The Department of Labor issued the final version of its investment advice rule last week, a sweeping change that makes one-time IRA rollover recommendations a clear fiduciary act.

It has enormous implications for brokers – including insurance agents who sell annuities via rollovers – who before may not have had to comply with the Employee Retirement Income Security Act, or ERISA.

The new rule, which begins to take effect in September but will not be fully phased in until April 2025, changes a 1975 definition of fiduciary investment advice. Previously, the regulator relied on a five-part test to determine fiduciary status, and that has been narrowed to a simpler but more encompassing test. The agency also amended prohibited transaction exemptions that allow brokers to receive commissions in connection with retirement account advice.

“The greatest impact will be on rollover recommendations, which will now almost always be fiduciary recommendations, where the advisor or agent will owe the participant a duty of care and a duty or loyalty, meaning that [they] will need to carefully and thoughtfully examine the alternatives available to the participant,” said Fred Reish, partner at Faegre Drinker Biddle & Reath, in an email. Conflicts of interest that arise will fall under the two amended prohibited transaction exemptions, known as PTE 2020-02 and 84-24, he noted. “When a rollover is recommended, there will be conflicts of interest because the advisor will make money from the rollover IRA, or the insurance agent will make money from the rollover annuity.”

Retirement investors as a group stand to benefit most from the new fiduciary test, which means a wider range of people receiving fiduciary-level advice, the DOL stated. But the rule also extends to insurance products that don’t include securities components, such as fixed indexed annuities, which will put many insurance agents’ sales under ERISA. And the new rule will require rollover recommendations broadly to be in a retirement investor’s best interest, the agency noted.

The inclusion of insurance products has that industry racing to figure out how to deal with the rule. It is widely expected that the DOL will be sued over it – a result that the agency itself said it has prepared for. After the 2016 Obama-era version of the fiduciary rule was struck down in the Fifth Circuit Court of Appeals, the DOL studied the legal shortcomings and drafted the new rule to better withstand a legal challenge.

“It remains to be seen what the ultimate fate of the new regulation and the amended exemptions will be,” said Alex Ryan, partner at Willkie Farr & Gallagher. “I would be surprised if there weren’t a litigation challenge.”

Insurance industry lobbying groups have charged that the agency has made a rule that is unnecessary, as investors already have levels of protection under the Securities and Exchange Commission’s Regulation Best Interest and various state-level insurance laws modeled on a standard from the National Association of Insurance Commissioners.

Opponents have also criticized the fast pace at which the DOL and Biden administration produced the rule – a tactic that kept it out of the range of the Congressional Review Act and thus will make it more difficult to overturn.

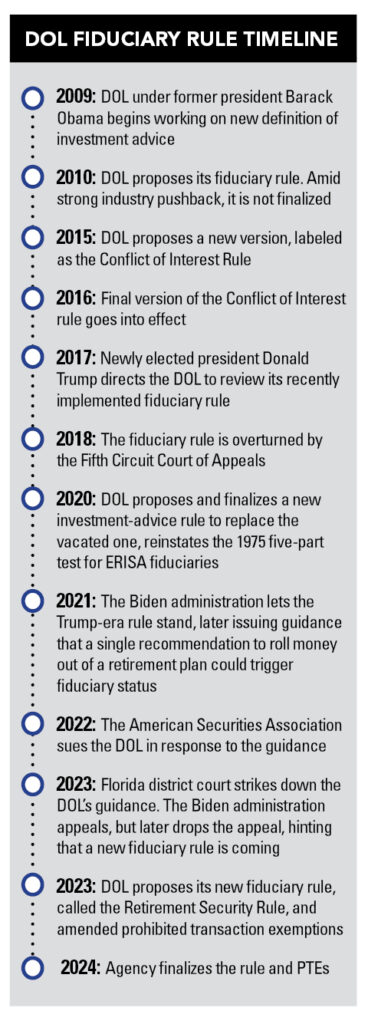

It’s important to point out that the DOL has been working on various versions of a new fiduciary rule since 2009, said Phyllis Borzi, who led the DOL’s Employee Benefits Security Administration from 2009 to 2017. The financial services industry has had ample notice about different proposals and opportunities to give input to the regulator, which has held hundreds of meetings with stakeholders, she noted. For the current rule, industry witnesses staunchly opposed it, with at least one saying no changes could make it acceptable, she said.

“I know first-hand that each and every written and oral comment submitted during that [Obama-rule] period was carefully read, categorized and analyzed by career staff and reviewed with EBSA leadership in minute detail. Moving forward expeditiously to finalize the rule is not unusual,” she said in an email. “It seems obvious that further delay in finalizing the rule would only allow the harmful financial losses from conflicted investment advice that plan participants and IRA owners experience to continue while at the same time delay would not improve the chances of improving industry support.”

In the new rule, the DOL emphasized fair and full disclosure to retirement investors, Ryan said.

“DOL is very concerned about retirement investors not having full transparency as to the range of conflicts that the department believes are embedded in many investment advisory relationships,” he said.

Although the final rule spans 476 pages, the DOL used a “principals-based approach” and was not overly prescriptive, said Jason Roberts, CEO of the Pension Resource Institute. Not spelling out expectations in some areas will lead some firms to be very conservative with how they approach rollovers, he noted.

For example, the DOL has repeatedly referred to differential compensation as problematic, which for many who will rely on PTE 2020-02 could mean that commissions will be tricky, he said. That refers to different commissions that a broker could get from different products or product types.

“If you can’t really distinguish one variable annuity from another … then all VAs must pay the same commission,” Roberts said of the “breadcrumbs” the DOL has left on the subject.

In the new rule, the DOL points to an FAQ that addressed the use of its Best Interest Contract Exemption for the 2016 version. That example led the asset management industry to roll out “clean shares” of products that allowed intermediaries to make their own charges for services or have levelized compensation.

“If a firm adopts their own [compensation] version and feels like they’ve mitigated the conflicts, but it’s not in line with the DOL’s example … it’s sort of up to enforcement to shape expectations,” Roberts said. “Any time a regulator gives you a roadmap, you’re well-served to follow it.”

Rajesh Markan earlier this year pleaded guilty to one count of criminal fraud related to his sale of fake investments to 10 clients totaling $2.9 million.

From building trust to steering through emotions and responding to client challenges, new advisors need human skills to shape the future of the advice industry.

"The outcome is correct, but it's disappointing that FINRA had ample opportunity to investigate the merits of clients' allegations in these claims, including the testimony in the three investor arbitrations with hearings," Jeff Erez, a plaintiff's attorney representing a large portion of the Stifel clients, said.

Chair also praised the passage of stablecoin legislation this week.

Maridea Wealth Management's deal in Chicago, Illinois is its first after securing a strategic investment in April.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.