For years, I've watched and listened to

the fiduciary debate. It's a super important conversation to have, and I'm so glad it's happening. But let's not miss the point in all the noise.

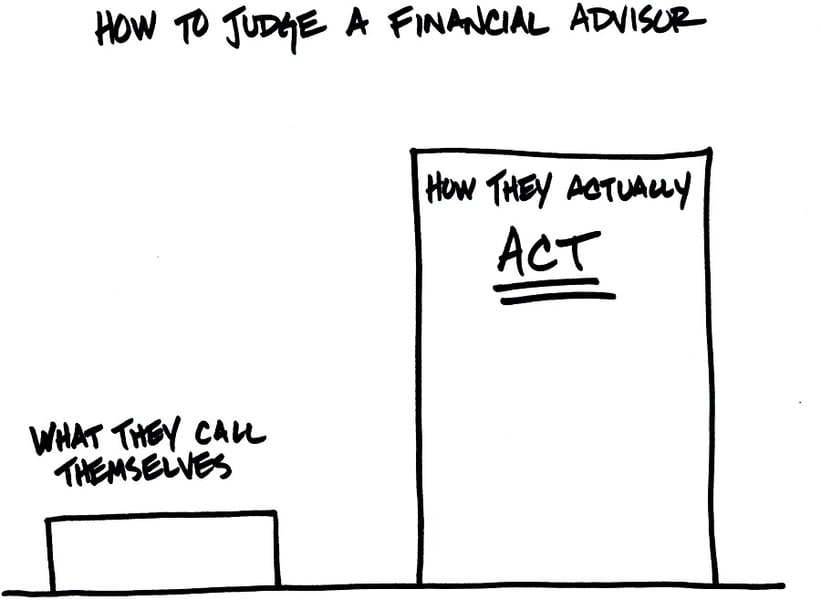

We all know people who can't legally call themselves fiduciaries under the current regulations, and that doesn't stop them from acting like a fiduciary. In fact, the people I know have put their clients' needs ahead of their own for decades, despite working for companies or in roles that prevent them from being a fiduciary. I wouldn't hesitate to send my mother to them.

We've also read the stories of fiduciaries who've stolen people's money. Clearly, a title only goes so far. Behavior matters.

(More from Carl Richards: Correcting the adviser-client disconnect over investment risk)

So while this much-needed discussion continues, I have a crazy idea. What if the rest of us, the members of the Secret Society of Real Financial Advisers who are doing the work on the ground, all act like fiduciaries? Whether we're legally obligated to or not, why don't we do what clients expect us to do anyway and put their needs first? I know many of you already do so, but for everyone else, why not?

I understand that in any relationship, conflicts of interest exist. Those conflicts won't go away, but imagine how the client relationship changes when you follow the fiduciary duty to explain and manage those conflicts. And in the end, isn't that how we all want to be treated?

Look, if you want to be in this business for a long time, it's much easier to put your clients first and keep them there than it is to find a new tool or product to sell. Plus, if you haven't experienced it yet, explaining why you're not putting clients first is pretty difficult. The public perception of this debate is undeniably negative. “What do you mean you shouldn't put our interests first?”

I know there's a bigger argument about regulation and increased costs. However, I'm increasingly hopeful about our industry understanding the need to act like fiduciaries. It not only the right thing to do, it's the right business decision, too.

Carl Richards is a certified financial planner and director of investor education for the BAM Alliance. He's also the author of the weekly "Sketch Guy" column at the New York Times. He published his second book, "The One-Page Financial Plan: A Simple Way to Be Smart About Your Money" (Portfolio) last year. You can email Carl here, and learn more about him and his work at BehaviorGap.com.