Investors in exchange-traded funds will soon be able to hedge the world’s safest asset.

Innovator ETFs will launch two so-called buffer funds tracking long-dated Treasuries next Tuesday, according to a company statement Friday. They’ll be the first fixed-income products of that category to begin trading amid a surge in popularity for defined-outcome equity funds, which shield holders against a certain percentage of declines in exchange for a cap on gains.

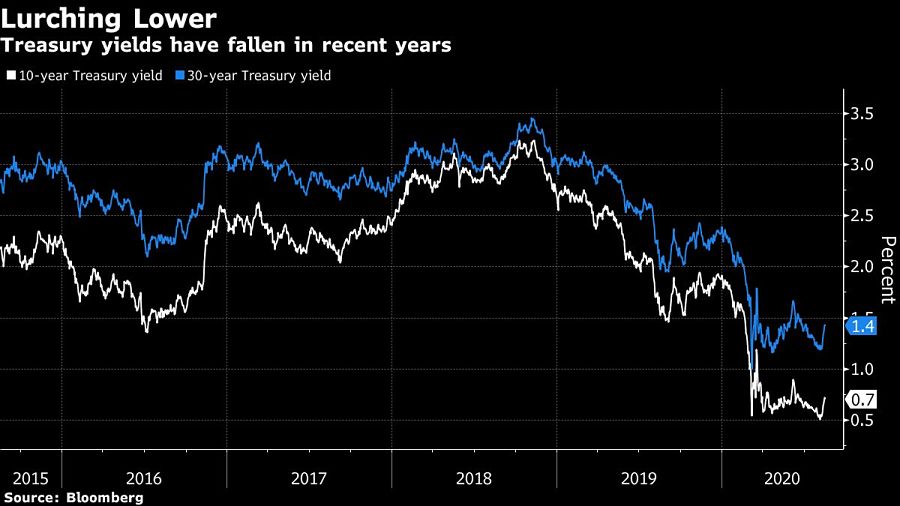

Buffer funds are increasingly luring investors as stocks reach new highs and coronavirus cases continue to rise. The new ETFs will also debut at a time when Treasury yields are hovering near historic lows, while duration risk -- a measure of sensitivity to interest-rate changes -- is climbing.

Rock-bottom rates have raised questions about the viability of Treasuries as a hedge in traditional portfolio mixes such as 60% equities and 40% fixed-income.

Bond buffer ETFs would give advisers a tool to protect their portfolios against the risk of yields turning sharply higher, said to Bruce Bond, CEO at Innovator.

“Historically, it hasn’t been as important as it is today when rates are so low and duration is so extreme,” Bond said. “You’re still going to get a portion of the upside, but the great thing is we’re going to be able to hedge your downside.”

The Innovator 20+ Year Treasury Bond 5 Floor ETF - JULY (TFJL) and the Innovator 20+ Year Treasury Bond 9 Buffer ETF - JULY (TBJL) will provide buffered exposure to the performance of BlackRock Inc.’s iShares 20+ Year Treasury Bond ETF (TLT). Both Innovator funds will have a 0.79% fee.

Investors have plowed over $2.3 billion into defined-outcome ETFs so far this year, according to data compiled by Bloomberg. While Innovator commands the lion’s share of assets, competition is building. Allianz Investment Management launched two buffer ETFs in June, and New York Life Investments’ IndexIQ unit has also filed plans.

Still, a bond buffer ETF might not drum up the strong demand seen for their equity counterparts.

“Equity ETFs are an easier sell and more intuitive to the average person,” said Bloomberg Intelligence analyst James Seyffart. “While the TLT buffer products could definitely be a useful tool in certain situations and for certain investors and strategies, I think the equity products have broader appeal.”

Driven by robust transaction activity amid market turbulence and increased focus on billion-dollar plus targets, Echelon Partners expects another all-time high in 2025.

The looming threat of federal funding cuts to state and local governments has lawmakers weighing a levy that was phased out in 1981.

The fintech firms' new tools and integrations address pain points in overseeing investment lineups, account monitoring, and more.

Canadian stocks are on a roll in 2025 as the country prepares to name a new Prime Minister.

Carson is expanding one of its relationships in Florida while Lido Advisors adds an $870 million practice in Silicon Valley.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.