James Iannazzo, the former Merrill Lynch broker who was fired in January after an incident at a Connecticut smoothie shop, is now a registered broker with Aegis Capital Corp., which is based in New York and has 300 retail registered reps.

Iannazzo, who had worked for Merrill Lynch in Stamford, Connecticut, became registered with Aegis on Tuesday, according to his BrokerCheck profile. Aegis has both independent contractor brokers and employee financial advisers under its roof, and it's not clear which type of business Iannazzo will be conducting at the firm's Westport, Connecticut, office.

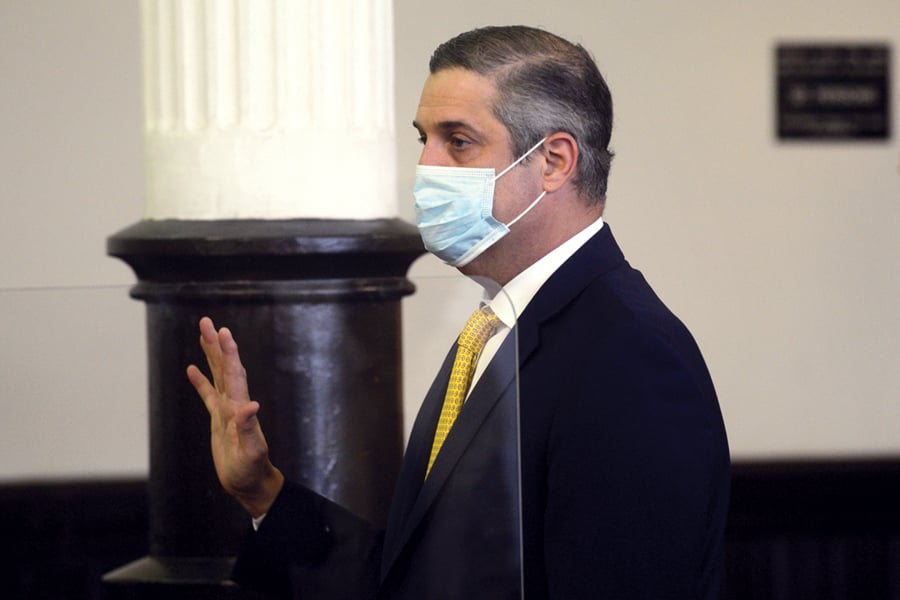

Iannazzo, 48, was arrested after the incident in January and faces three charges, including intimidation based on bigotry or bias in the second degree, a felony. The other charges are second-degree breach of peace and first-degree criminal trespass. Earlier this month, he applied for a pretrial probation program, and a Superior Court Judge in Bridgeport, Nbidi Moses, continued the case until April 8.

In November, Aegis Capital Corp. was sanctioned $2.75 million by the Financial Industry Regulatory Authority Inc. for churning, or excessive trading in client accounts, from 2014 to 2018.

Eugene Riccio, the attorney for Iannazzo, declined to comment about his hiring by Aegis. An attorney for Aegis, Michael Ference, also declined to comment.

Iannazzo was arrested Jan. 22 by the Fairfield, Connecticut, police after erupting at a Robeks smoothie store, throwing a drink at an employee, hitting employees and demanding to know who made a smoothie that contained peanuts and caused his child to have a severe allergic reaction, according to the Fairfield police.

A video of the incident, in which Iannazzo repeatedly uses profanity and calls one employee an “immigrant loser,” caused a firestorm at the time on social media platforms including Twitter. Iannazzo told officers that he was upset about his son's severe allergic reaction and went back to the store as a result, according to the police.

Canadian stocks are on a roll in 2025 as the country prepares to name a new Prime Minister.

Two C-level leaders reveal the new time-saving tools they've implemented and what advisors are doing with their newly freed-up hours.

The RIA led by Merrill Lynch veteran John Thiel is helping its advisors take part in the growing trend toward fee-based annuities.

Driven by robust transaction activity amid market turbulence and increased focus on billion-dollar plus targets, Echelon Partners expects another all-time high in 2025.

The looming threat of federal funding cuts to state and local governments has lawmakers weighing a levy that was phased out in 1981.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.