices to slump.

“Investors have a need for yield, yet people are skittish to get that yield in the bond market because they know the Federal Reserve is hell-bent on raising rates,” Balchunas said on Bloomberg’s “Trillions” podcast. “With these ETFs, you’ve got this perfect one-two punch where they have two things people want right now — exposure to energy and high dividends.”

Energy companies often have high dividend yields, and the sector is the only portion of the S&P 500 Index that’s in the green this year as the war in Ukraine has crimped supplies, with the sector rising 29% as of Friday’s close versus a decline of 18% for the broader benchmark. Meanwhile, dividend-paying stocks have outperformed every other factor except value year-to-date, according to data compiled by Bloomberg.

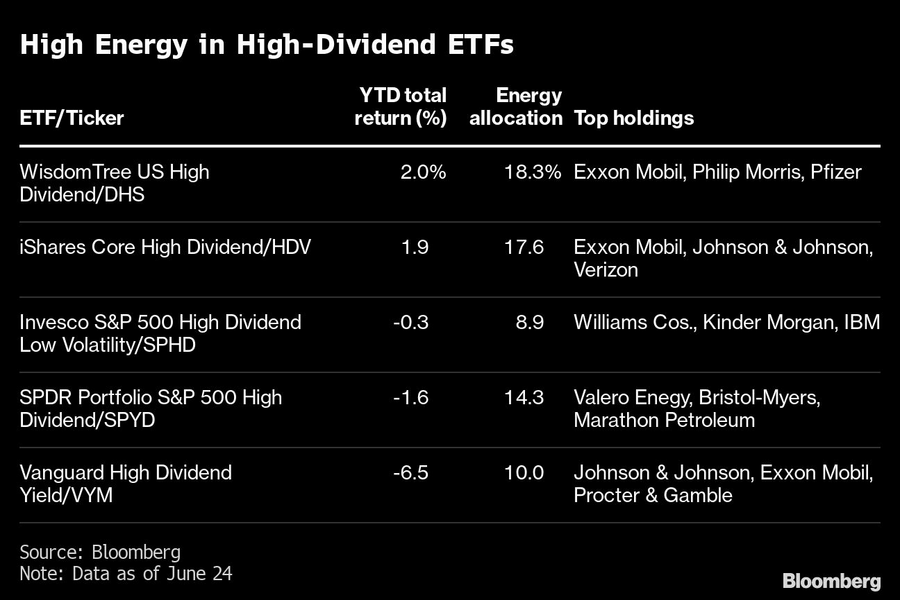

Some of the high-dividend ETFs have energy stakes approaching 20%, helping boost their performance. Exxon Mobil Corp. (XOM), which yields just over 4% and whose stock is up 42% this year, is a top holding in many funds. These include the WisdomTree US High Dividend Fund (DHS) and the iShares Core High Dividend ETF (HDV), both of which have total returns of about 2% so far this year.

Many funds have dividend yields between 3% and 4%, about double the S&P 500’s trailing 12-month yield of 1.6%. While the 10-year Treasury note yields over 3% as well, “until the Fed cools off, the bond market is going to be a tough place,” said Balchunas. “We’ve seen it in mutual fund flows with older investors bailing. That will be a constant drain on the prices of bonds for the foreseeable future.”

The yields offered by high-dividend ETFs may be similar across funds, but they vary greatly in how they find that yield. The Vanguard High Dividend Yield ETF (VYM) holds about 440 stocks and tracks the FTSE High Dividend Yield Index, which is made up of U.S. companies (excluding real estate investment trusts) that have paid above-average dividends for the previous 12 months. The SPDR Portfolio S&P 500 High Dividend ETF (SPYD), meanwhile, homes in on 80 of the S&P 500’s highest-yielding companies.

The ETFs also weight their portfolio companies differently, which can dilute or amp up concentration. Some weight by market cap, some weight every stock equally, and some weight based on dividends. In WisdomTree’s ETF, for example, which focuses on the highest dividend yields, Exxon Mobil has a 7.3% weight, while it is a much more tame 2.8% in Vanguard’s market cap-weighted fund.

“If a fund weights by dividends you clearly are going to have some stocks that dominate, and that can be a little scary, because yes, this thing yields a lot but now it’s really controlling your fund,” said Balchunas. “Some investors would likely opt for the equal-weighted version on these funds.”

The looming threat of federal funding cuts to state and local governments has lawmakers weighing a levy that was phased out in 1981.

The fintech firms' new tools and integrations address pain points in overseeing investment lineups, account monitoring, and more.

Canadian stocks are on a roll in 2025 as the country prepares to name a new Prime Minister.

Carson is expanding one of its relationships in Florida while Lido Advisors adds an $870 million practice in Silicon Valley.

The approval of the pay proposal, which handsomely compensates its CEO and president, bolsters claims that big payouts are a must in the war to retain leadership.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.