Advisory practices with racial and ethnic minorities represented in management are more likely to be viewed by their professionals as open and inclusive, and they are about twice as likely as others to have a diverse client base.

These are the findings from Diversity & Inclusion in Financial Advice, a white paper by the American College of Financial Services. The new study, which underscores the business case for a commitment to industry diversity, is based on survey data gathered last year in partnership with InvestmentNews Research.

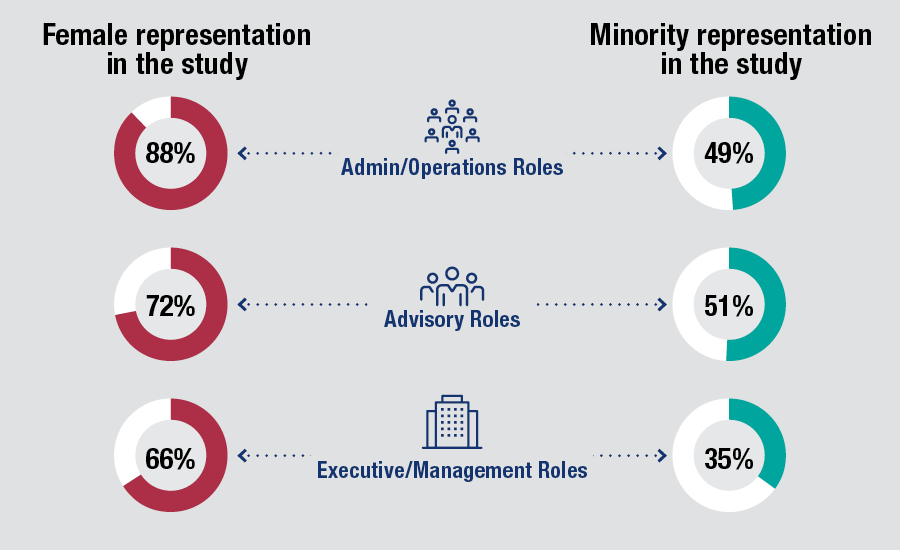

Only 35% of advisers surveyed for the study had racial or ethnic minorities employed in executive or management roles at their firms, but those respondents were more likely to say that their firms were inclusive, that they were comfortable broaching diversity issues with senior leaders and that their firms actively promote and develop minority professionals.

In addition, about half of advisers at these firms said their client base reflected the country’s diversity, compared with 25% at firms without diversity in their upper ranks. Despite the yawning racial and gender wealth gaps that persist in the United States, the study makes the case that, as the country changes, firms now focusing on diversity in all areas of their business will be positioned to work with the wealth management clientele of the future.

Yet even if the data suggest that diversity efforts are both a virtuous cycle and a good business move, the obstacles they face are clear.

When firms hire for advisory roles, for example, 60% primarily use direct outreach or networking to find candidates, which limits entry points to the industry and helps perpetuate its existing demographics, according to the study. A third of firms use networking even to fill administrative and operations roles.

Once candidates are in the door, business-building expectations come hard and fast. Forty-two percent of firms have business development targets for a new adviser’s first three months, and most expect new advisers to meet their targets by leveraging existing networks and generating their own leads.

“These expectations and requirements likely disadvantage candidates from less privileged backgrounds who often don’t have a network of affluent potential investors to tap,” according to the study.

The paper also noted that 71% of advisers said either that they were unsure of how leads were distributed at their firm or that leads were distributed solely at the discretion of management. Although most advisers ultimately viewed the process as fair, a lack of transparency can leave it vulnerable to unconscious bias.

Asked about policies in place at firms to address diversity, respondents from minority backgrounds singled out mentoring programs as the most effective. Respondents across all demographics viewed policies that fostered collaboration and assigned accountability as more impactful than diversity education, training and committees.

“The key point in taking steps that lead to greater diversity and inclusion is that accountability is central to effecting change,” American College writes. “Unless there are specific, concrete ways for everyone at a firm to contribute to the solution, even well-intentioned people will stand on the sidelines because they are not sure what to do.”

To read more about the state of diversity in financial advice and steps firms are taking to address it, download the full study here.

Carson is expanding one of its relationships in Florida while Lido Advisors adds an $870 million practice in Silicon Valley.

The approval of the pay proposal, which handsomely compensates its CEO and president, bolsters claims that big payouts are a must in the war to retain leadership.

Integrated Partners is adding a husband-wife tandem to its network in Missouri as Kestra onboards a father-son advisor duo from UBS.

Futures indicate stocks will build on Tuesday's rally.

Cost of living still tops concerns about negative impacts on personal finances

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.