During a bull market, the critical fiduciary success factor is connecting with a client’s mind. During crises, the critical factor is connecting with the client’s heart.

1. Fiduciary is a relationship, not a transaction. You’ve learned that a quarterly performance report can’t paper over a client’s emotional voids.

2. ESG/SRI is now an integral part of a fiduciary standard. Before the crisis, you often heard that the inclusion of ESG/SRG could trigger a fiduciary breach. Now the opposite is true — having a discussion with a client about impact investing is considered a fiduciary best practice.

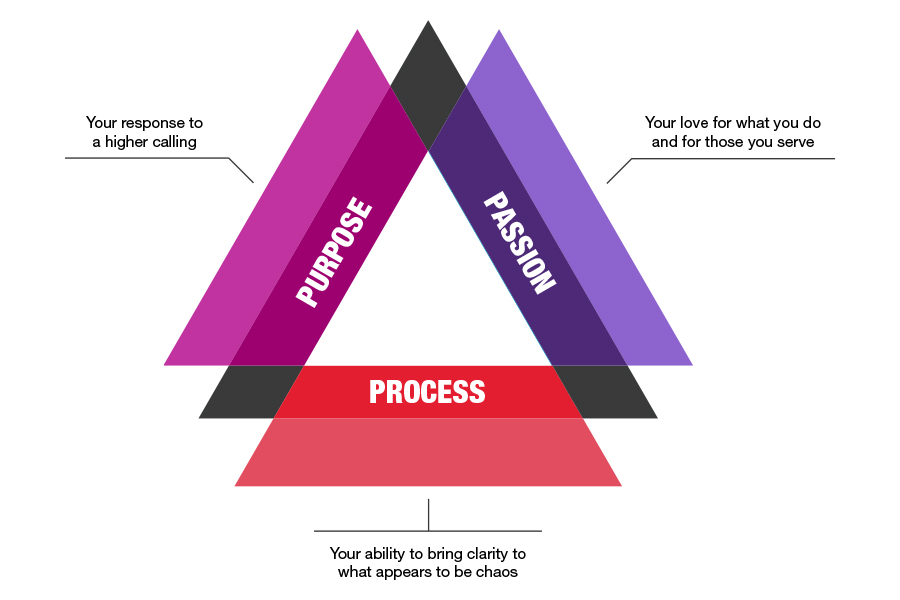

3. The 3 F’s have been supplanted by the 3 P’s: You can no longer define your value proposition in terms of fiduciary, funds and fees. Instead, the imperative is that you demonstrate your capacity for purpose, passion, and process.

4. It’s now easier to spot the disingenuous fiduciary. What matters during a crisis is compassion, character and competence. As such, a broker who acts like a fiduciary is far more preferable than a fiduciary who acts like a broker.

5. You have a fiduciary duty to harden clients for a VUCA world. We‘ve had to come to grips with the fact that we live in a volatile, uncertain, complex and ambiguous world. It’s now harder to model the risk/return profile of asset classes and to conduct the appropriate due diligence on investment options.

6. You’ve learned the importance of connectivity and having a communications cadence. Whatever the frequency of your communications with clients before the crises, during the crises you probably had to double it.

7. What clients needed during the crises couldn’t be found in Reg BI. A crisis is the absolute worst time to ask a client to sign a complex disclosure, for complexity often inhibits the formation of trust.

Don Trone is CEO of the new Center for Board Certified Fiduciaries.

Futures indicate stocks will build on Tuesday's rally.

Cost of living still tops concerns about negative impacts on personal finances

Financial advisors remain vital allies even as DIY investing grows

A trade deal would mean significant cut in tariffs but 'it wont be zero'.

Inflation, economic risk is greater than previously thought.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.