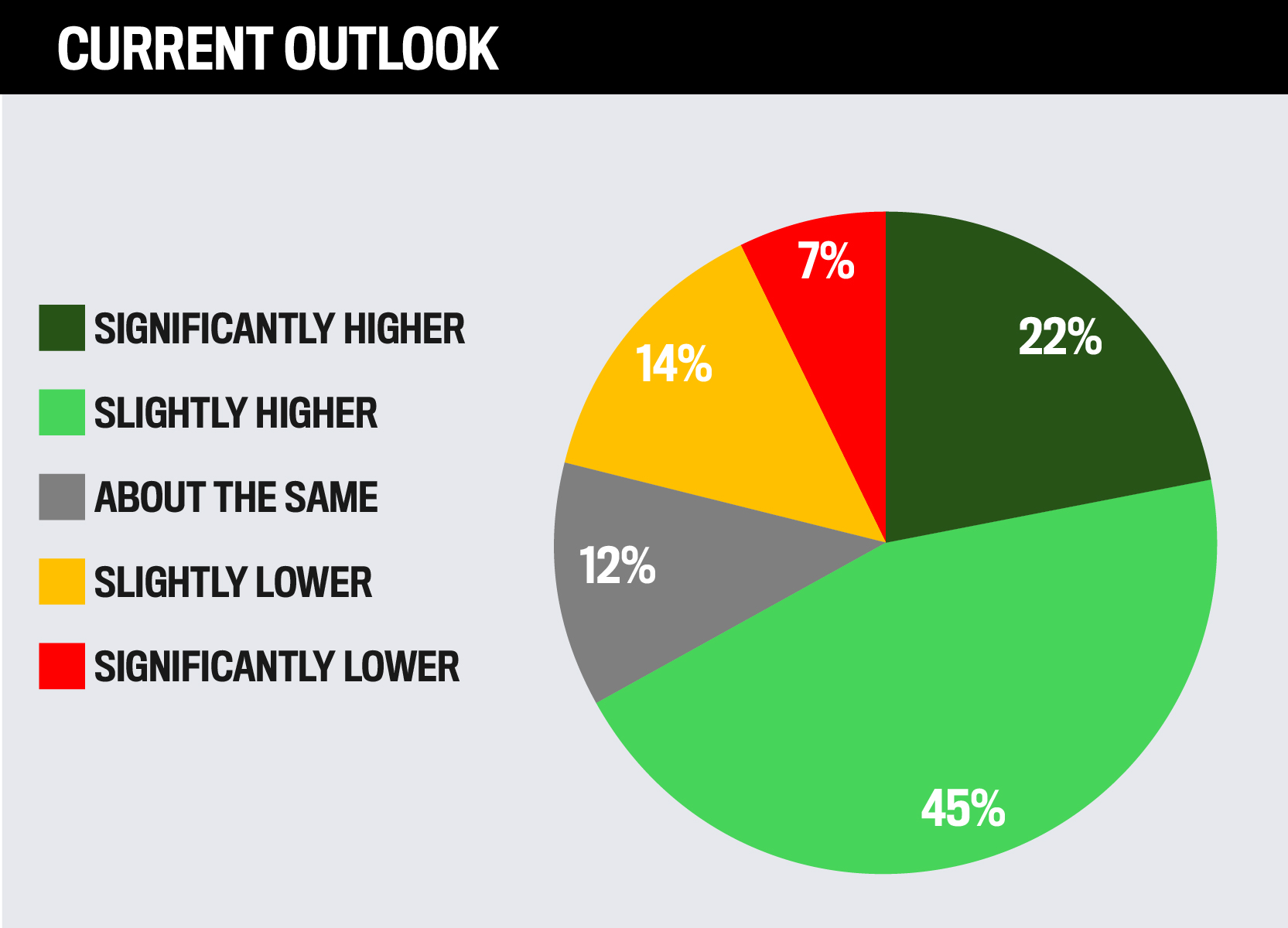

Where do you expect the S&P to be in 12 months, compared with today?

Between Oct and Dec 2024, 67% of advisors expected markets to rise over the coming year while 21% expected them to fall.

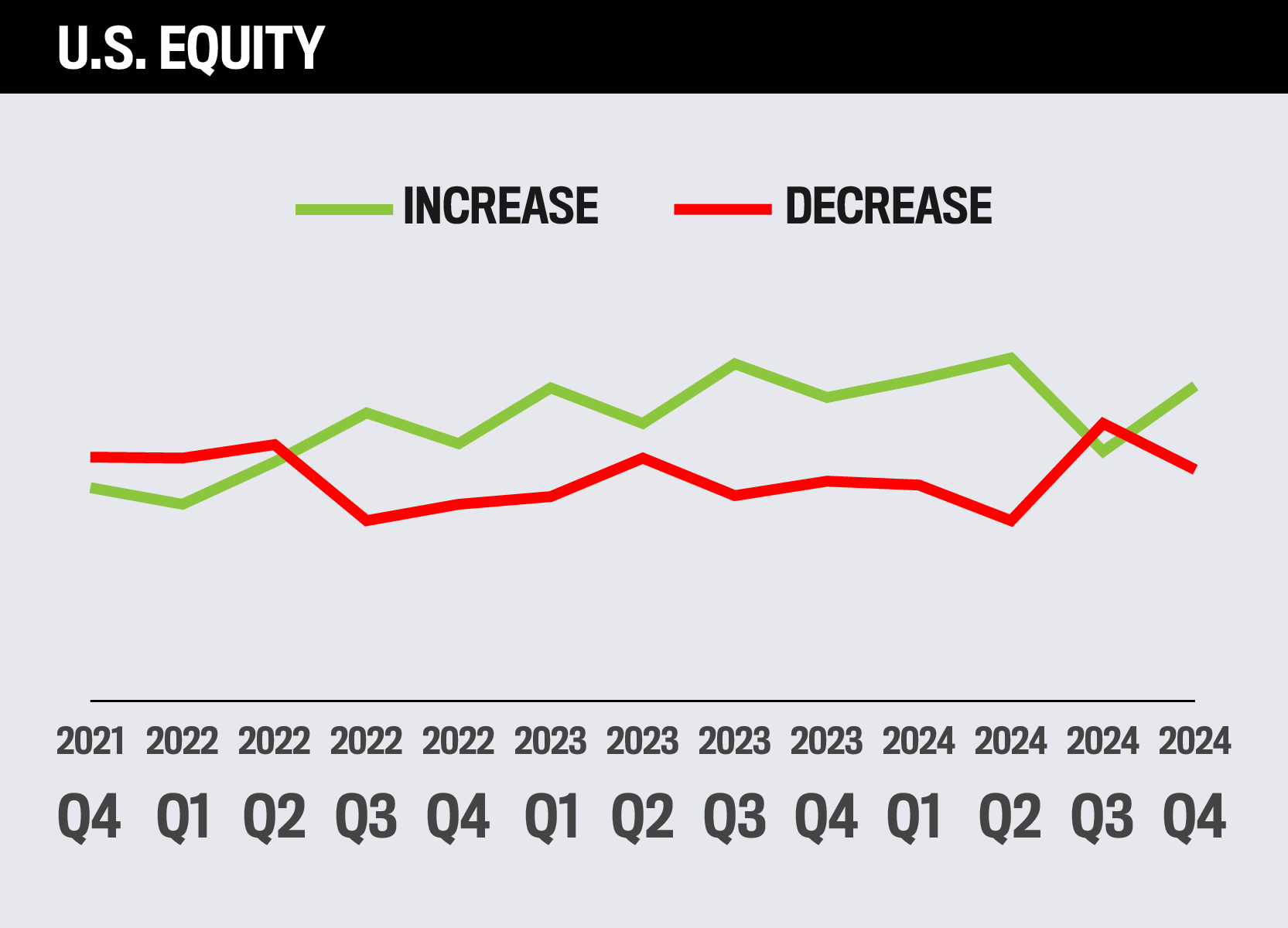

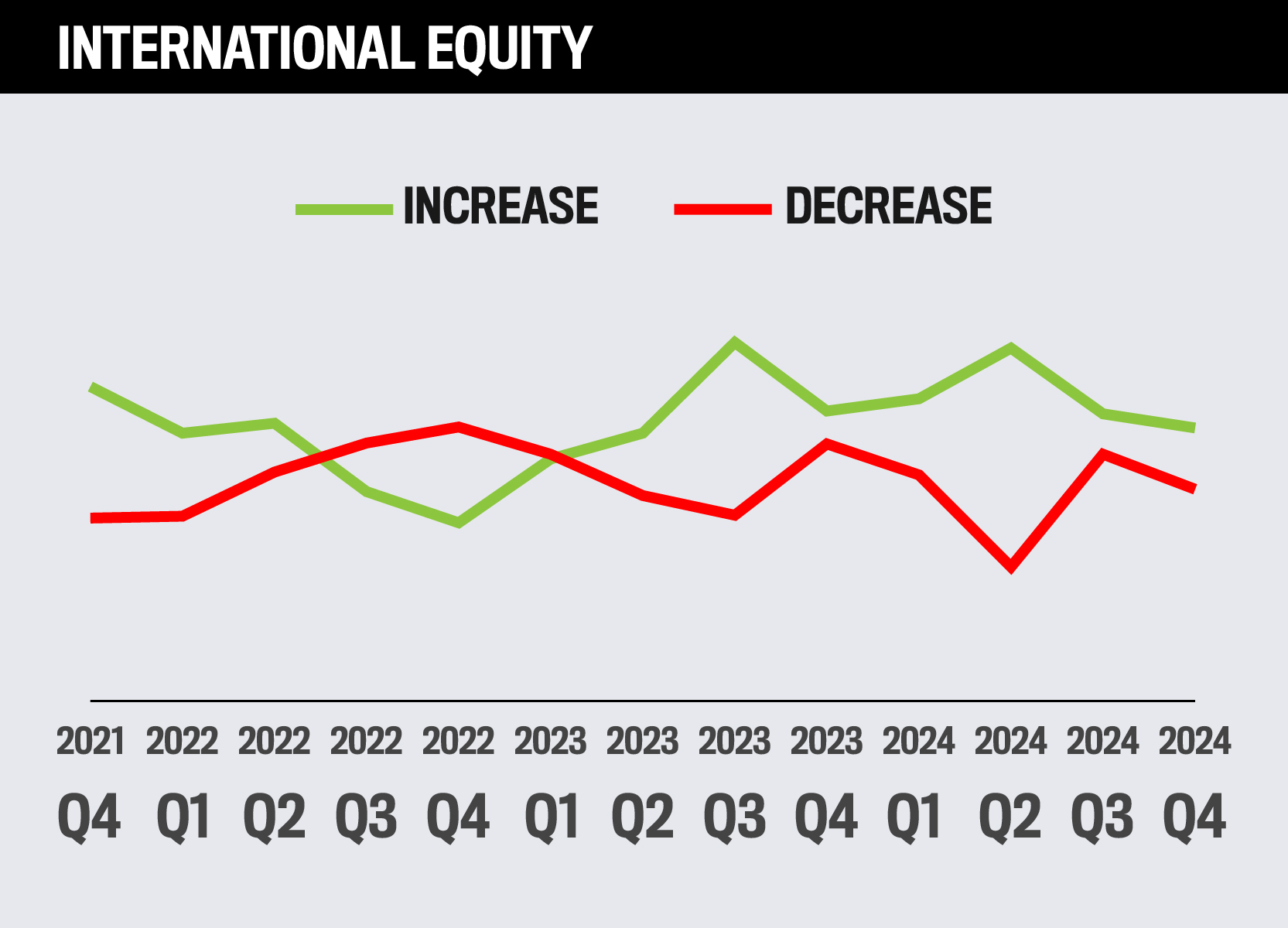

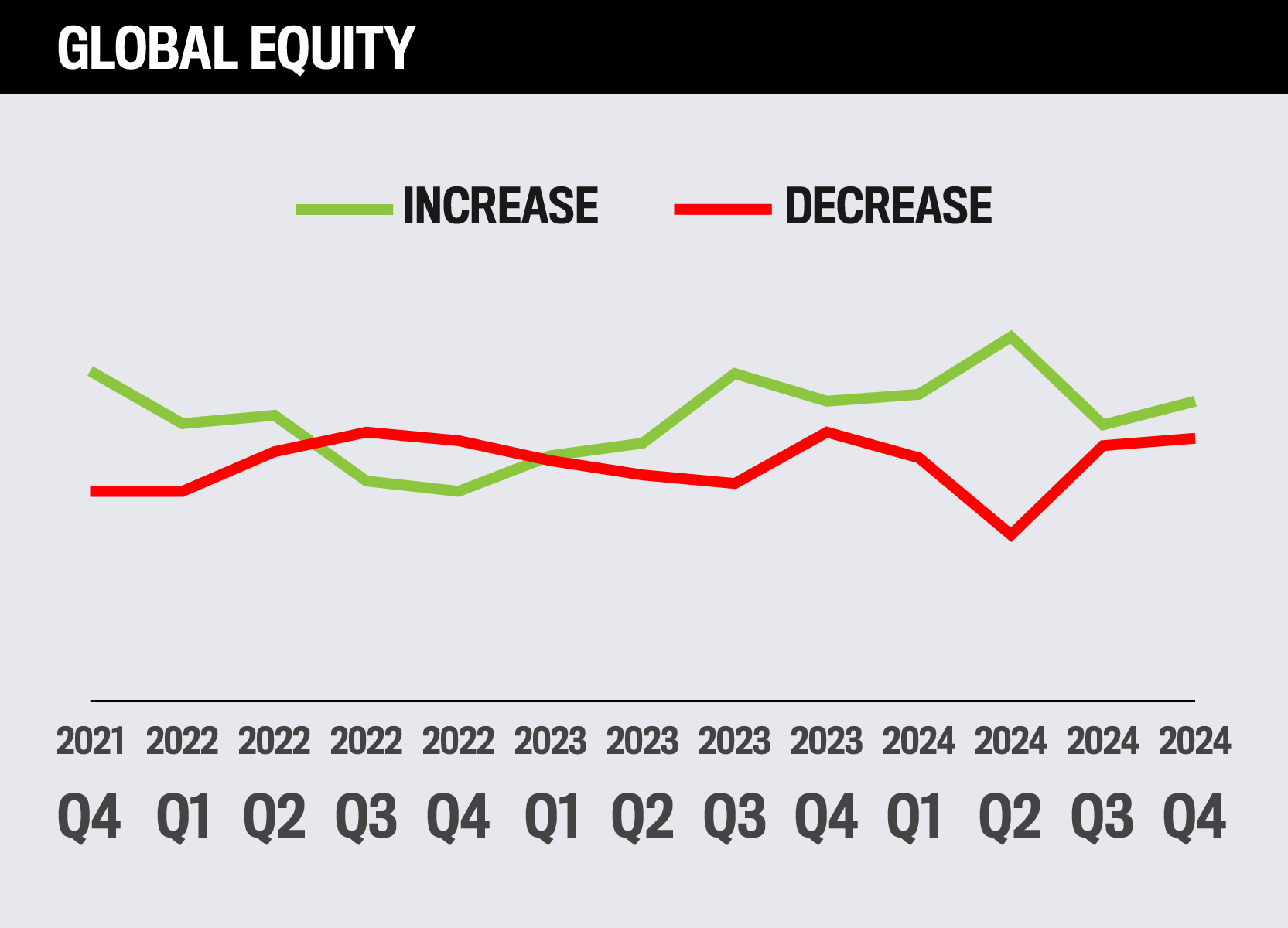

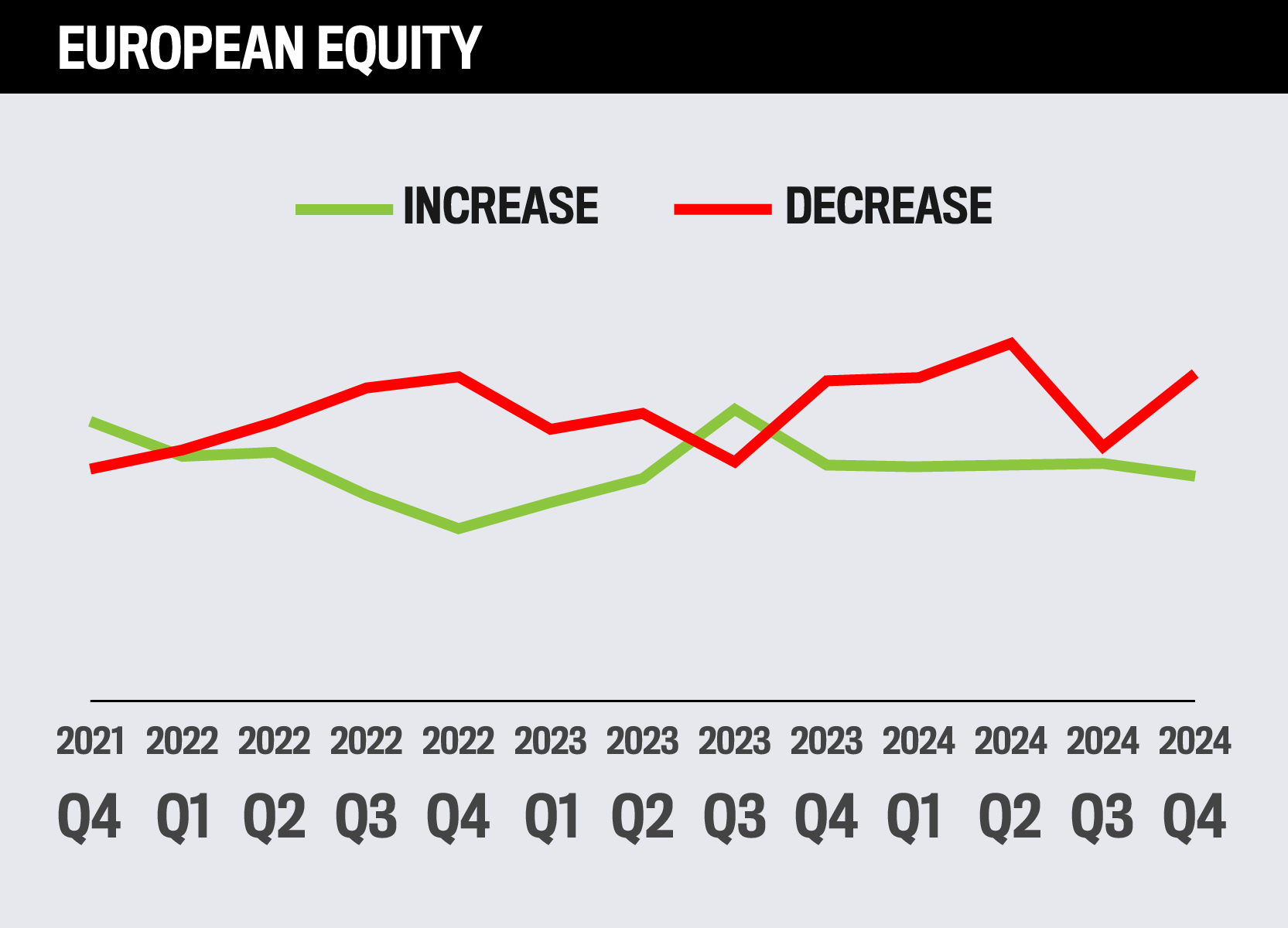

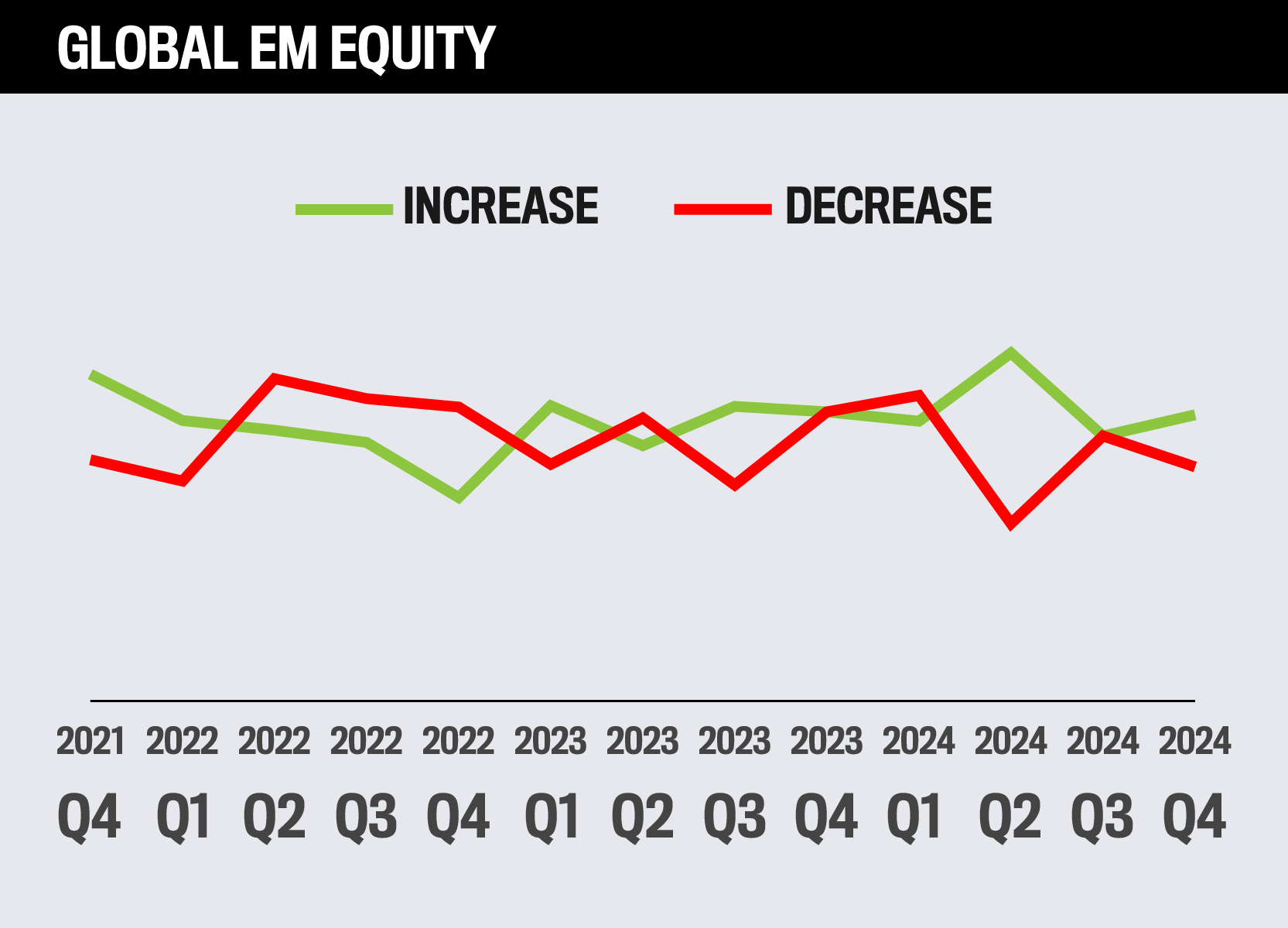

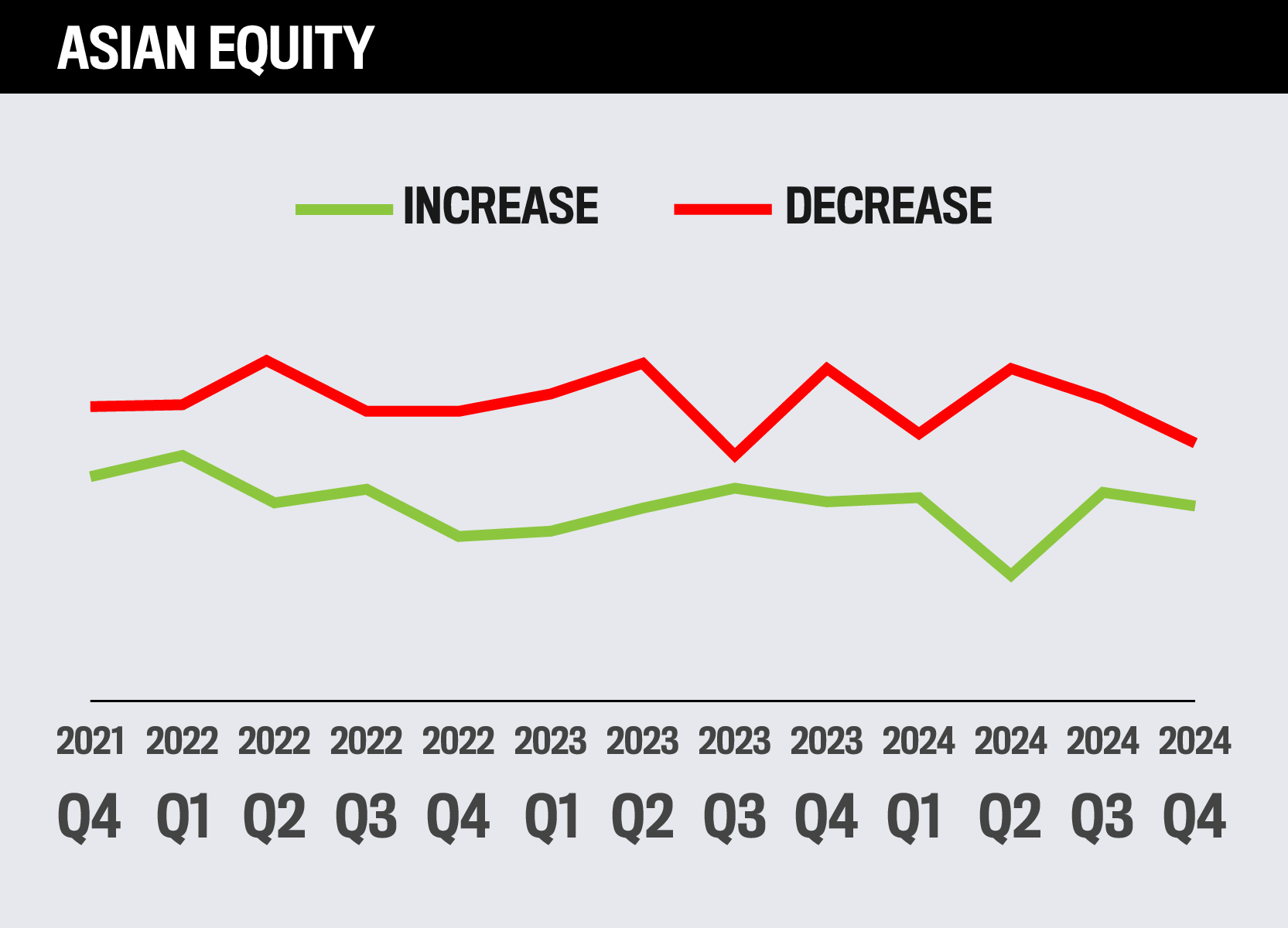

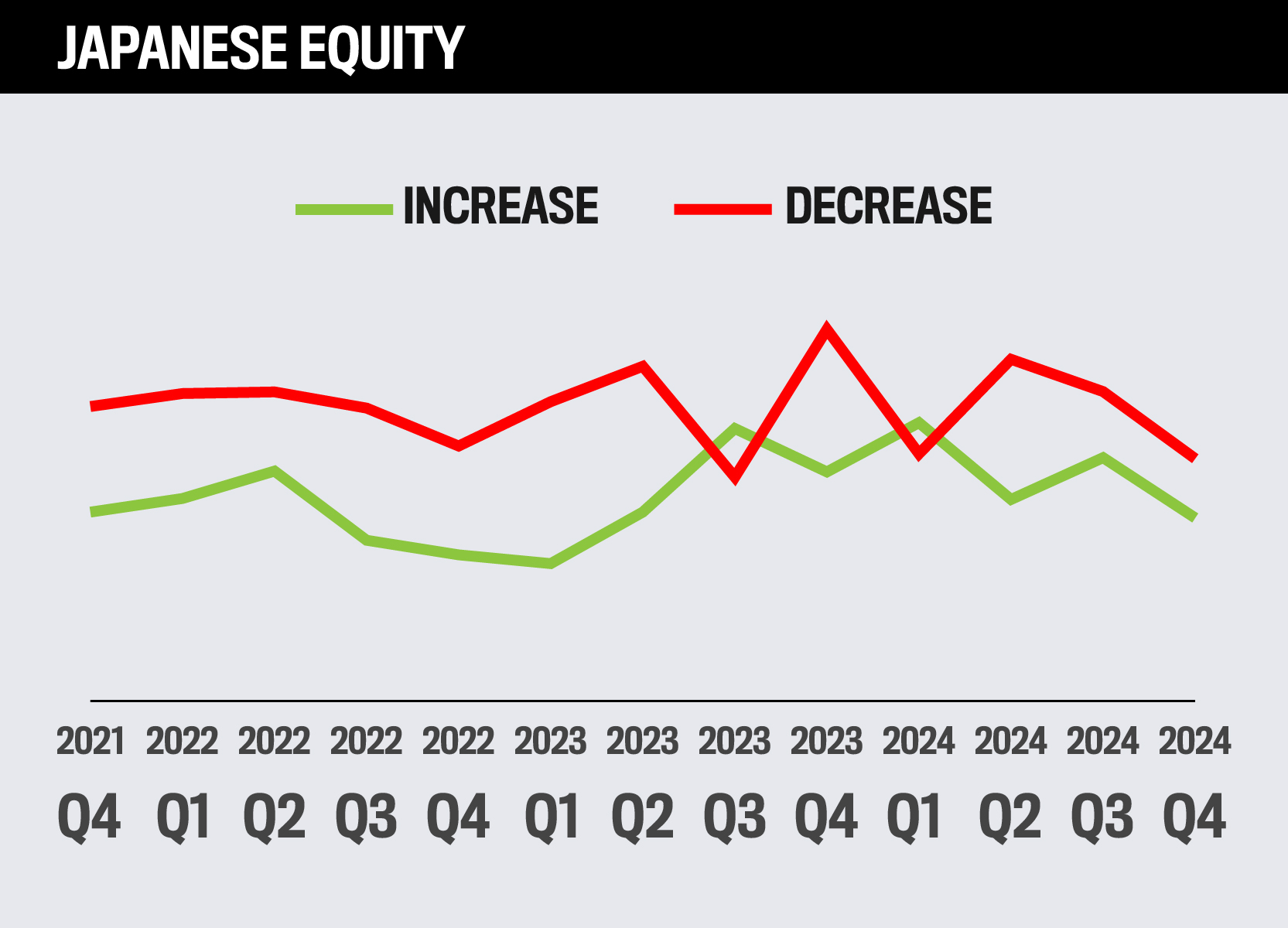

How advisors plan to allocate assets to equities over the next year

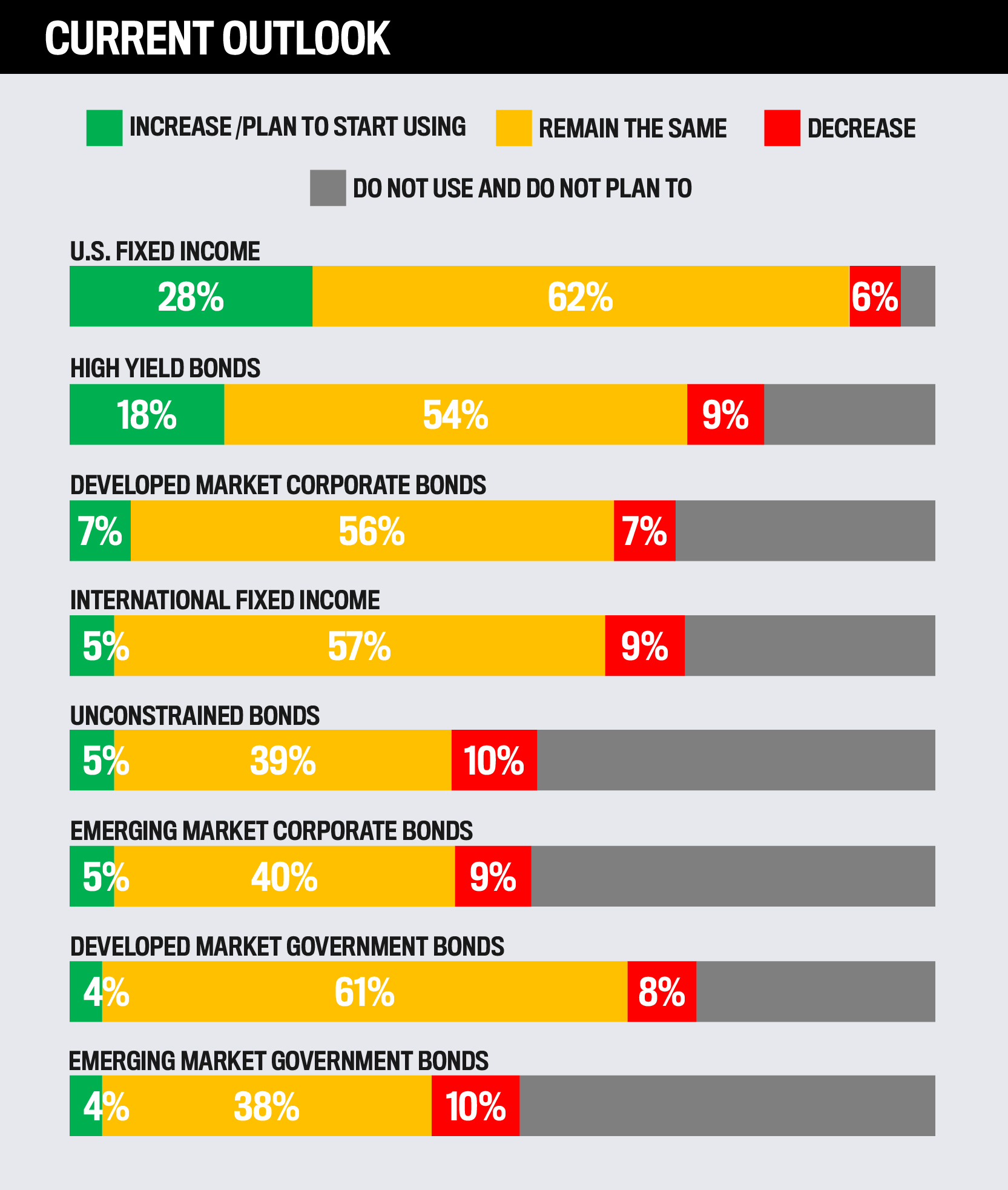

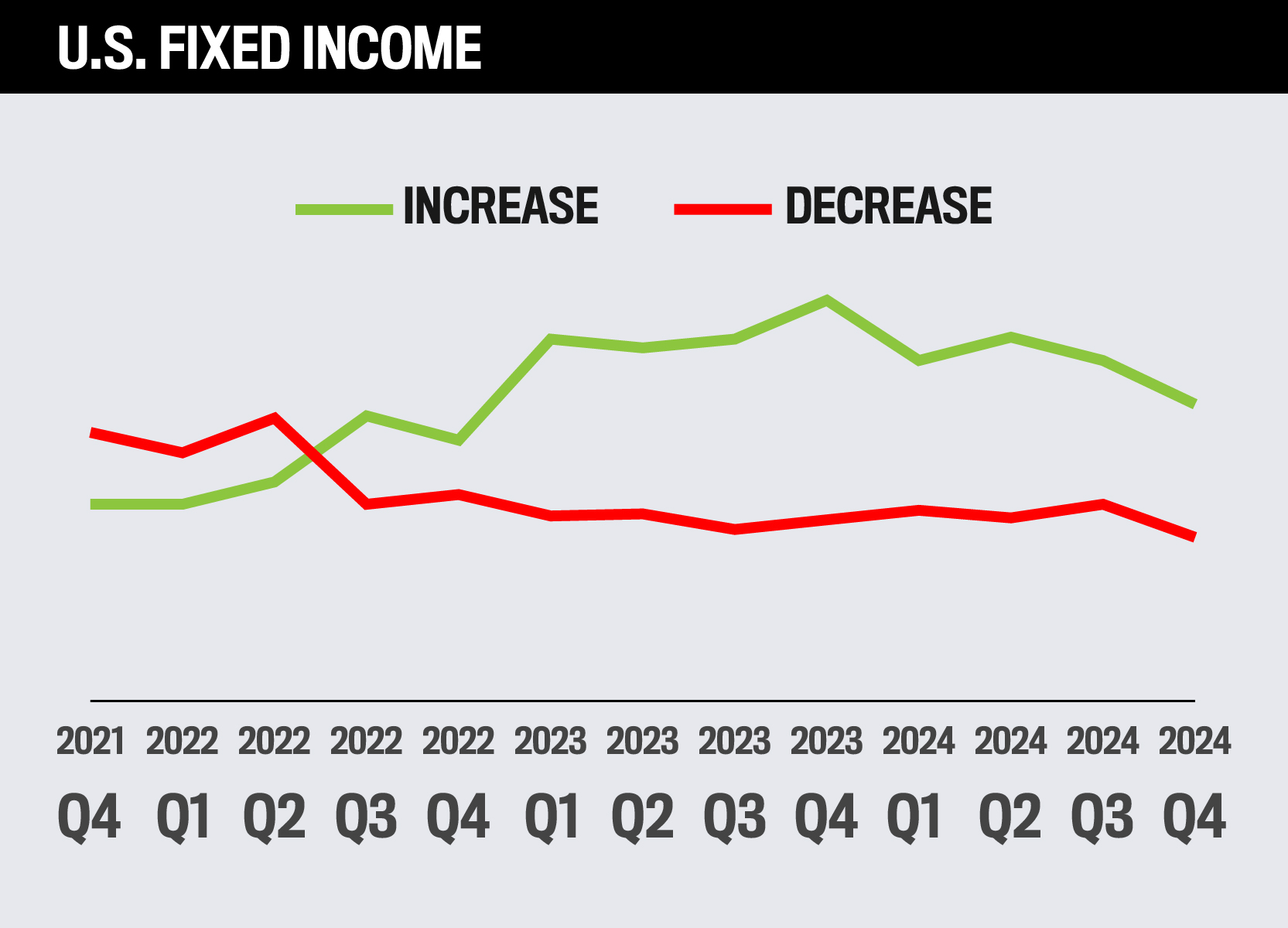

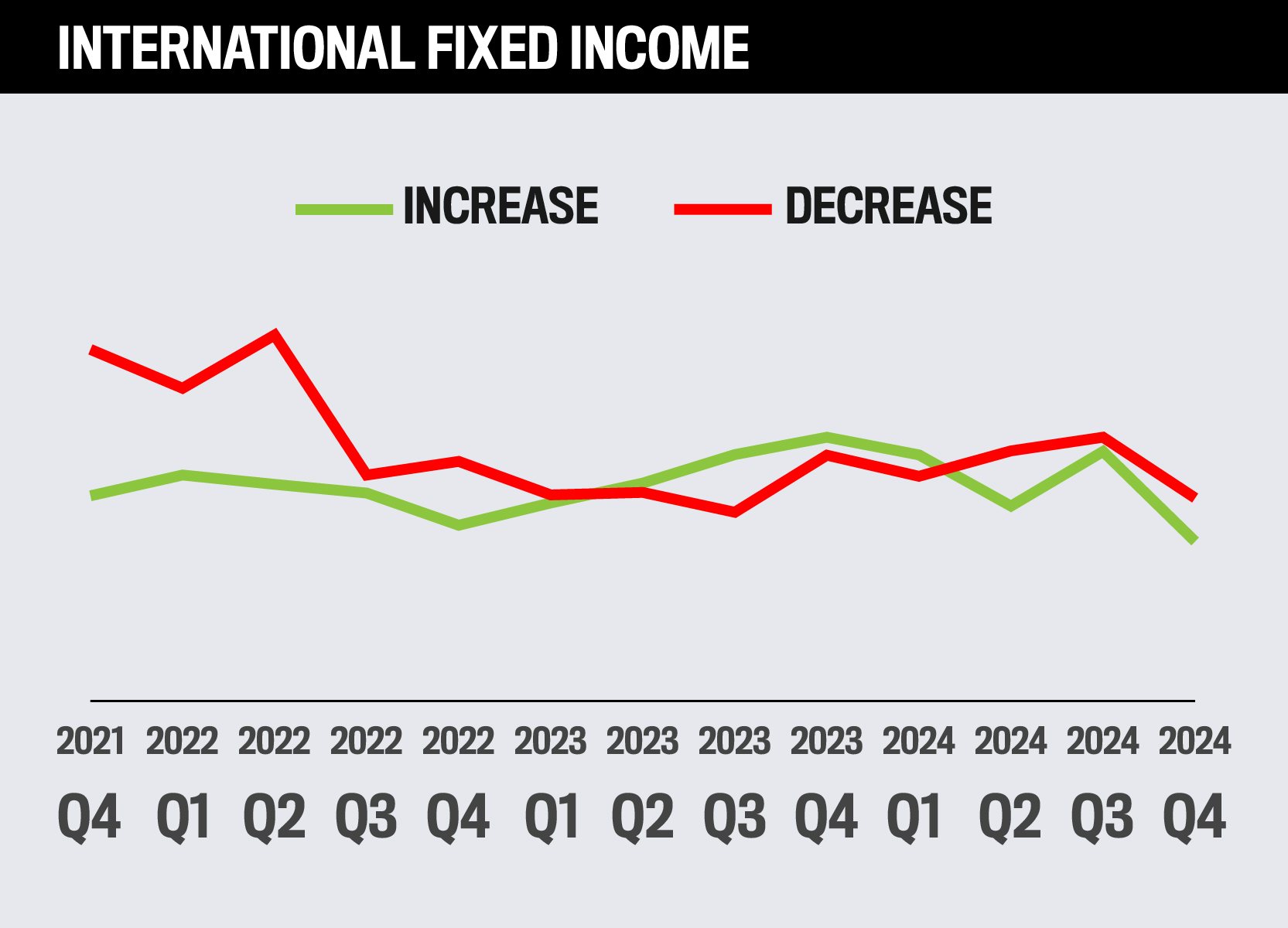

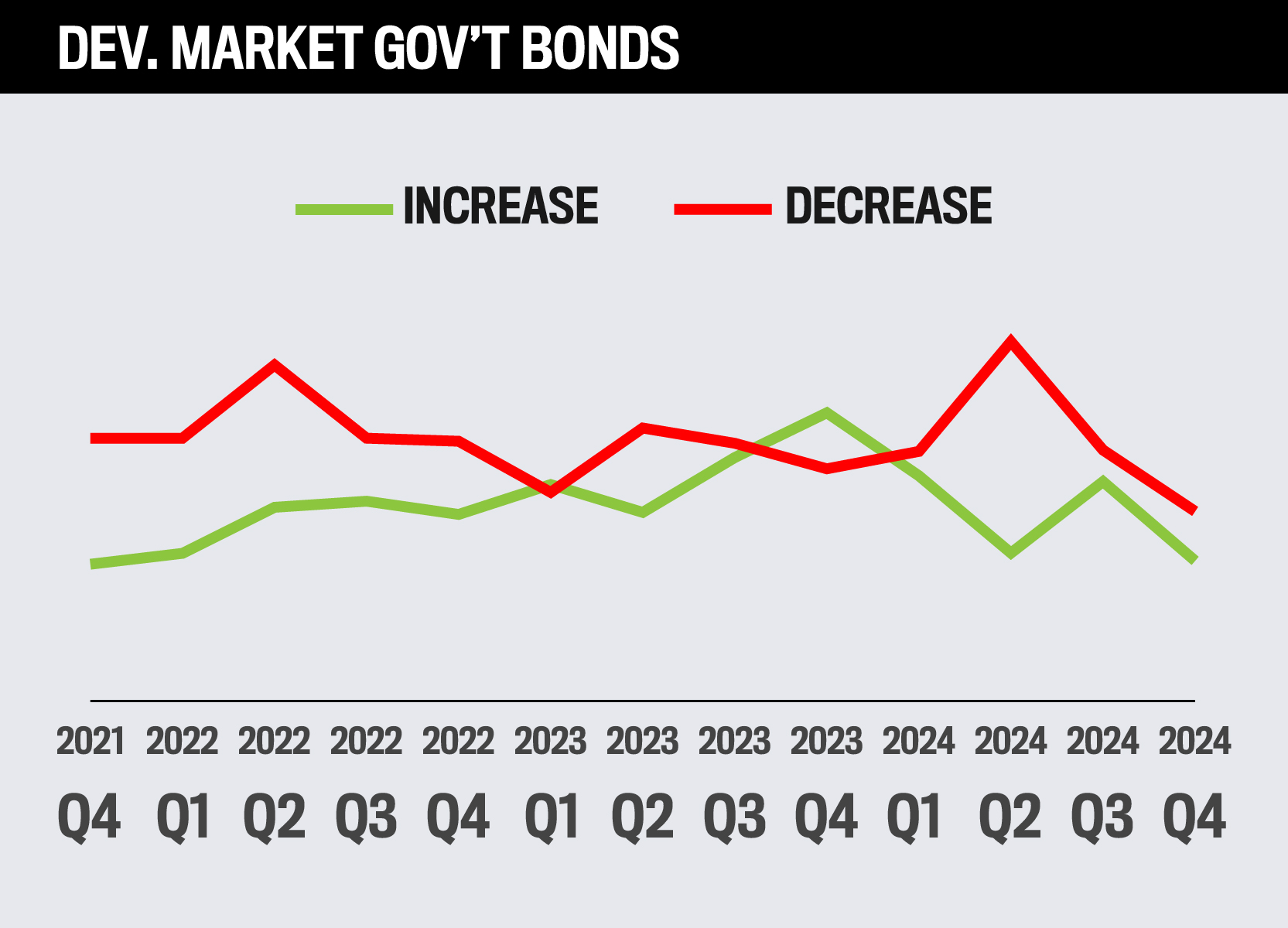

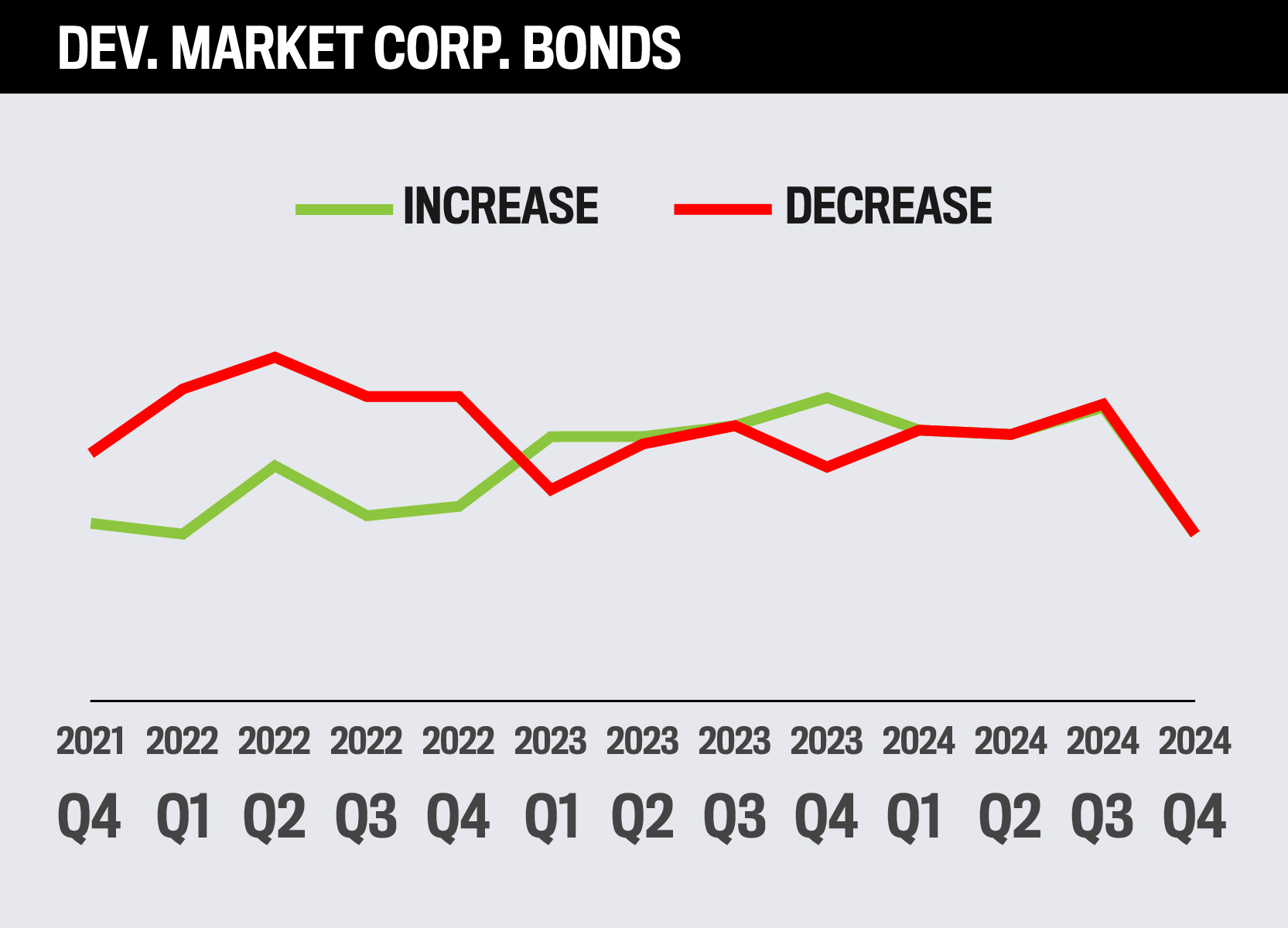

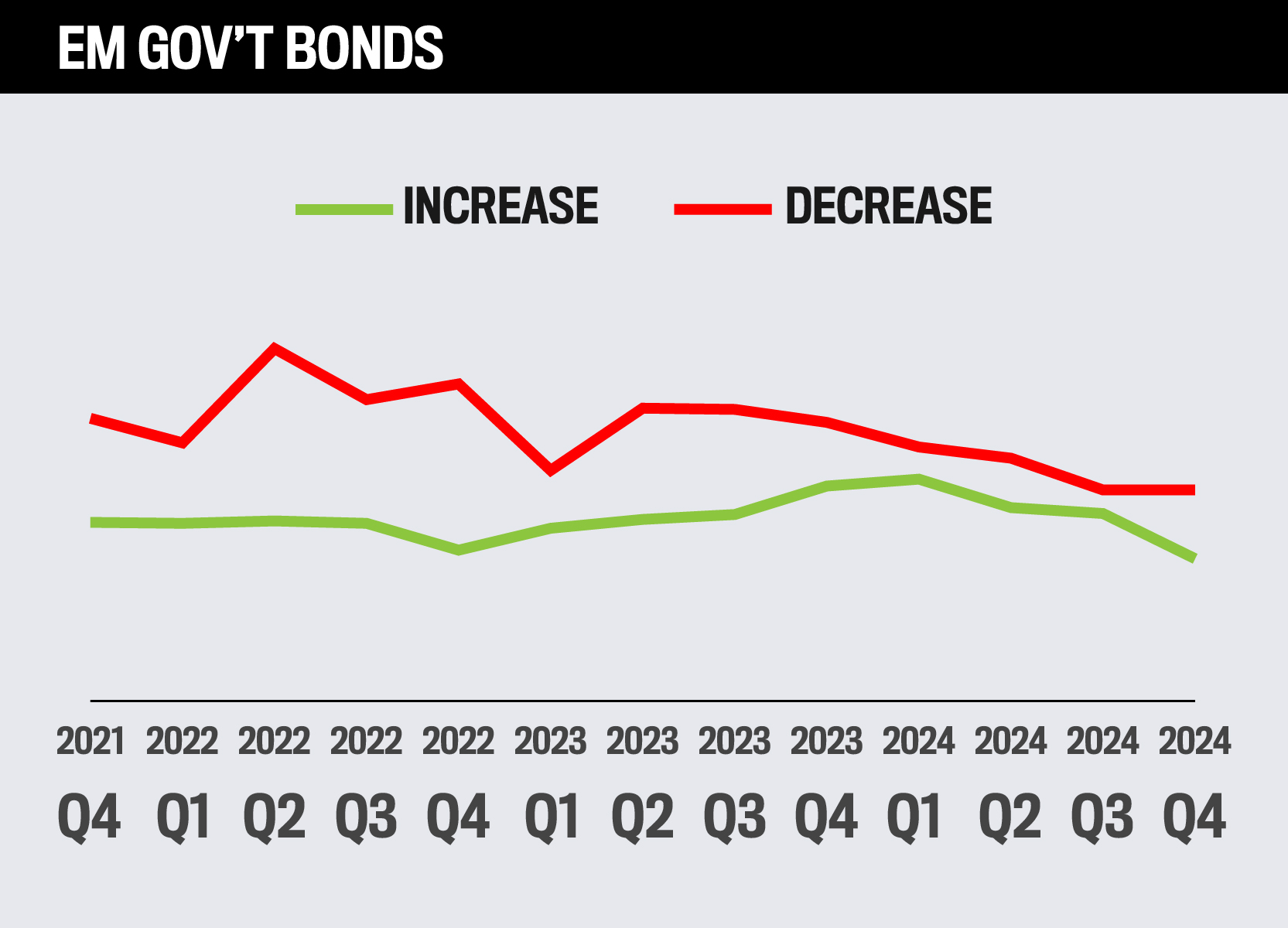

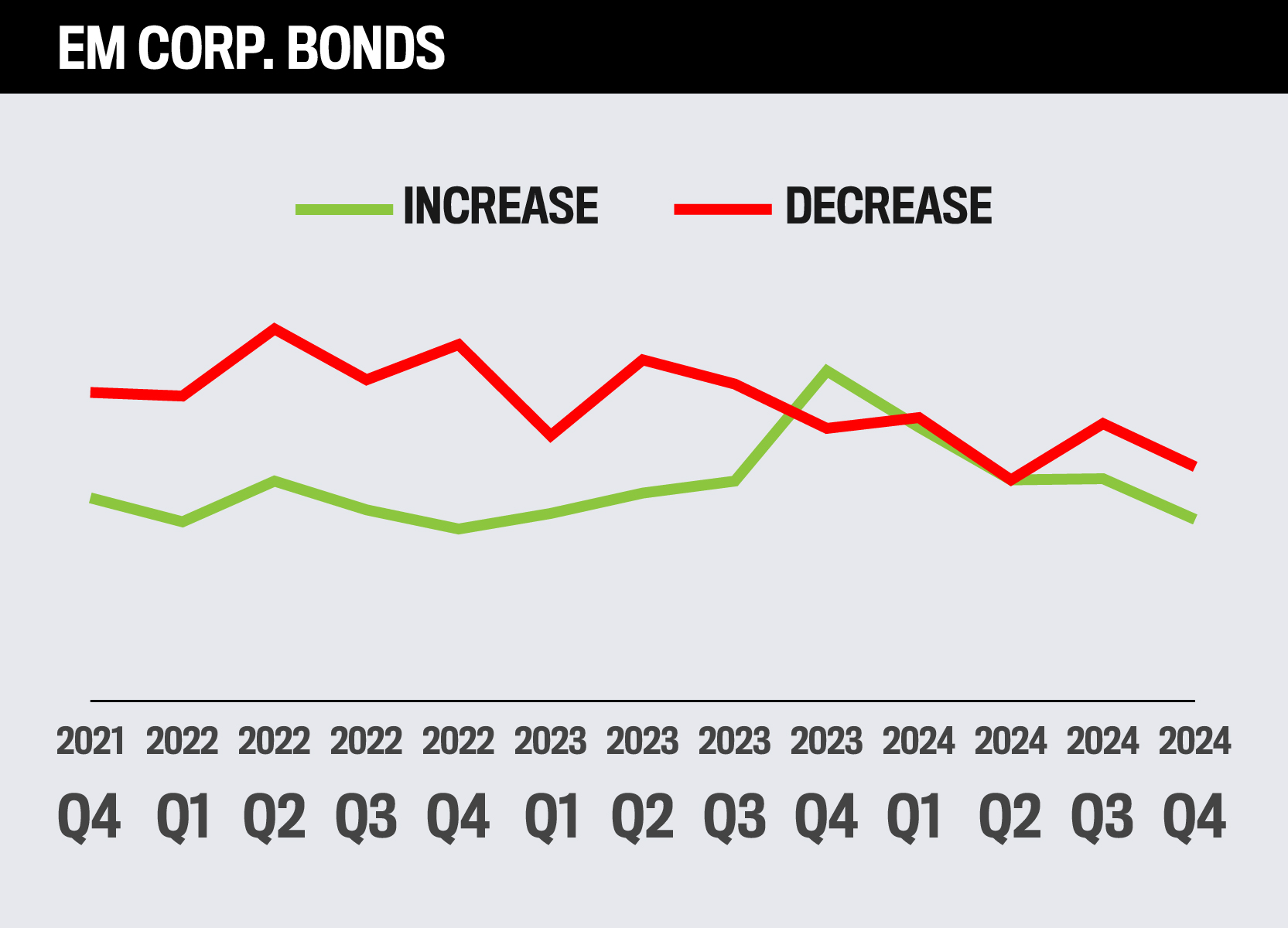

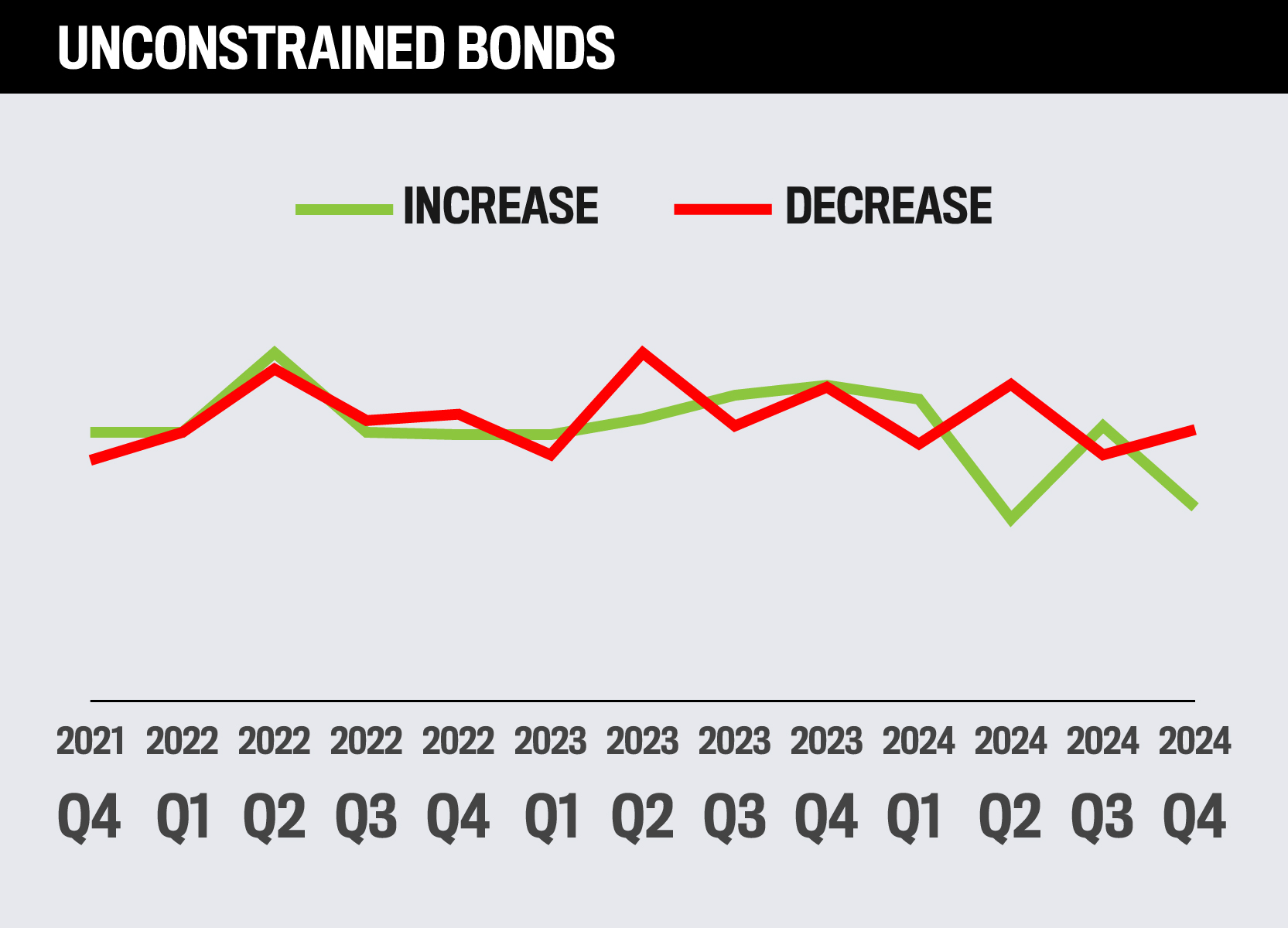

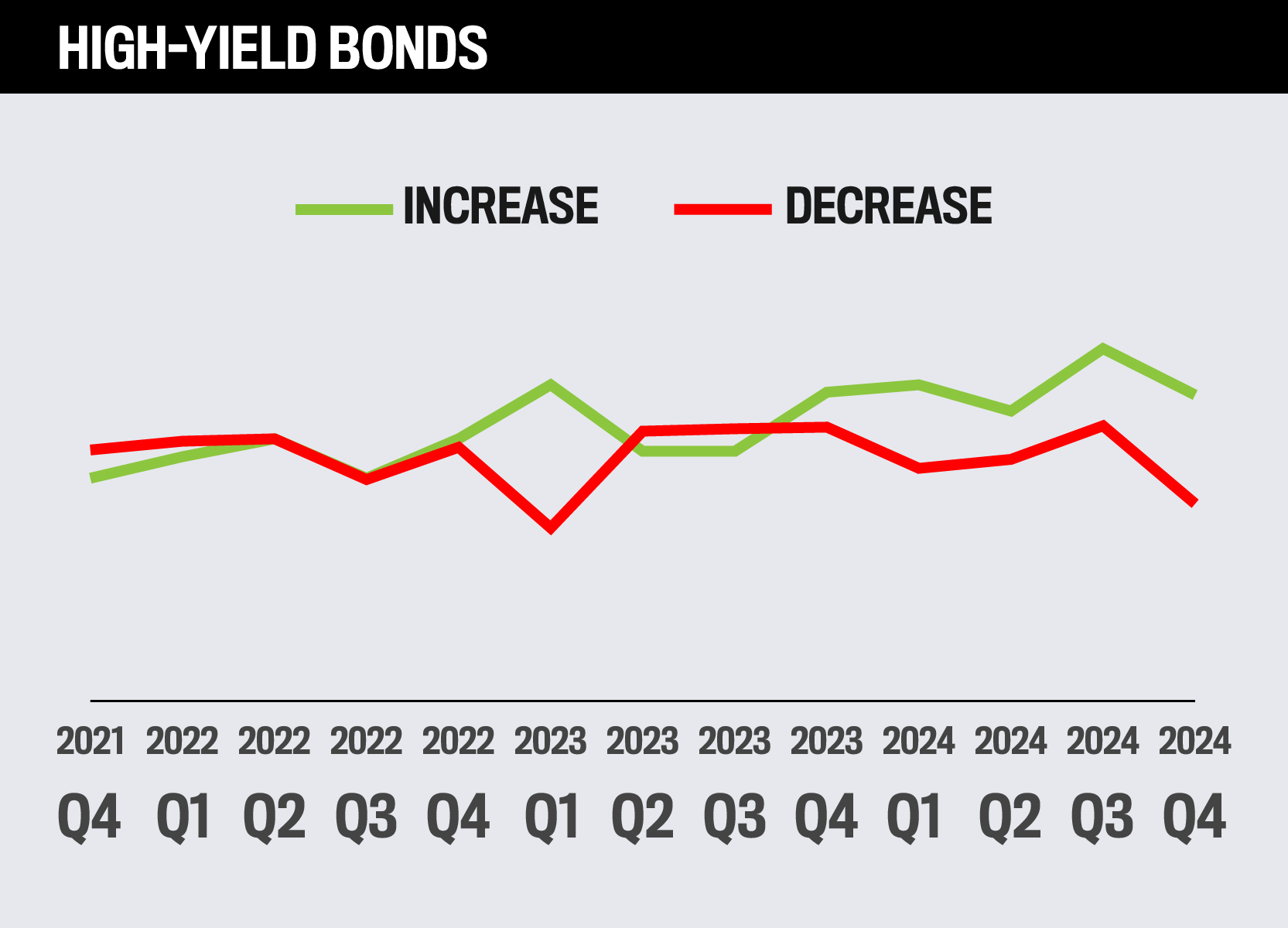

How advisors plan to allocate assets to fixed income over the next year

Within fixed income markets, U.S. fixed income is expected to see the most investment among financial professionals over the next year, while developed market government bonds and emerging market government bonds are expected to see the least.

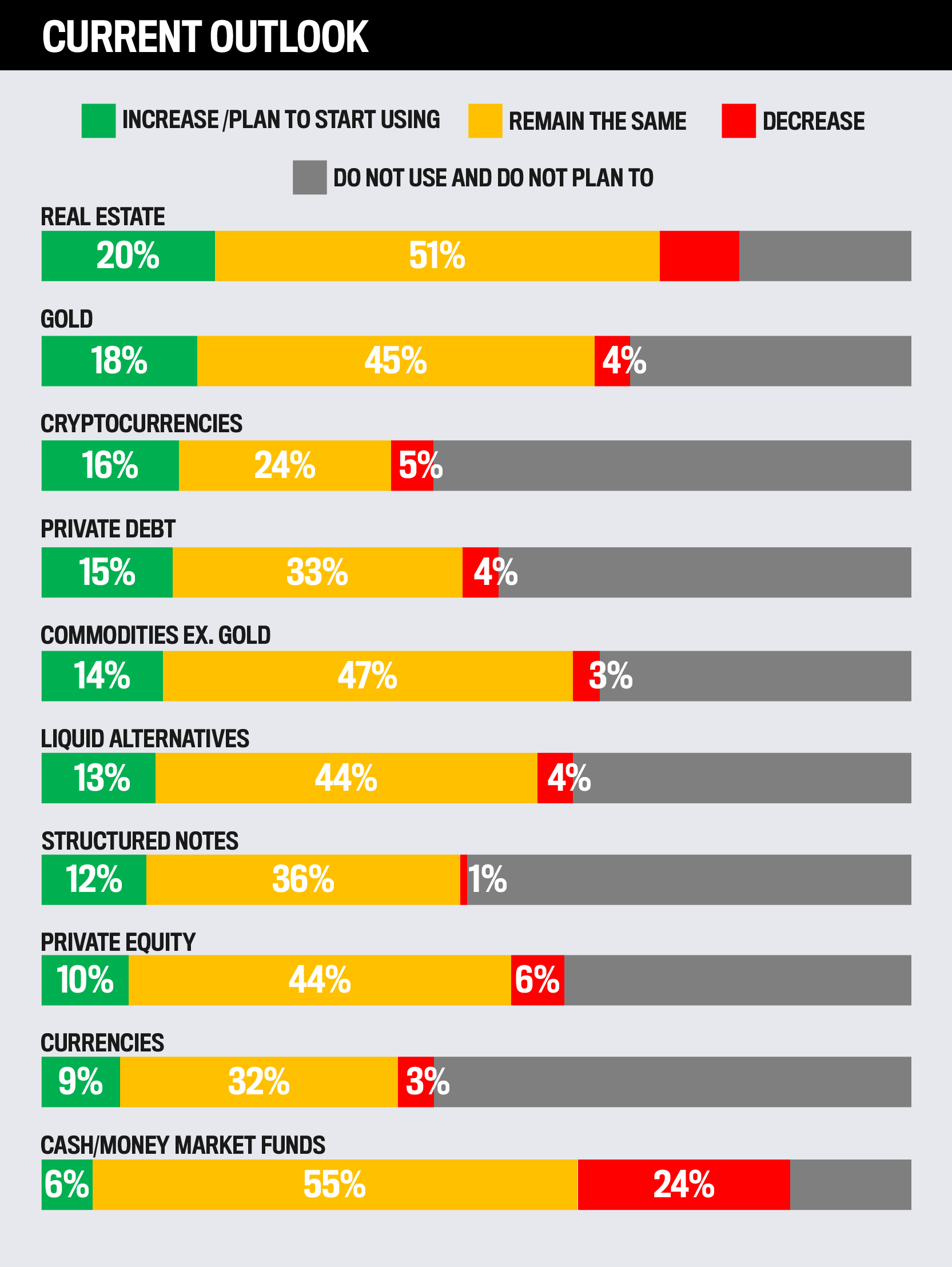

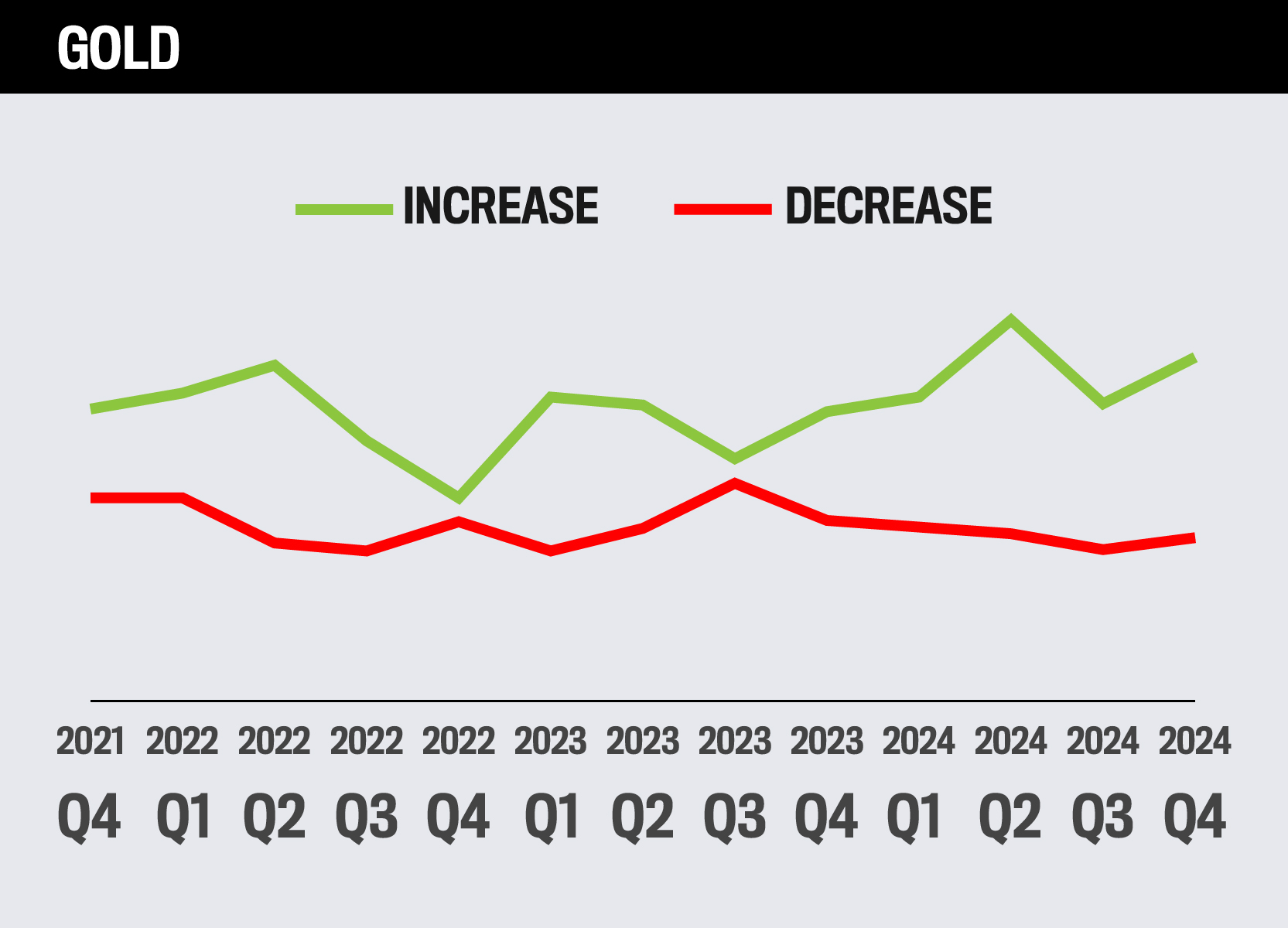

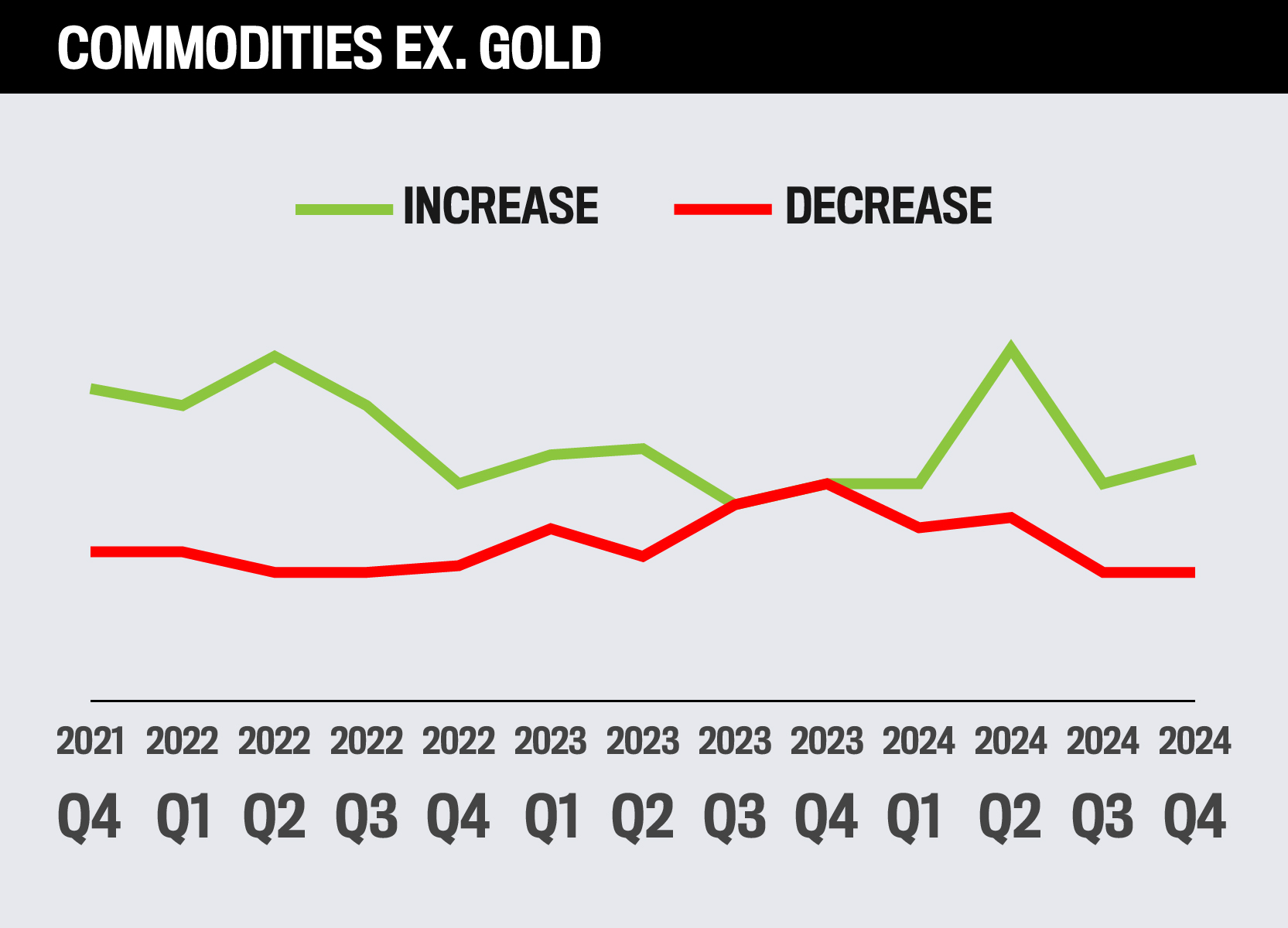

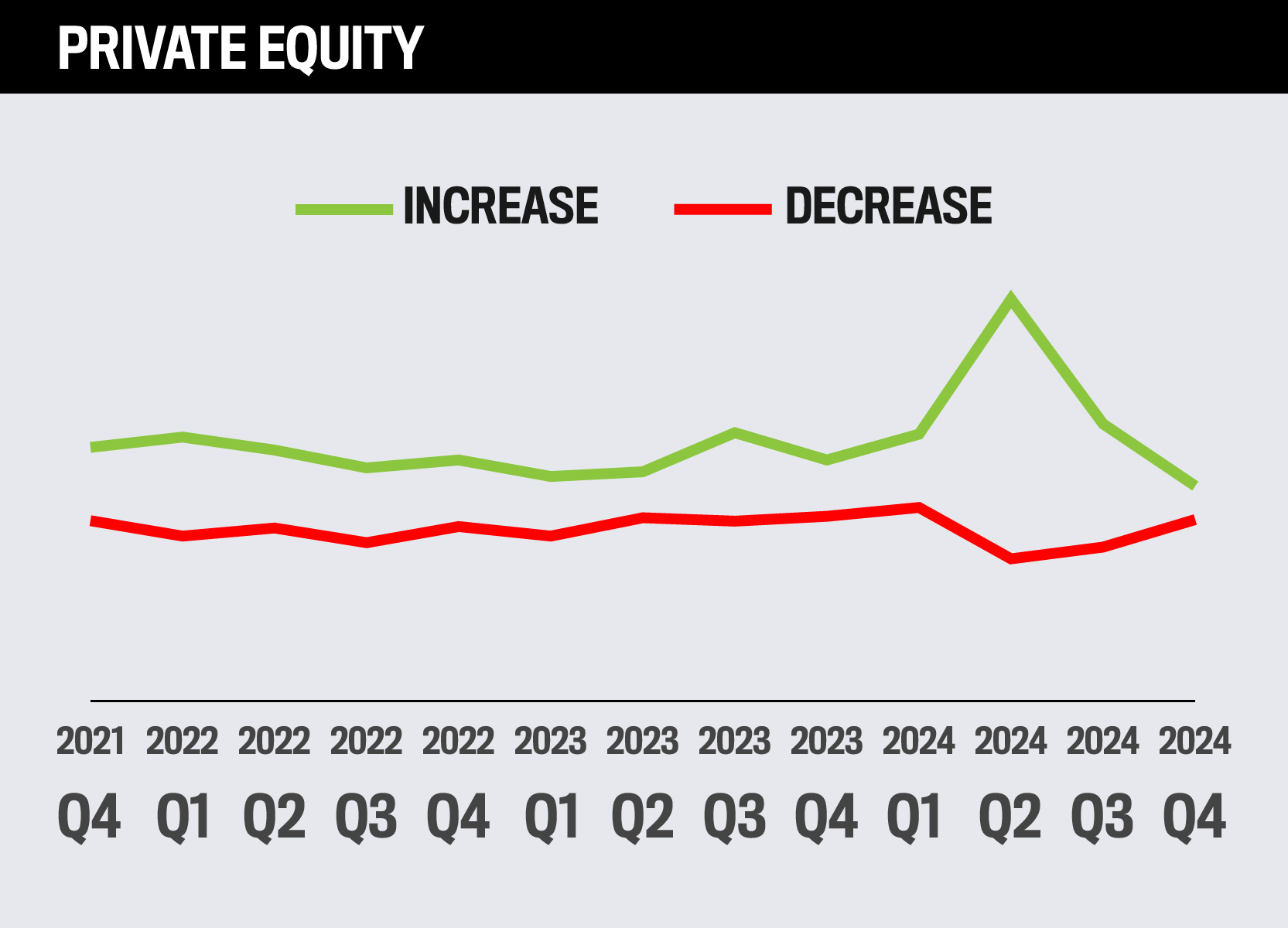

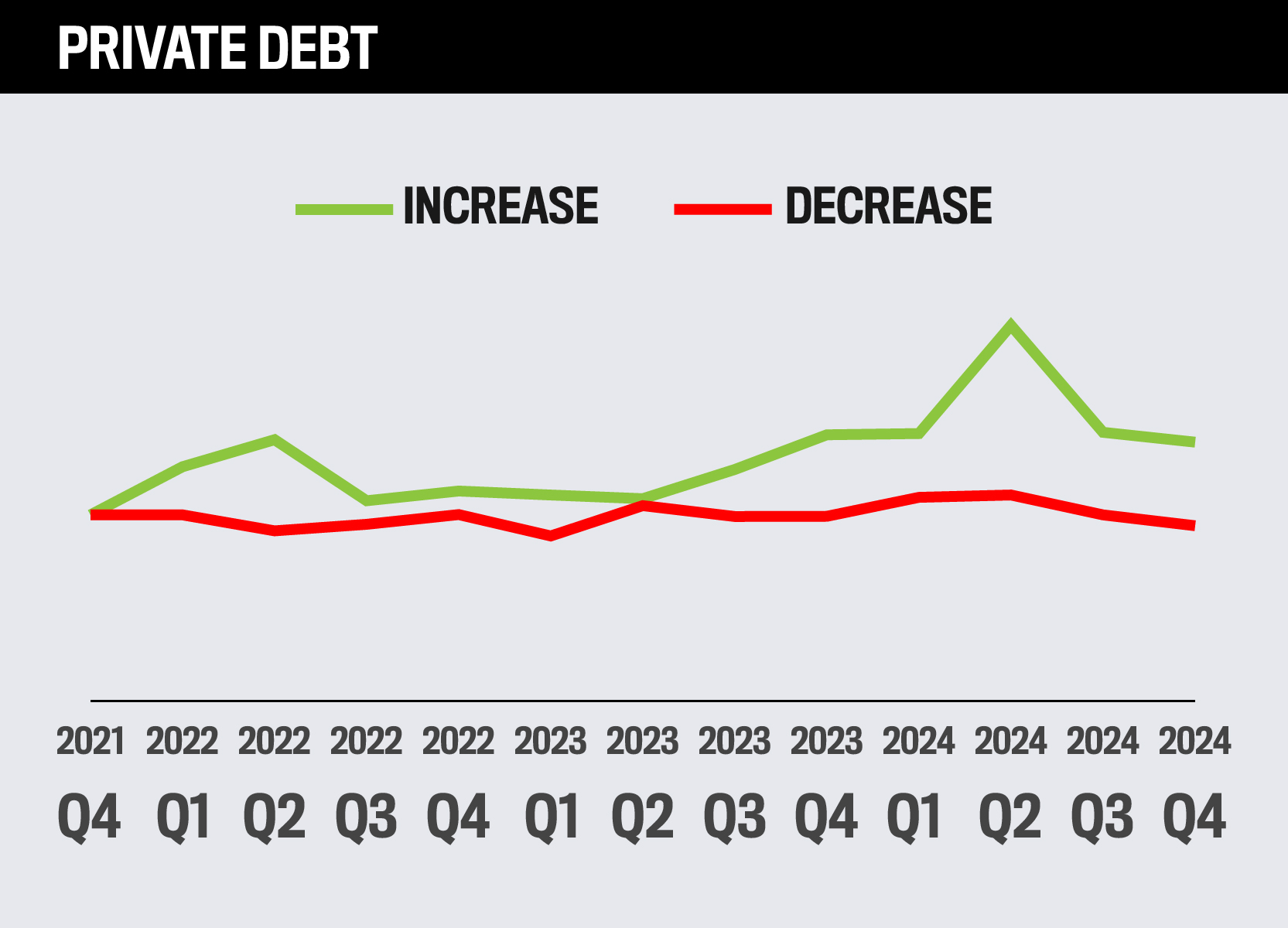

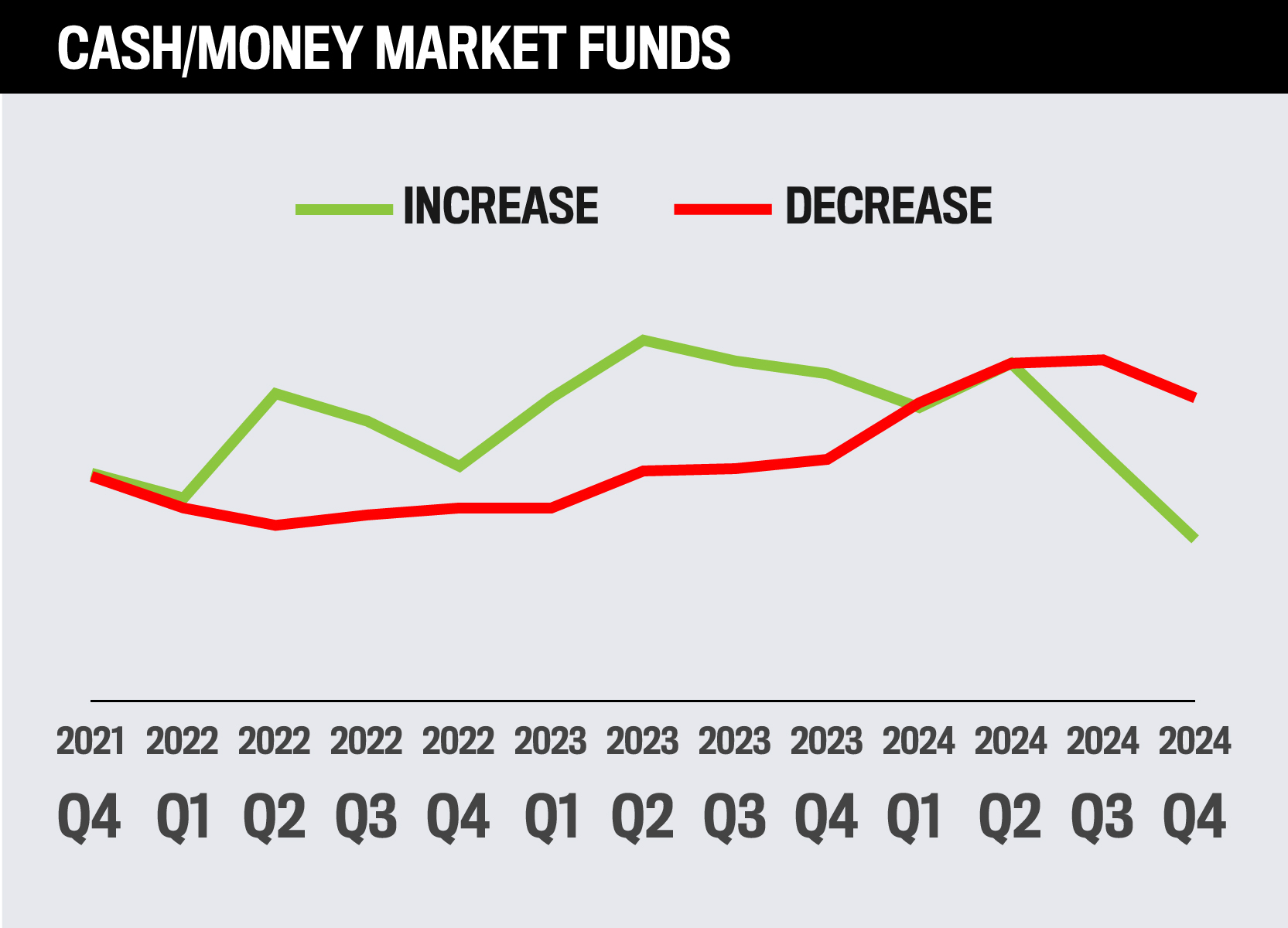

How advisors plan to allocate assets to alternative assets over the next year

Within the alternatives category, real estate and gold are expected to see the most investment among financial professionals over the next year, while cash/money market funds are expected to see the least.

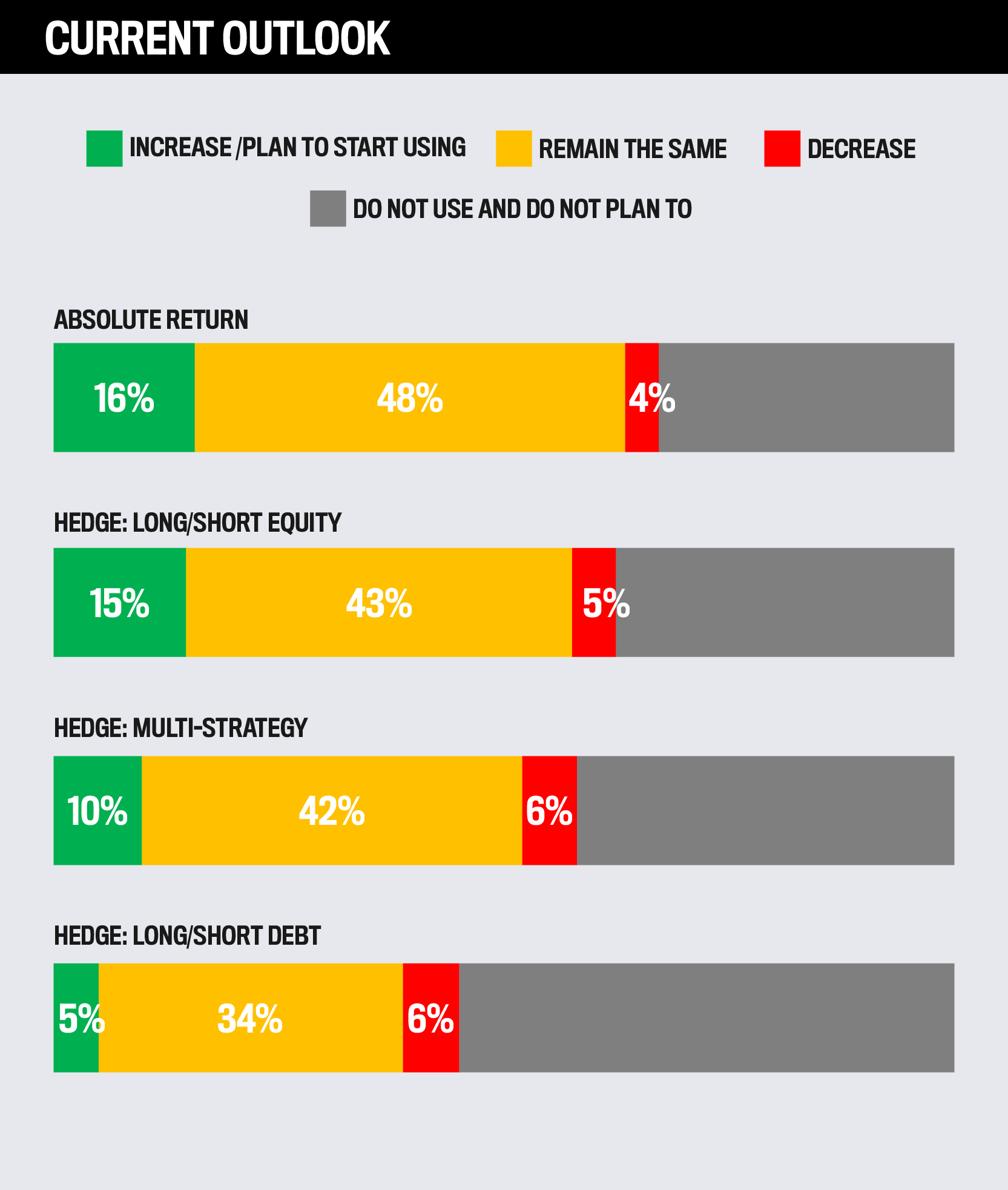

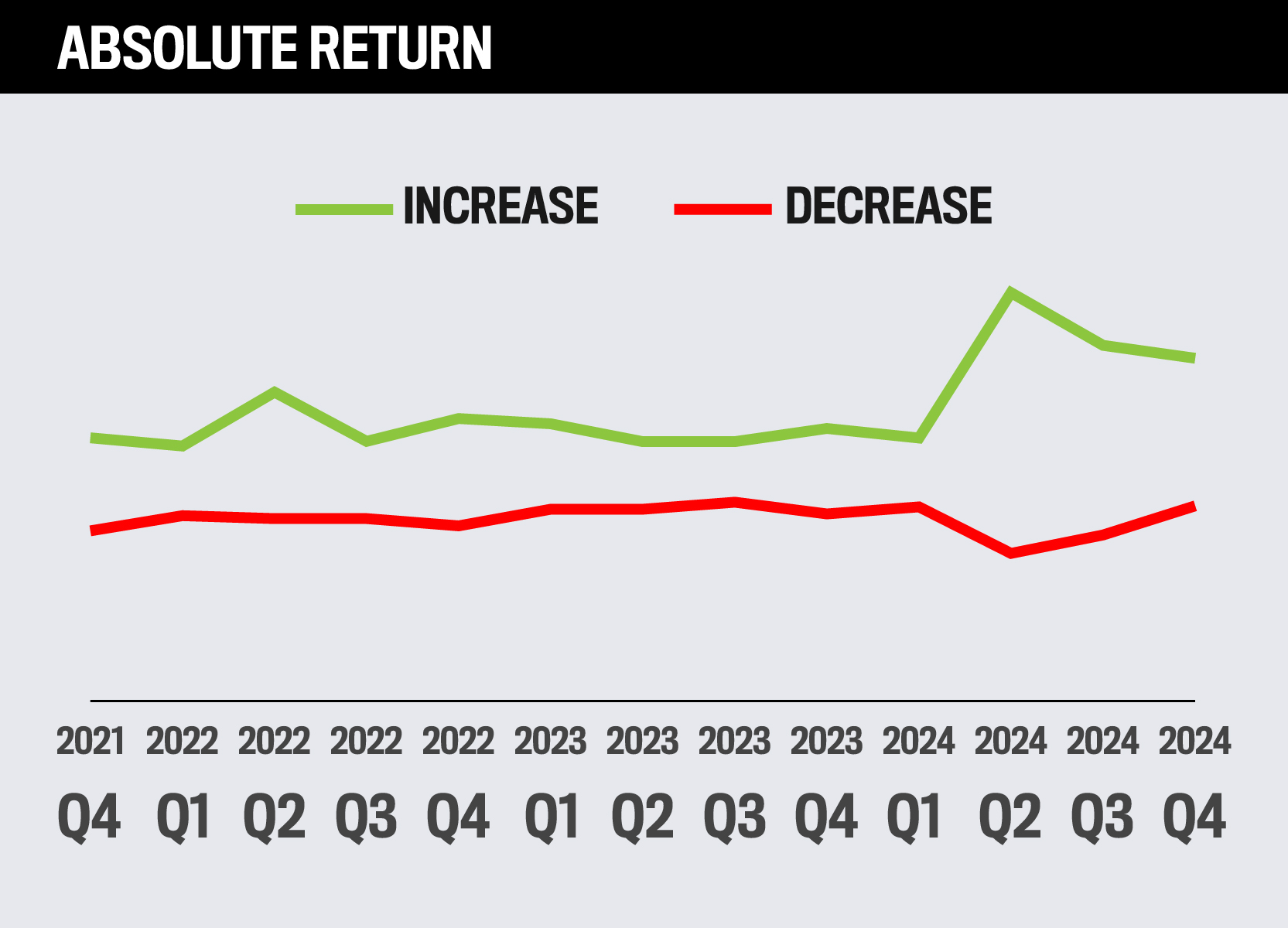

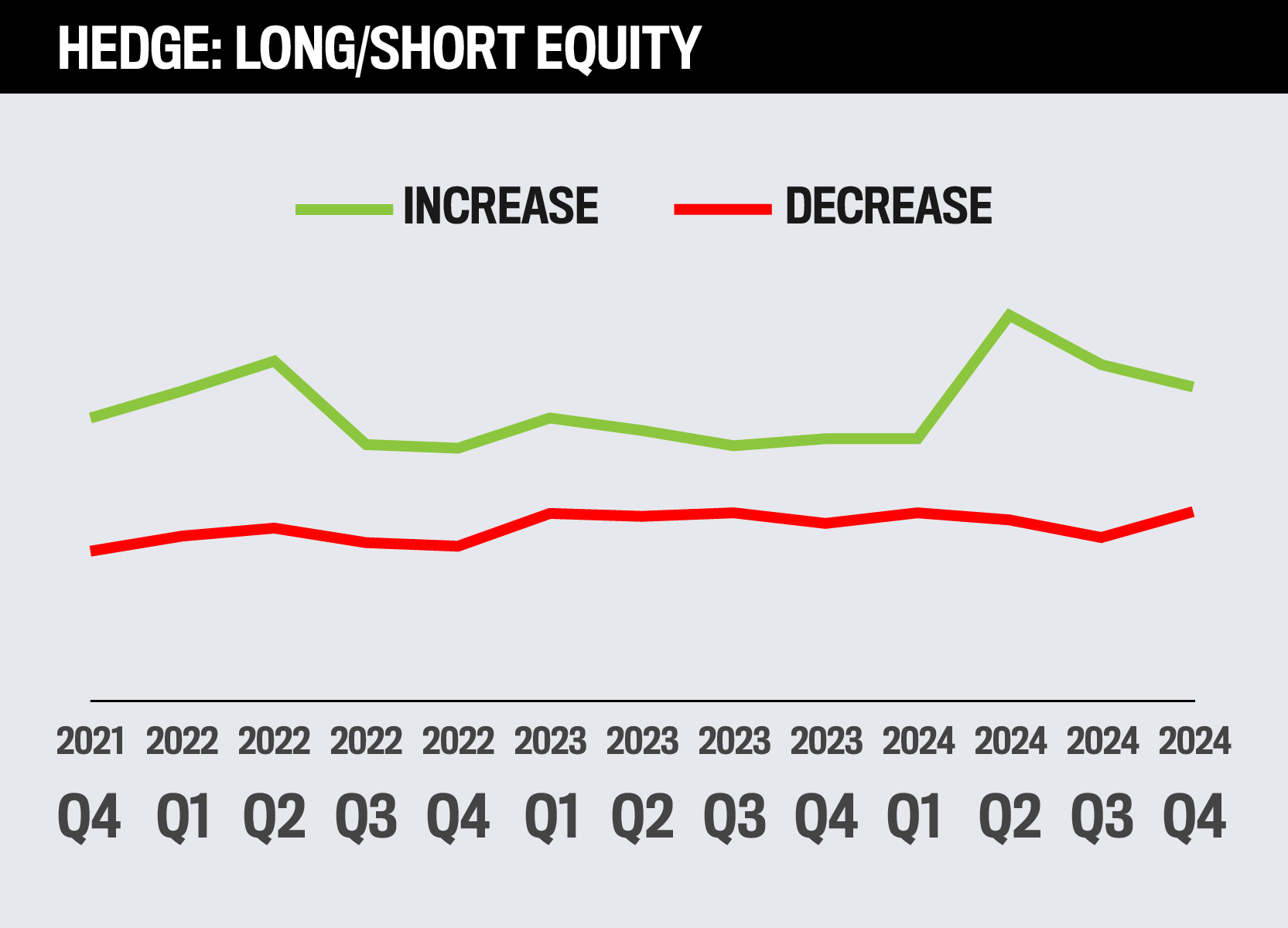

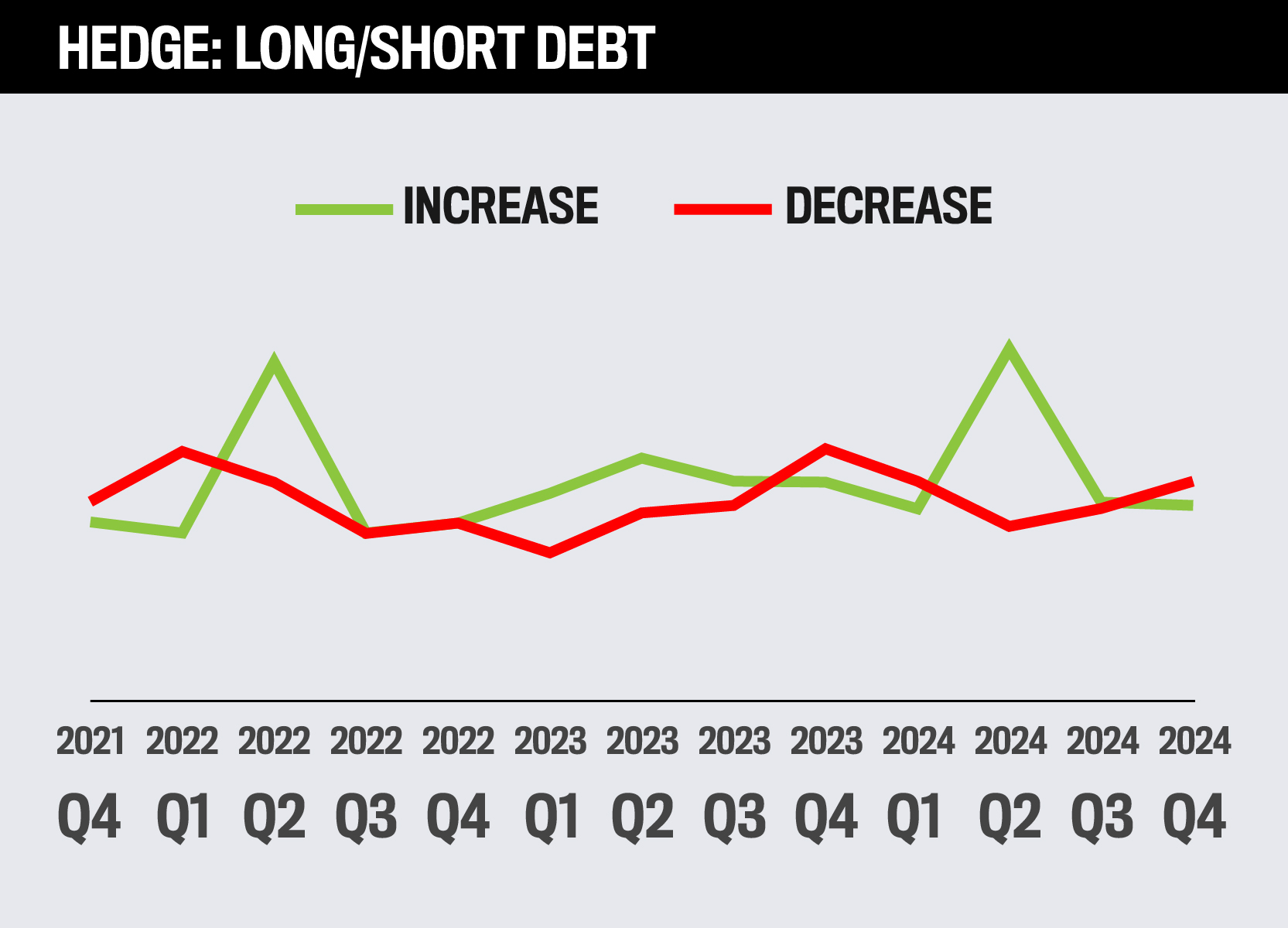

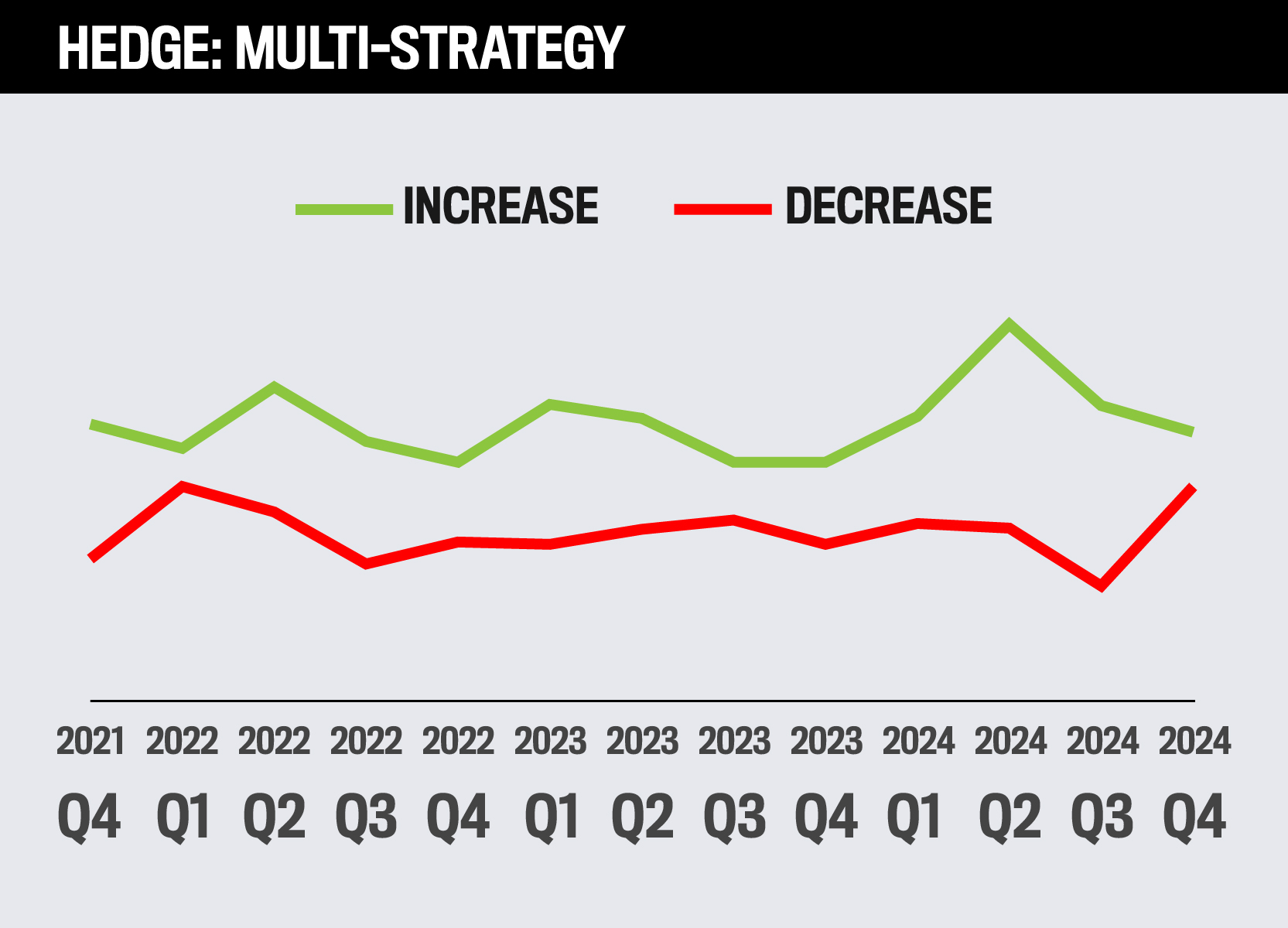

How advisors plan to utilize advanced strategies over the next year

The most popular advanced strategy currently is absolute return and long/short equity hedging, while the least popular is long/short debt hedging.

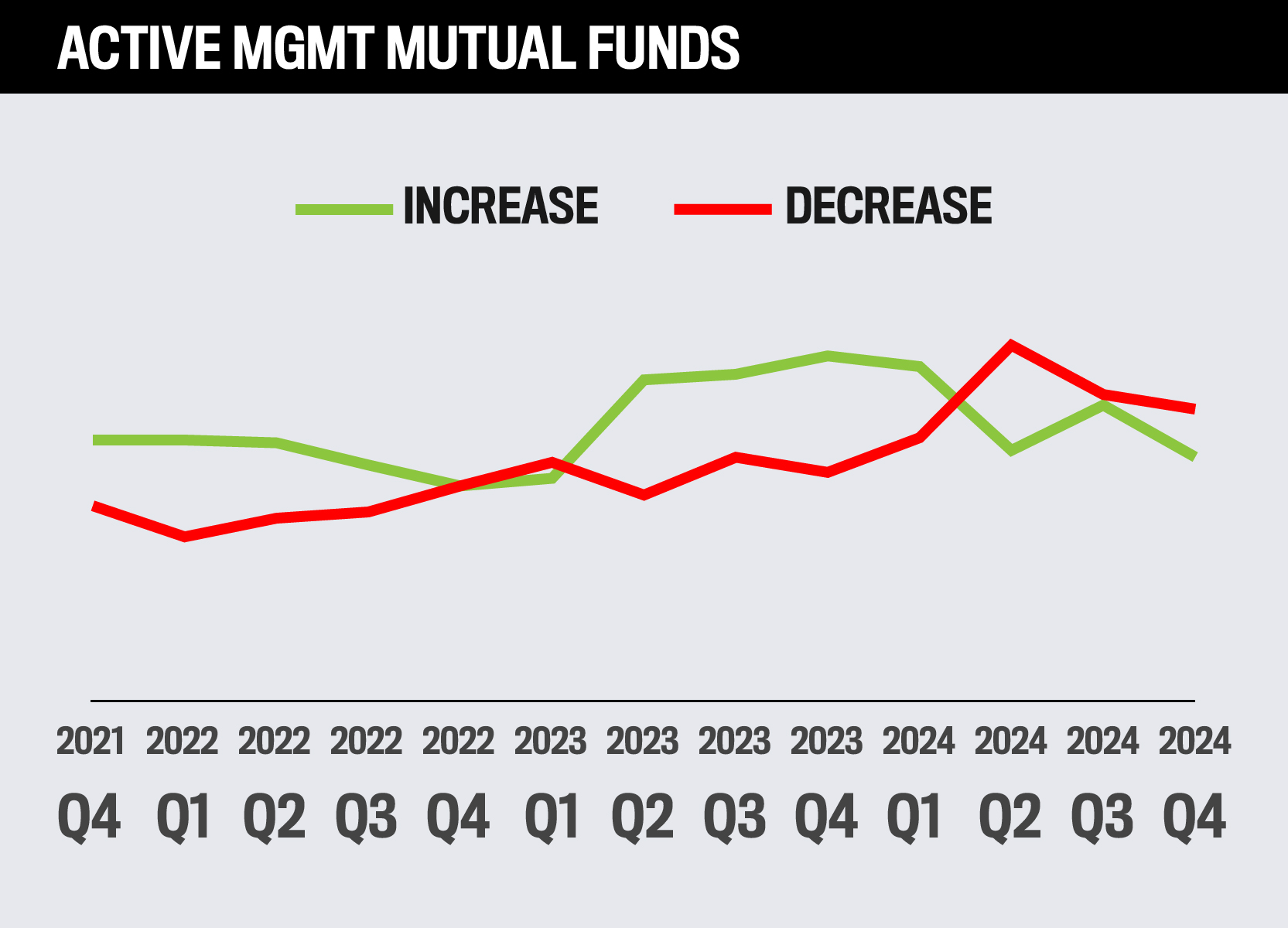

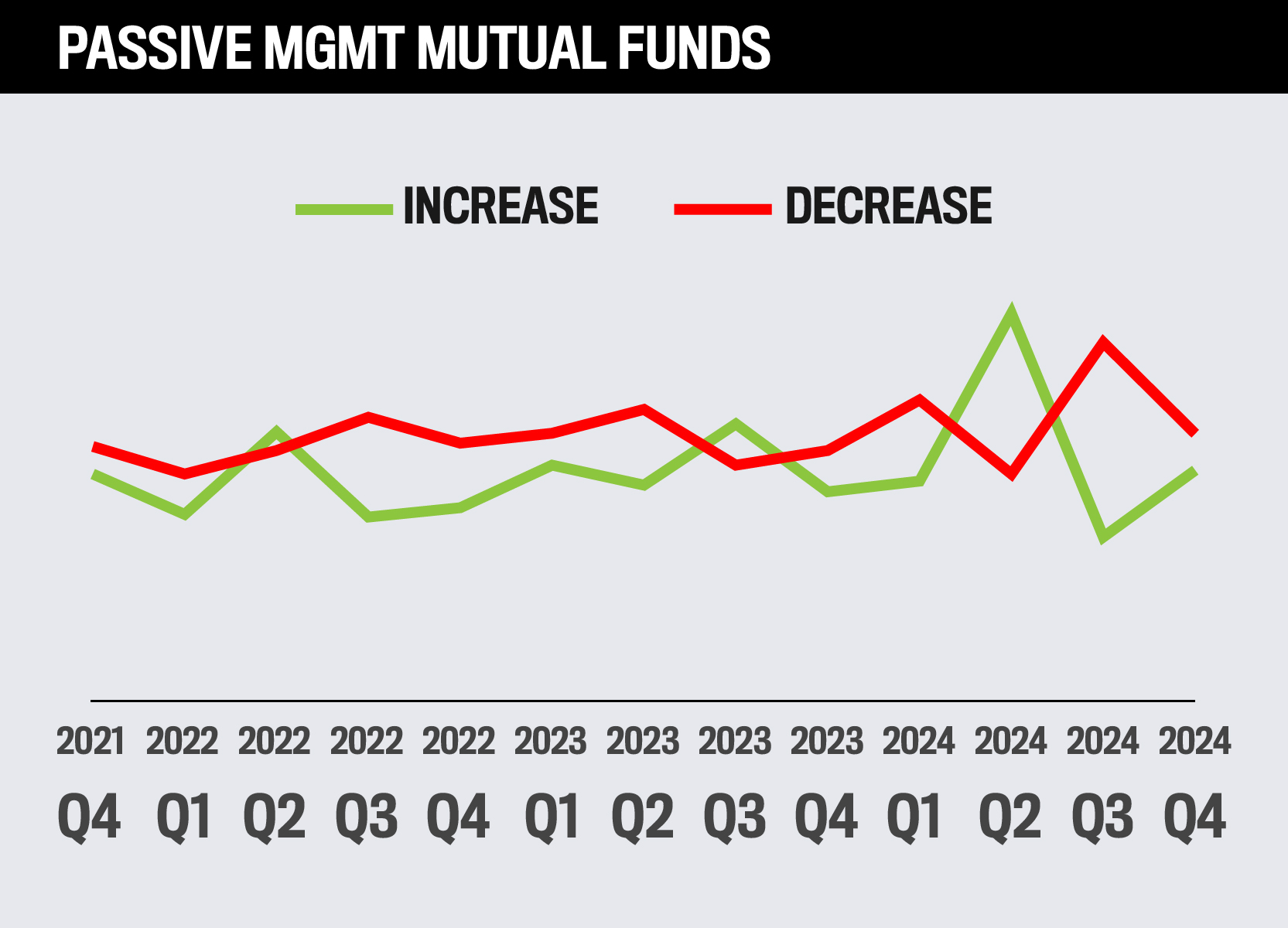

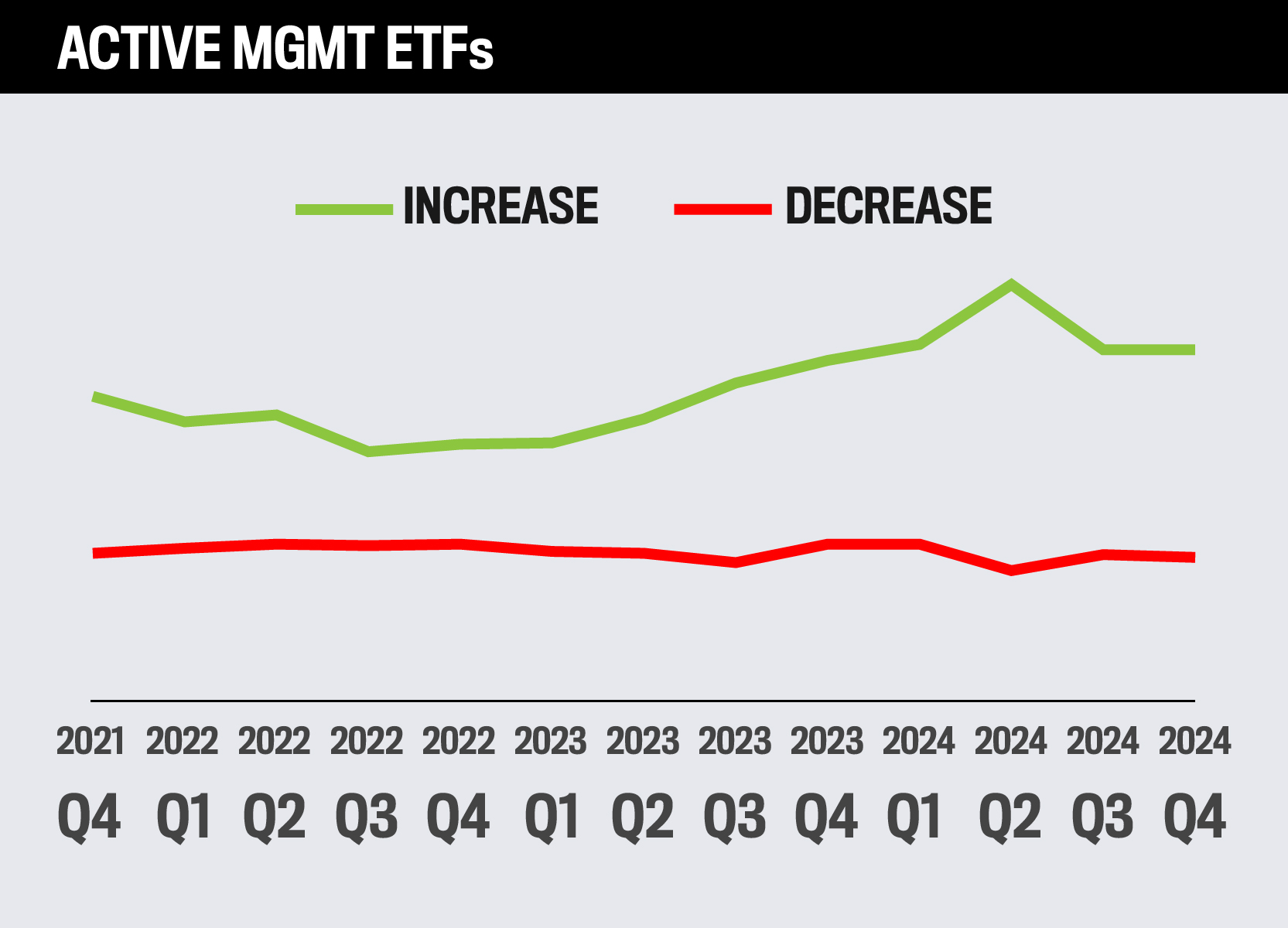

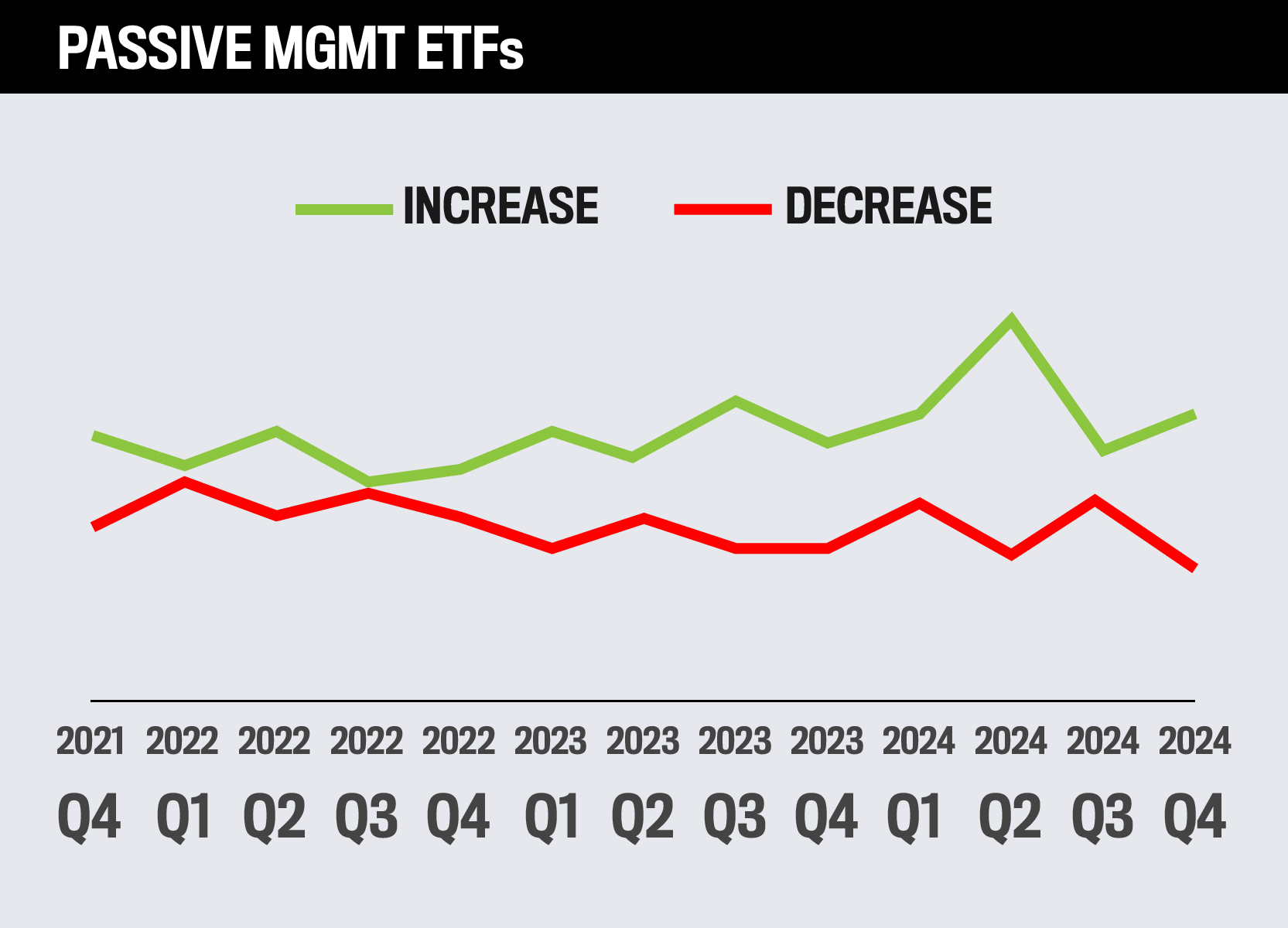

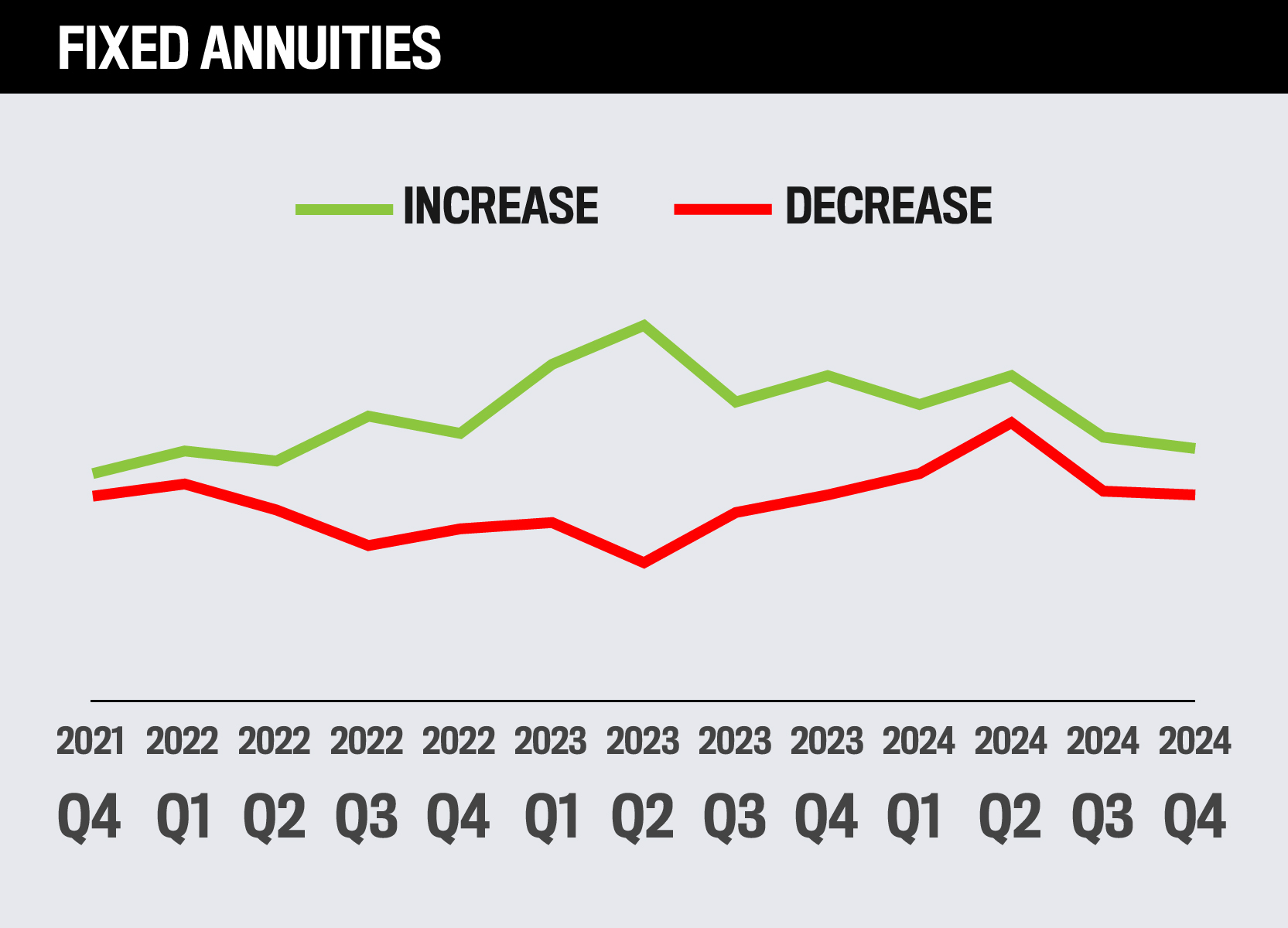

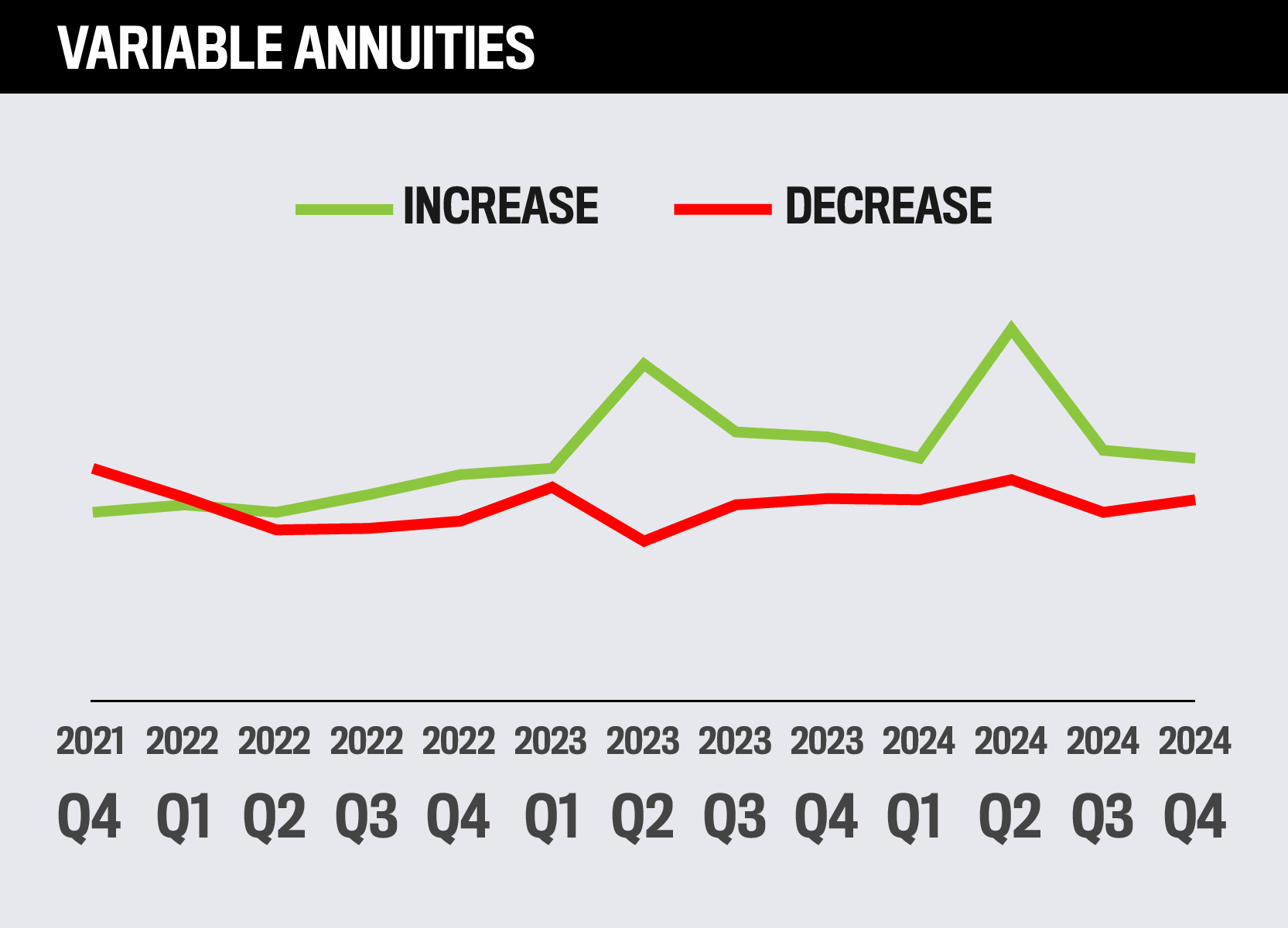

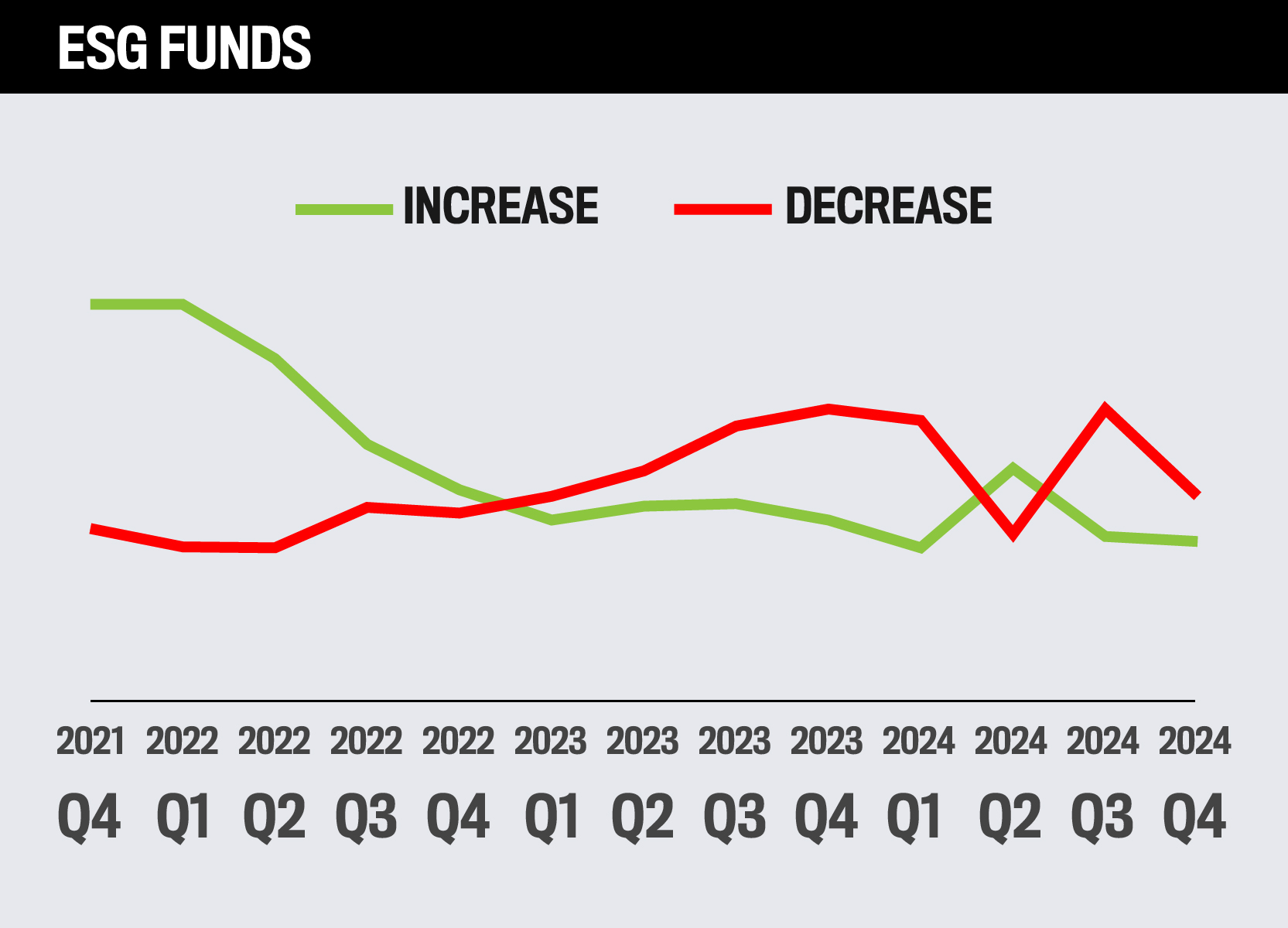

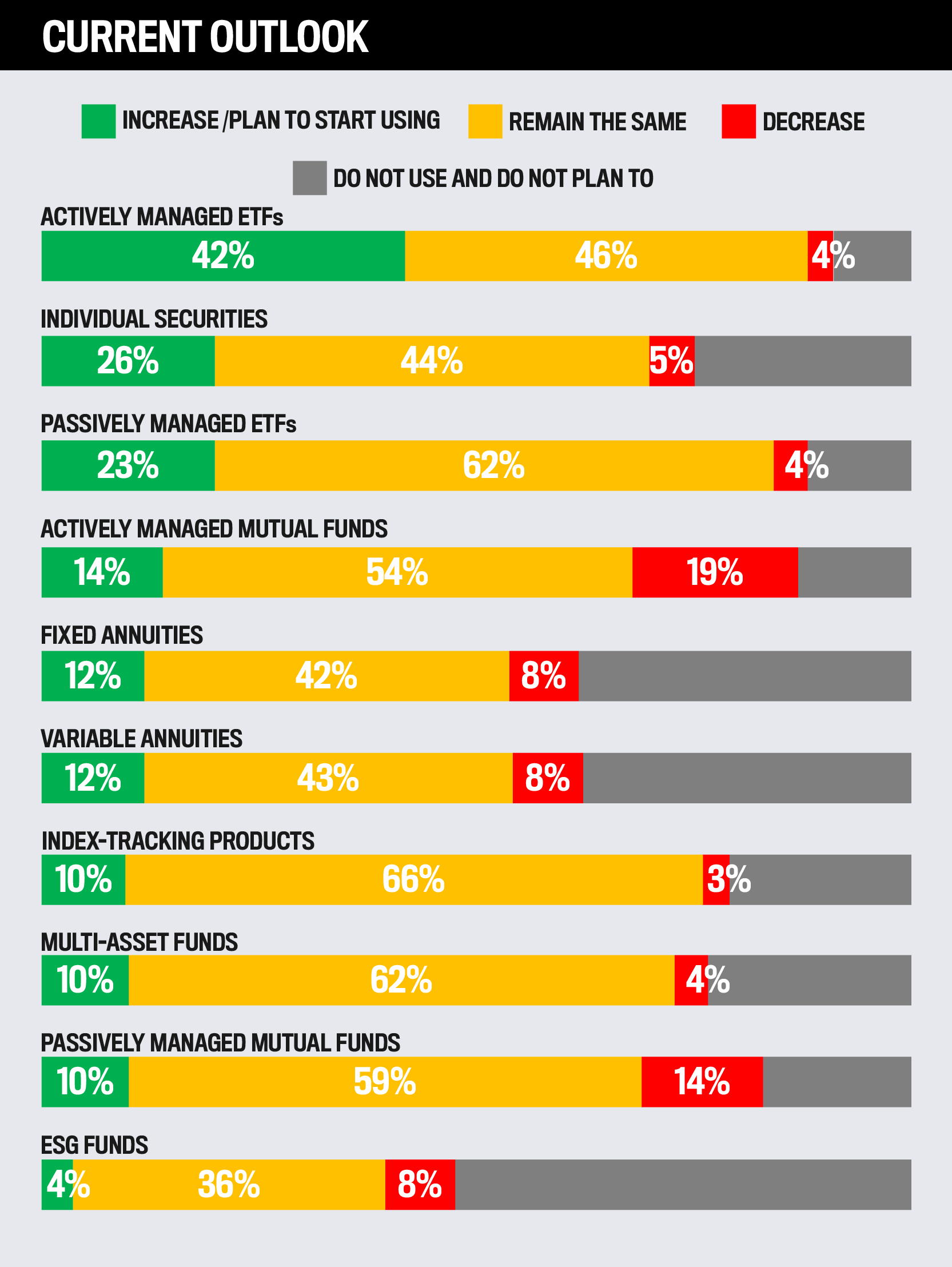

How advisors will use fund, annuity and other investment products over the next year

Actively managed ETFs are currently expected to see the most increase in usage among advisors over the next year, while ESG funds and passively managed mutual funds are expected to be used less.