Financial planning is becoming an increasingly competitive market for software providers, but regardless, another new platform has launched with an adviser-targeted offering that it touts as different.

RightCapital, a financial planning software provider specifically for advisers, announced its launch Tuesday during the XY Planning Network Conference in Charlotte, N.C. The web-based platform already has integrations with Morningstar Inc, Yodlee Inc., a data aggregator, and Redtail, a client relationship management software provider.

Advisers will be charged $49.95 per month for the basic planning platform or $74.95 per month for the planning platform with account aggregation.

"We think financial planning is going to be a key component for wealth management going forward," said Shuang Chen, co-founder and chief executive of RightCapital.

Indeed, it will be. Although financial advisers have been creating financial plans for years, only recently has there been a significant emphasis on looking at clients' overall financial picture. Many cite robo-advisers as one reason for the increased focus on digital platforms. Some argue that automated investment services have

commoditized investment advice.

"It is becoming the hallmark for being a financial adviser," said Lorraine Ell, president and director of training at Excellat Consulting, a technology firm for advisers. "The days of just selling mutual funds or collecting assets to manage are quickly becoming obsolete."

Ms. Ell said what financial planning software providers can do to help advisers is make the process for creating financial plans smoother.

"The whole financial planning process right now is very time-consuming," she said. "It takes hours and hours to create and enter the data accurately."

Then someone must review and maintain the data to ensure that everything is up-to-date and the system generates the same, accurate output every time.

A platform for advisers, rather than one targeting nvestors,seems to be a safer option for financial planning startups.

Recently, another financial planning software startup,

Plumvo, closed its doors because its business model, primarily geared toward consumers, was too tough a sell.

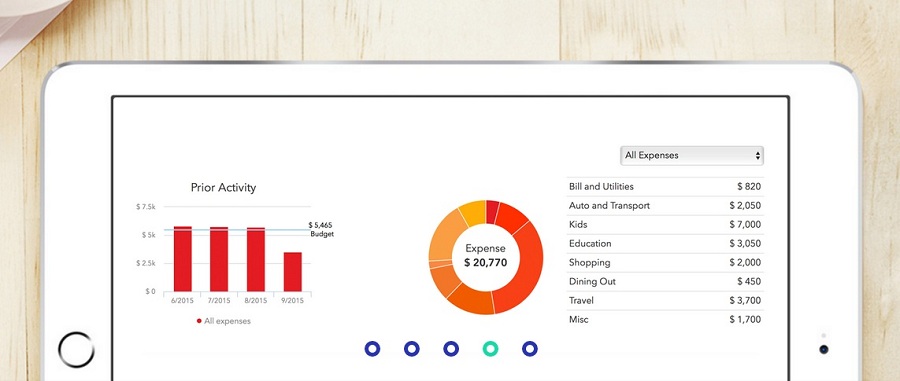

RightCapital's platform offers a client portal, as well as integrated functions for retirement, investments, insurance, education and budgeting. It incorporates financial information on taxes and Social Security, as well.

Mr. Chen has been in the industry for more than 15 years, and prior to starting RightCapital was vice president at Prudential Financial, where he was responsible for product development for the annuity business.

Co-founder Song Chen, the chief technology officer of RightCapital, has also been in the industry for more than a decade. Prior to the launch of the financial technology startup, Mr. Chen was vice president at J.P. Morgan Chase & Co., where he focused on design and implementation technology for trading systems.

They believe their platform is different than what the industry already uses because RightCapital focuses on enabling adviser-client interactivity.

"We see the future of financial planning is promoting collaborations, and in order for advisers to collaborate, tools have to be interactive," Mr. Chen said.

Some financial advisers don't think there's any one perfect solution out there for them and their practices.

Robert Klein, founder and president at Retirement Income Center, said he uses six financial planning tools so that any client need can be addressed without issue.

"There is no single one out there that solves the needs of all of my clients," Mr. Klein said.

He said he is always trying new software, but will not commit to one until it becomes established financially. Mr. Klein also said the reason so many come and go, aside from funding, is a lack of flexibility in technology upgrades. The key to success is to take suggestions into consideration.

"The biggest thing is listening to customers, that is, the advisers, and developing the software, not only initially, but evolving over the years." Mr. Klein said.

"The best software providers spot the fact that one user might only be one user, but that if they make an enhancement suggestion, if it's really good, they'll implement it," he said.